COMMENTARY BY ABBY GREIMAN

Cattle futures spent the early part of the week slowly grinding higher, as last week’s news around New World screwworm seemed to give the market a slightly more cautious tone. This kept futures well in line with last week’s cash trade, and cash markets this week did not develop until Friday. When they did finally develop, they provided a solid boost to futures with packers forced to pay up, ending the week on a high note for cattle producers.

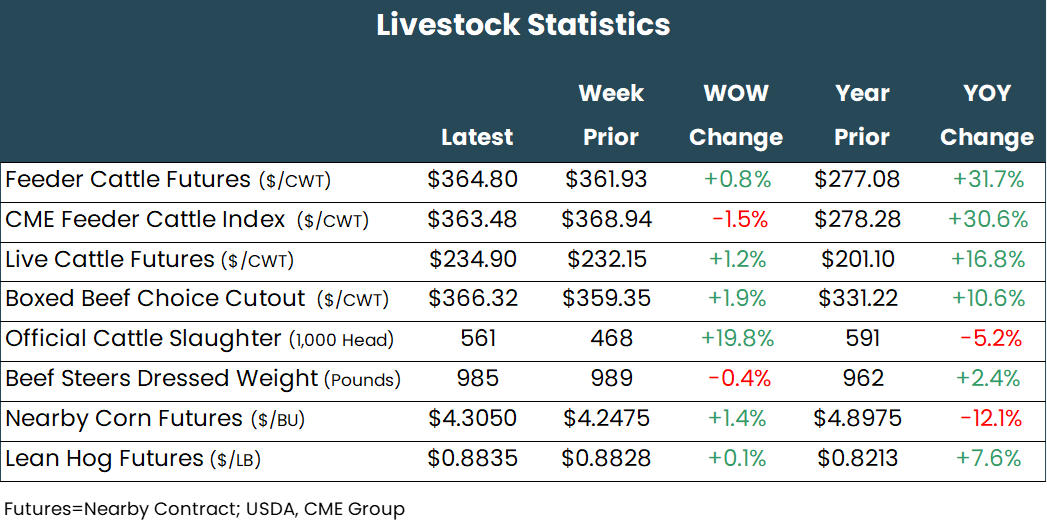

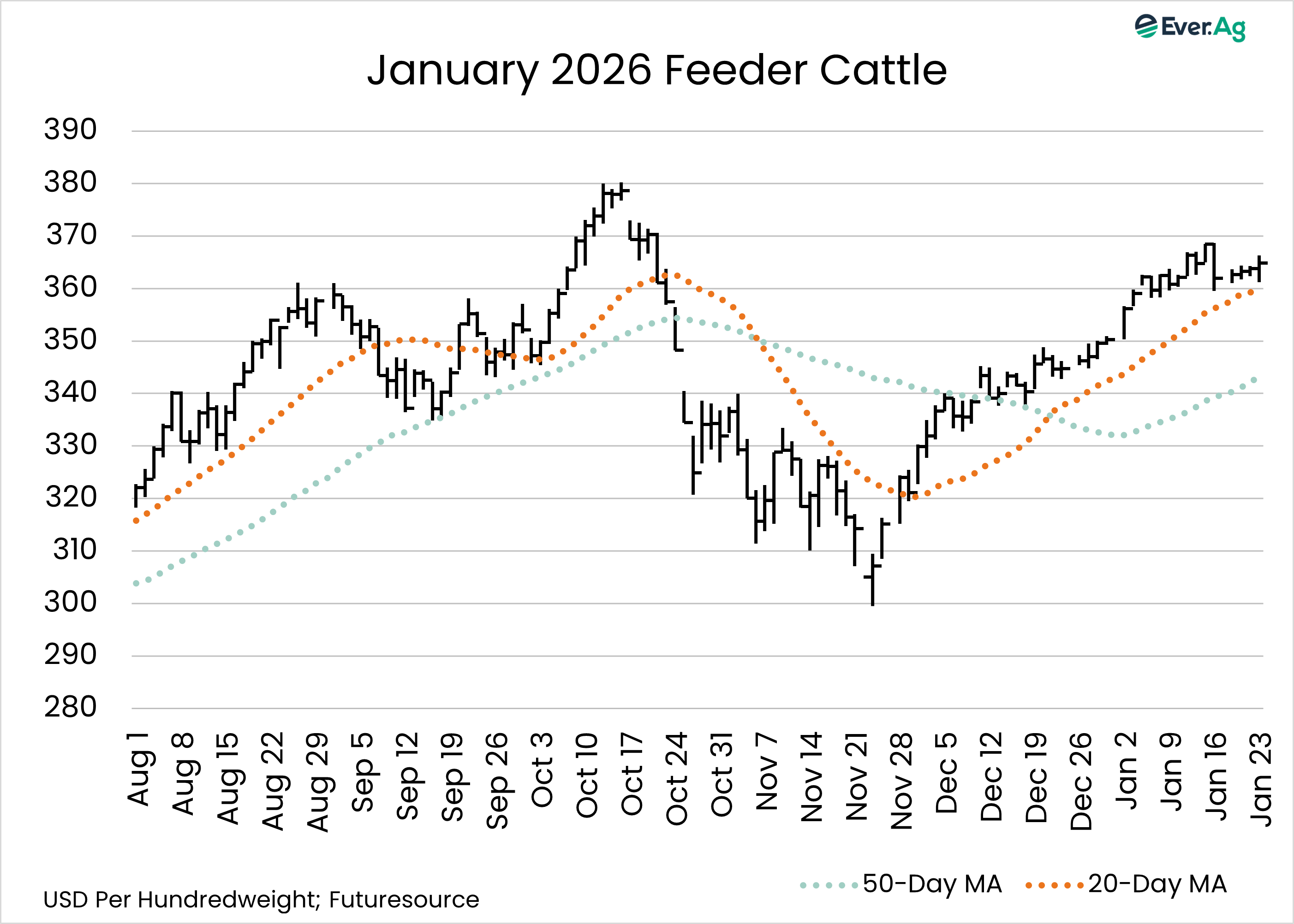

Both live and feeder cattle finished with week-over-week gains in all contracts on the board. Live cattle front month February was up $2.750 to $234.90 per hundredweight, while the April-August contracts were up between $2.775 and $2.95. Friday took the nearby contracts up through the 10-day moving average, which had been a point of resistance throughout the week.

