COMMENTARY BY ABBY GREIMAN

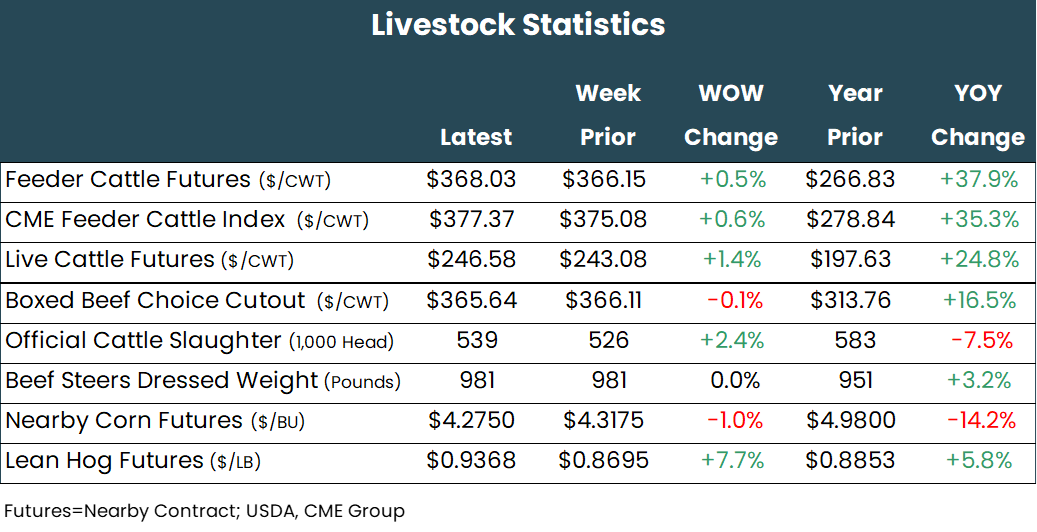

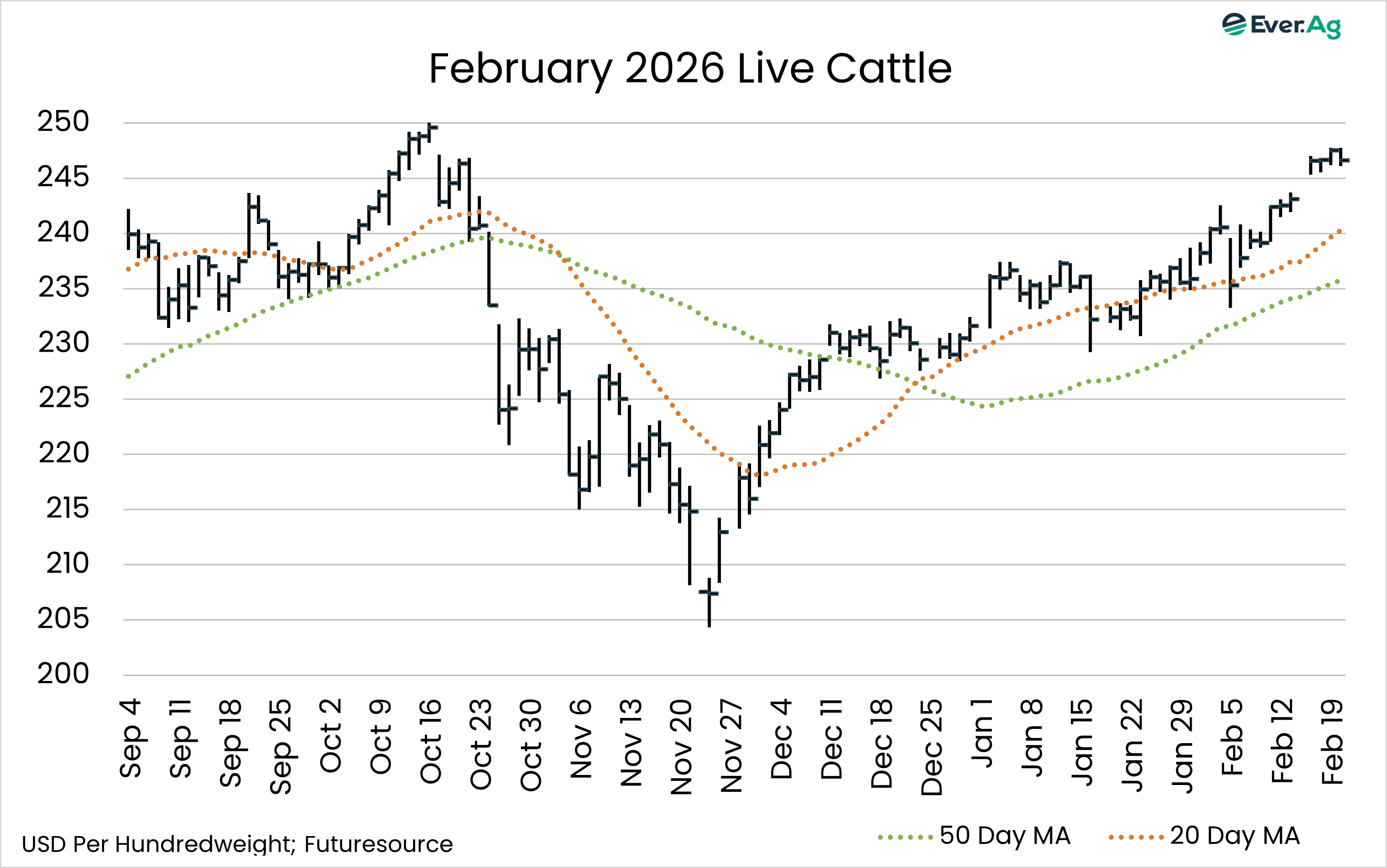

Cattle feeders continue to look for more blue sky a week after setting new all-time highs in the 5 Area Weekly Weighted Average Cash price. Cash traders kept activity quiet throughout the week until Friday, when packers began bidding $245 per hundredweight in all regions, steady with the bottom side of last week’s trade in the north and $1 lower than last week’s trade in the south. Feeders rejected those bids, pushing the price up to $248 in the north and $249 in the south. Packers showed less willingness to chase cattle this week than they typically do.

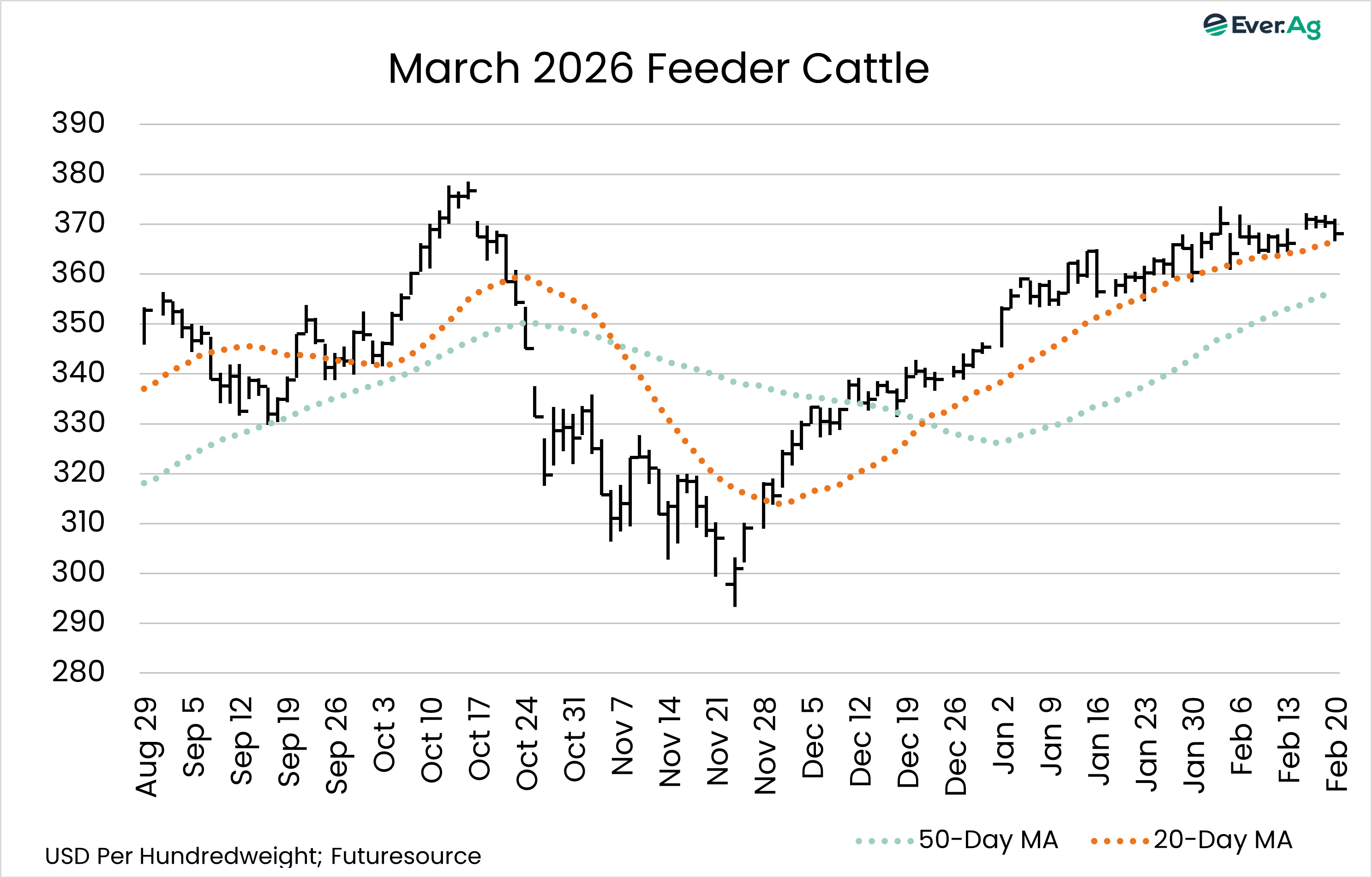

Cash trade has also been strong in the feeder cattle market, as the feeder cattle index set new all-time highs at the end of the week. The index rose to $377.37 per hundredweight, $0.86 above the previous high.

After the President’s Day holiday on Monday, the live cattle market opened higher on Tuesday following strong cash trade late last Friday. Wednesday and Thursday brought back and forth action, and Friday ultimately reversed some of the early week gains and filled Tuesday’s opening gap, as cash trade once again mostly held out until after market close. Ultimately, Tuesday’s strength created week-over-week gains, as the live cattle front month February gained $3.50 per hundredweight, and the April through August contracts were up $1.25 to $1.375. Feeder cattle followed a similar pattern, with front month March up $1.875 on the week, while the April through September contracts were up $0.775 to $1.60. Volume remained light in both live and feeder cattle contracts throughout the week.