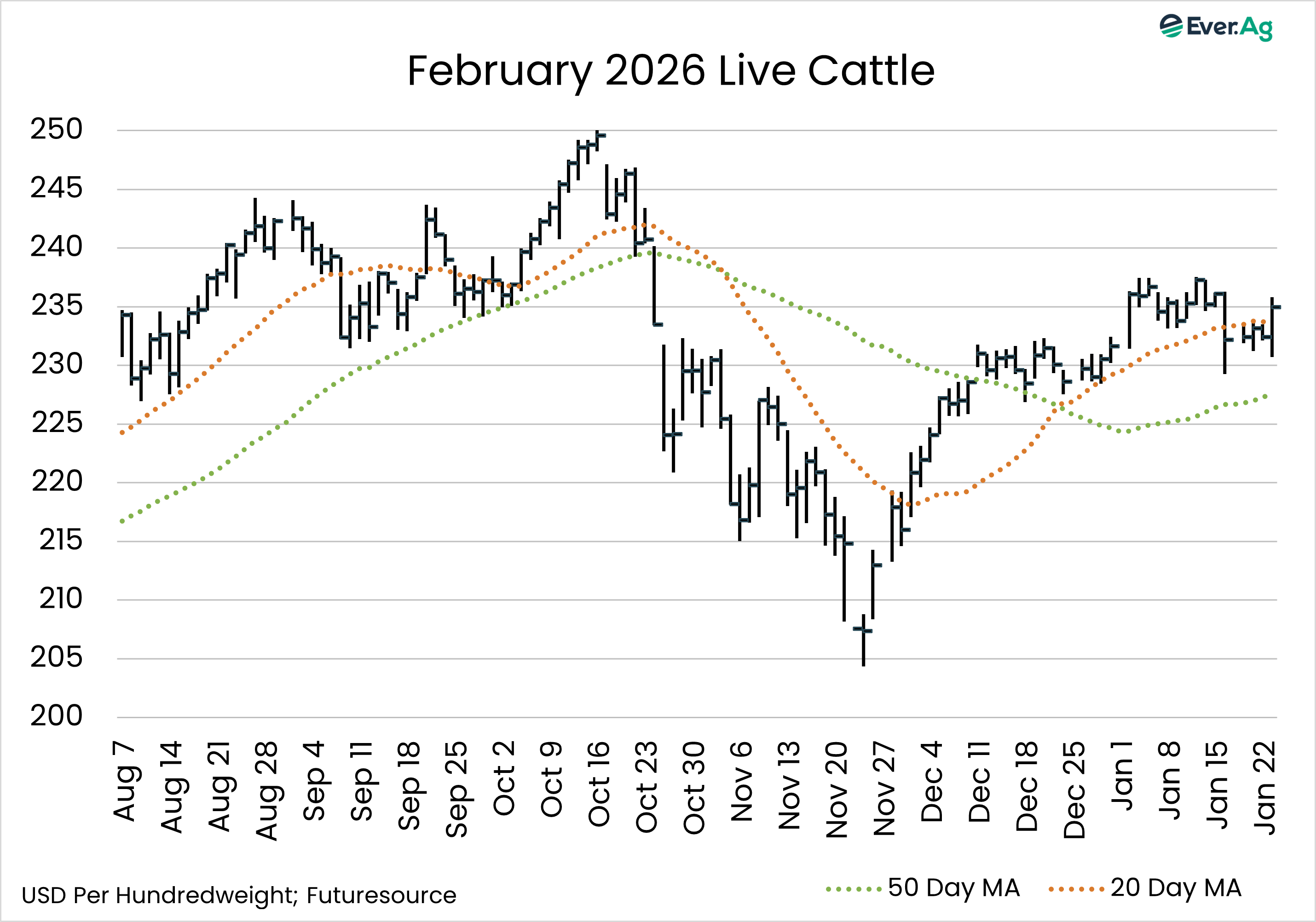

Feeder cattle front month January closed the week up $2.875 compared to last Friday, finishing at $364.80 per hundredweight. The March-August contracts were up between $3.725 to $4.125 week-over-week. After last Friday’s losses, cash feeder cattle prices were weaker in the countryside, leading the feeder index to be down $5.46 on the week. The January contract will expire on Thursday, January 29. After today’s index print, it sits just premium to the index.

Though cash trade mostly held out until Friday, it brought some life back into markets to end the week. Bids initially came in at steady money, which many feeders passed on, leading packers to pay from $233 up to $236 per hundredweight in both the North and the South on a live basis. Dressed trade came in at $370 per hundredweight. Even with the recent reduction in slaughter capacity from Tyson, cattle feeders appear to have maintained control of their leverage.

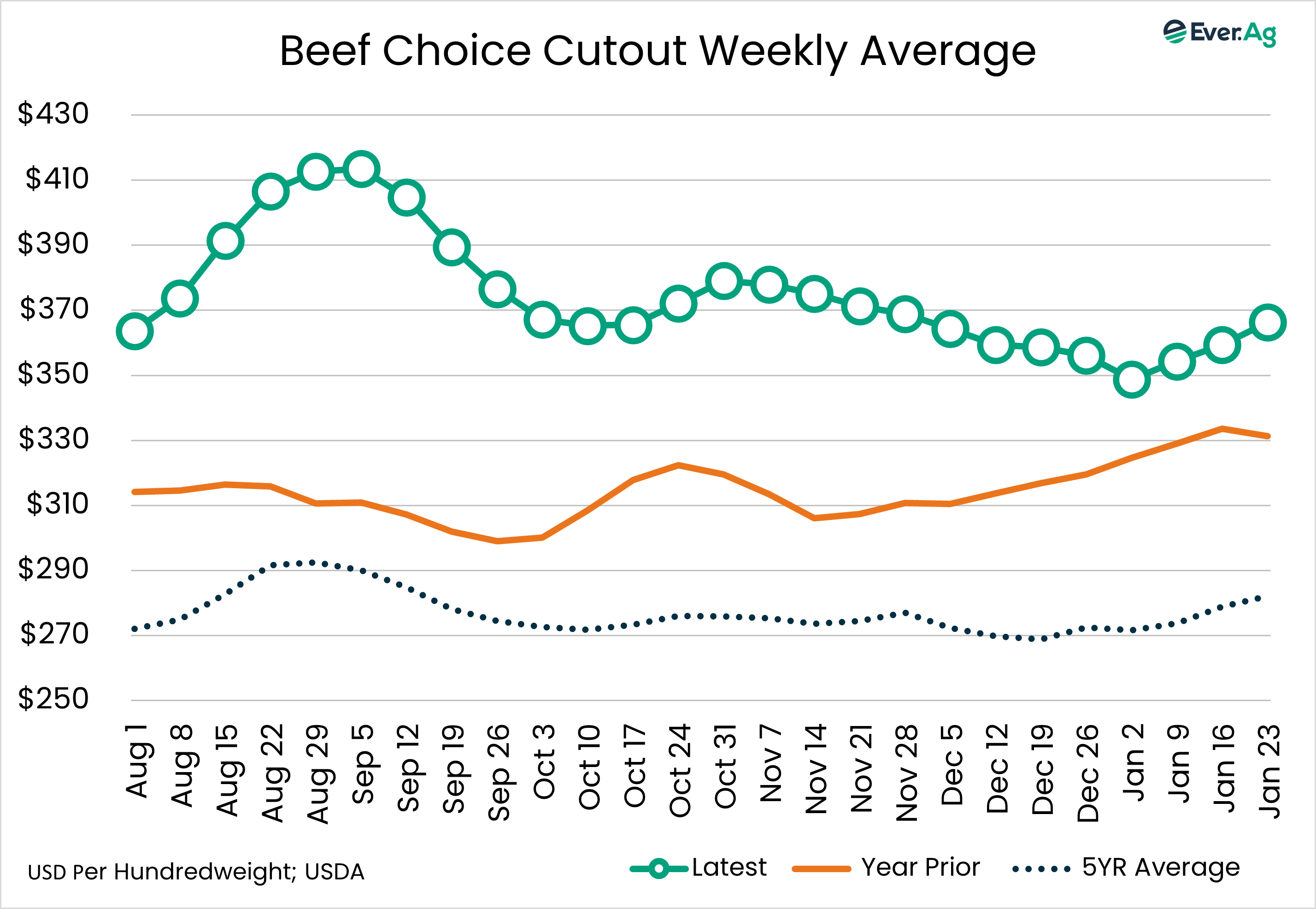

This occurred in a week where packers continued to pull back on kill, in part to keep margins stable and towards the end of the week due to an impending snowstorm and extreme cold. Slaughter for the week is expected to finish at 535,000 head, down from 562,000 last week and 593,000 in the same week last year. There’s potential for the continued cold temperatures and aftermath of the storm to delay Monday’s start times as well.

The cutout price has benefitted from the reduced slaughter numbers and the typical small January rally, with Choice up $6.54 per hundredweight and Select up $2.20 on the week. The Choice/Select spread has widened since its inversion on January 12, with all the Choice primals gaining week-over-week except for the flank. The rib primal has rebounded solidly as well, now down only $2.20 per hundredweight from last year, compared to the $25+ discount from last Friday.

Retail beef sales continue to increase, though at a slightly slower pace than earlier in 2025. December volume sales were up 1.7% year-over-year, compared to pork down 0.1% and chicken up 1.4%, according to recent Circana data.

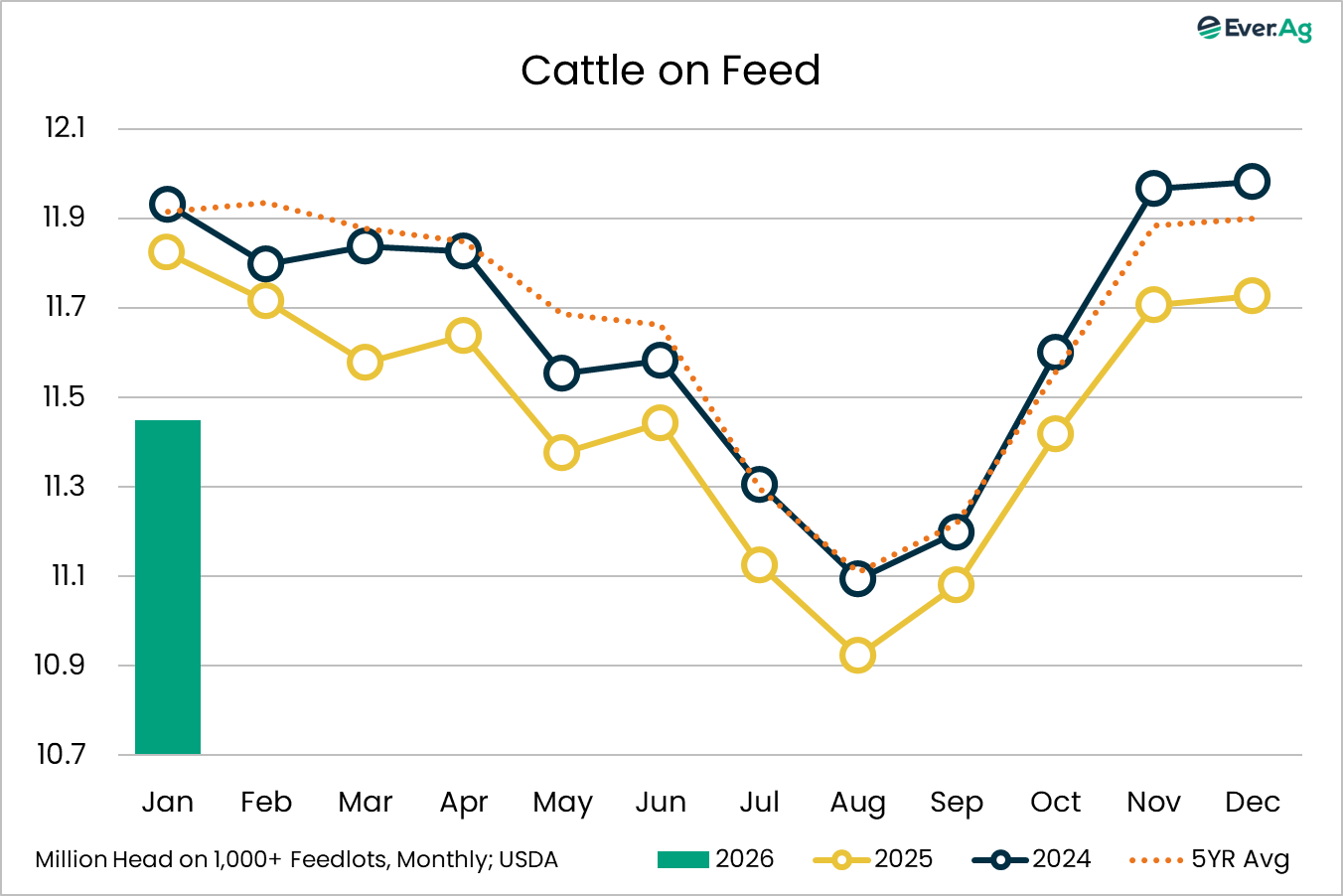

Today’s Cattle on Feed report was relatively neutral. Cattle on feed as of January 1 came in at 96.8% of last year, spot on with the average trade guess. From a percentage standpoint, this is down slightly from where we were most of 2025, which has consistently been below or around 2%.

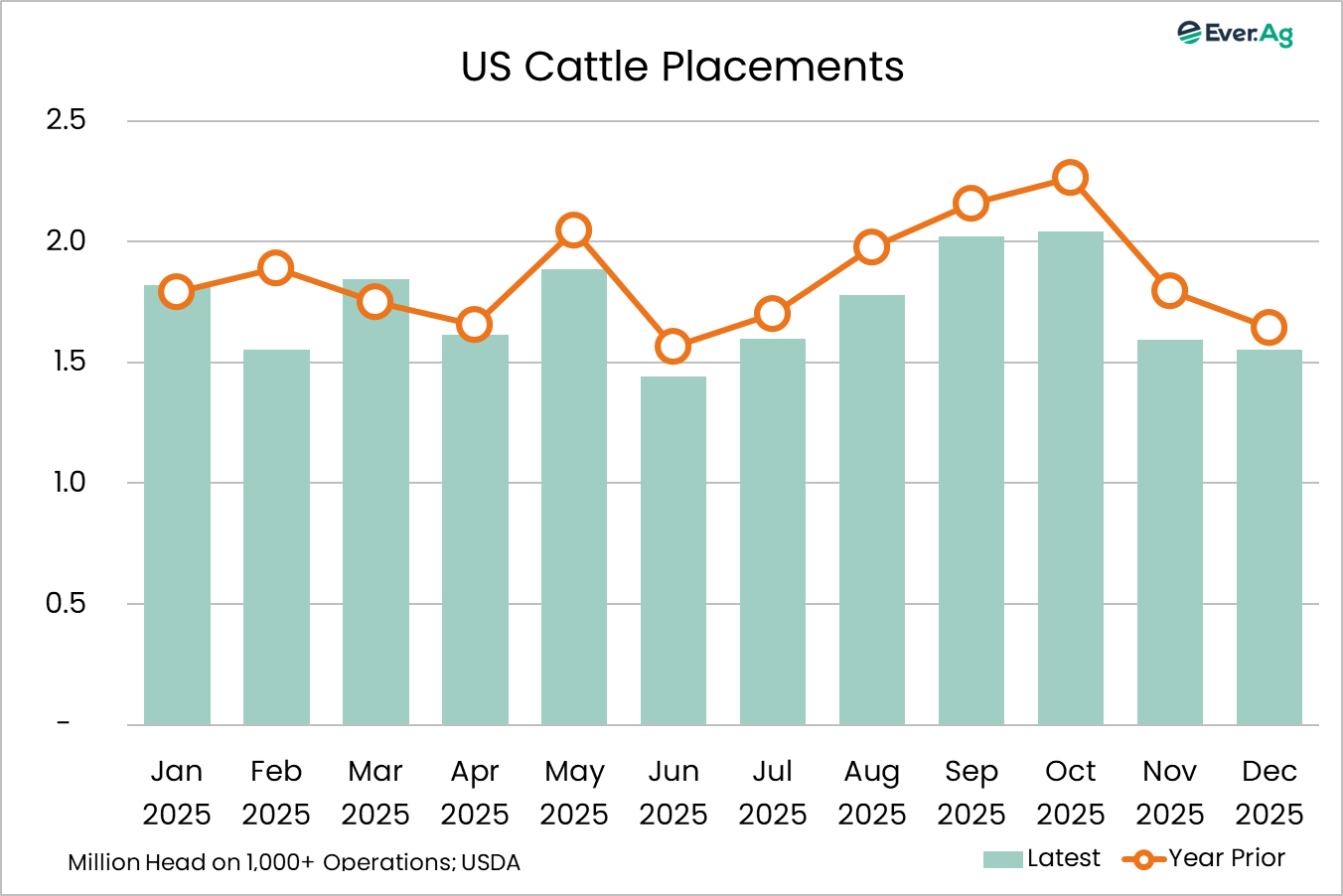

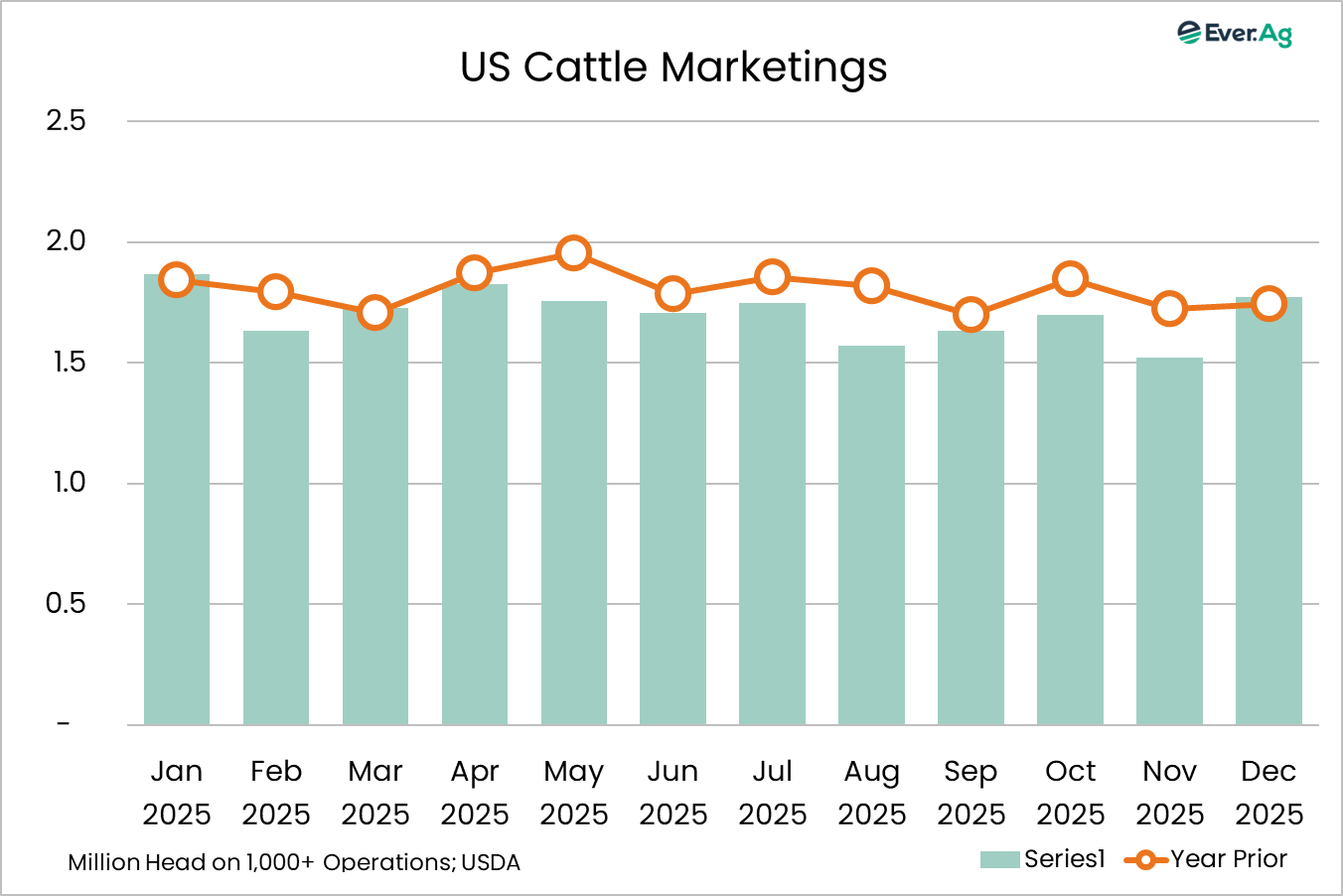

Placements in December were 94.6% of last year, near the top end of pre-report estimates and up from the average of 93.1%, though this is typically the metric with the largest variation compared to estimates. December marketings were 101.8% of last year compared to the average estimate of 101.7%. It is important to note that there was one additional business day in December 2025 compared to 2024.

The quarterly percentage of heifers on feed was included in this report and ticked up to 39% of total cattle on feed compared to 38% back in October. Though this is not the only metric that we look at when determining herd rebuilding, it certainly doesn’t add any fuel to the conversation that a rebuild is under way. There will be more to come on that, with the January Cattle report due next Friday.

Futures and options on futures trading involve significant risk and are not suitable for every investor. Information contained herein is strictly the opinion of its author and not necessarily of Ever.Ag and is intended for informational purposes. Information is obtained from sources believed reliable but is in no way guaranteed. Opinions, market data and recommendations are subject to change at any time. Past results are not indicative of future results. Trey Freeman and Matt Wolf maintain financial interests in the commodity contracts mentioned within this research report at the time it is published. Reproduction or redistribution is prohibited by law. Ever.Ag Insurance Services is an affiliate of Ever.Ag and is a licensed insurance agency in the following states: AZ, CA, CO, CT, FL, GA, ID, IL, IN, IA, KS, KY, LA, ME, MD, MA, MI, MN, MO, MT, NE, NV, NH, NM, NY, NC, ND, OK, OH, OR, PA, RI, SD, TN, TX, UT, VT, VA, WA, WV, WI, WY. This agency is an equal-opportunity employer.