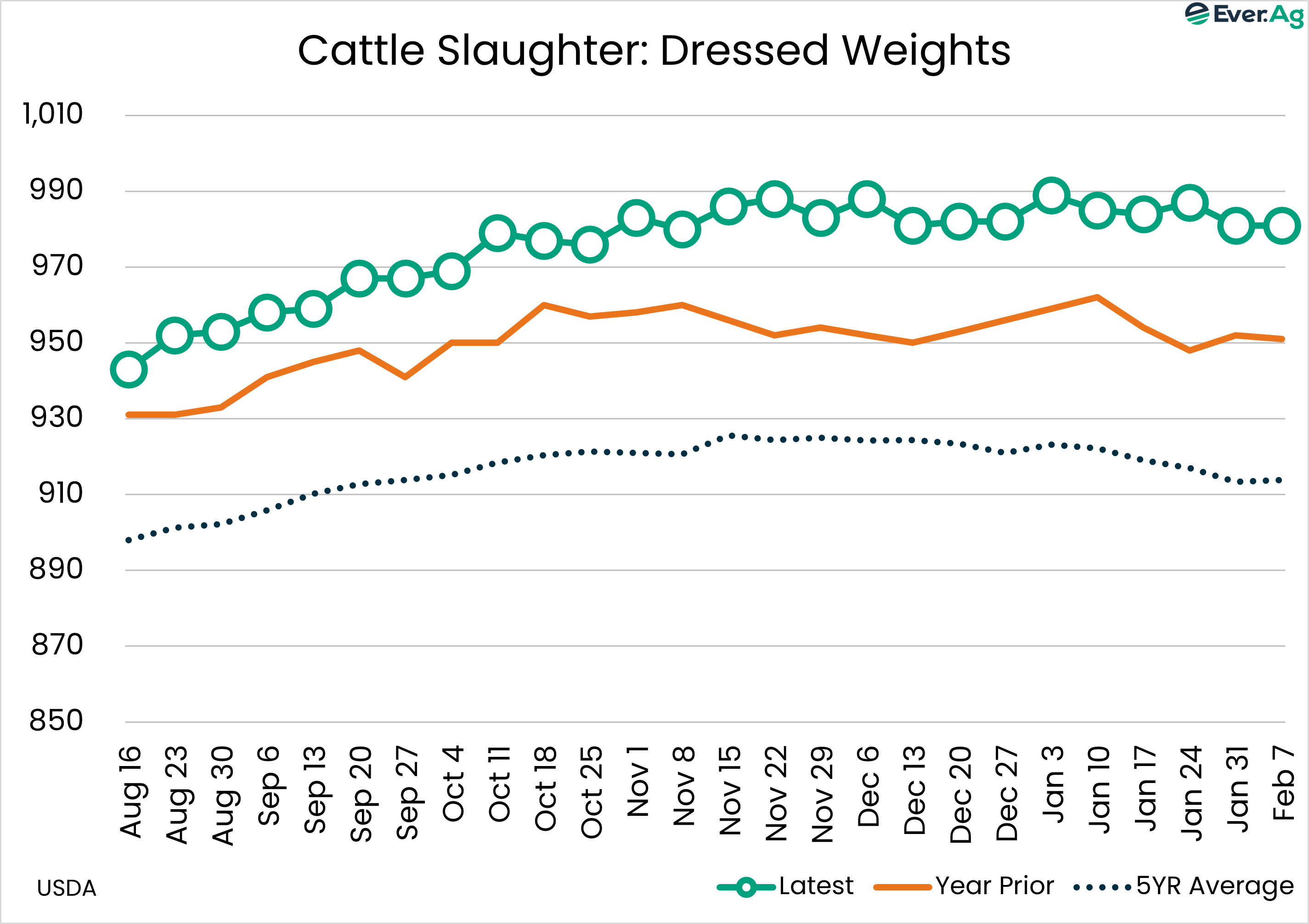

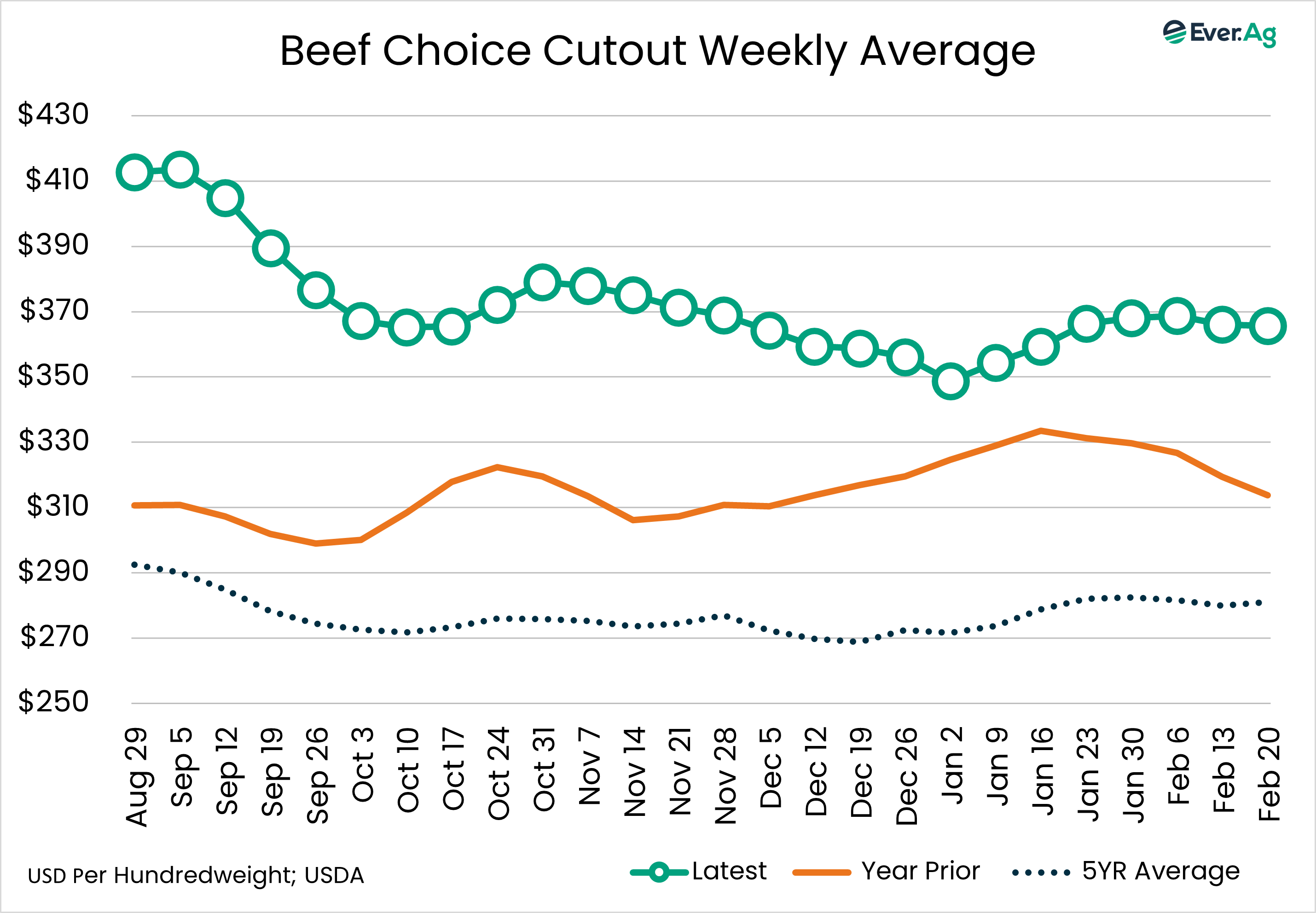

On the meat side of fundamentals, seasonal trends continue to persist. The cutout moved mostly sideways through the week, with the spot Choice up $2.23 per hundredweight on the week and the spot Select down $2.68. The rib continues finding support, while the end meats remain weaker. Packers reduced kills slightly more this week; the total came in at 516,000 compared to 541,000 last week and 565,000 last year. We have not seen non-holiday weekly kills this light since the spring of 2020, during the COVID-19 pandemic lockdowns. Packers are working to prevent margins from sliding further, hoping they can wait out the toughest seasonal period of demand.

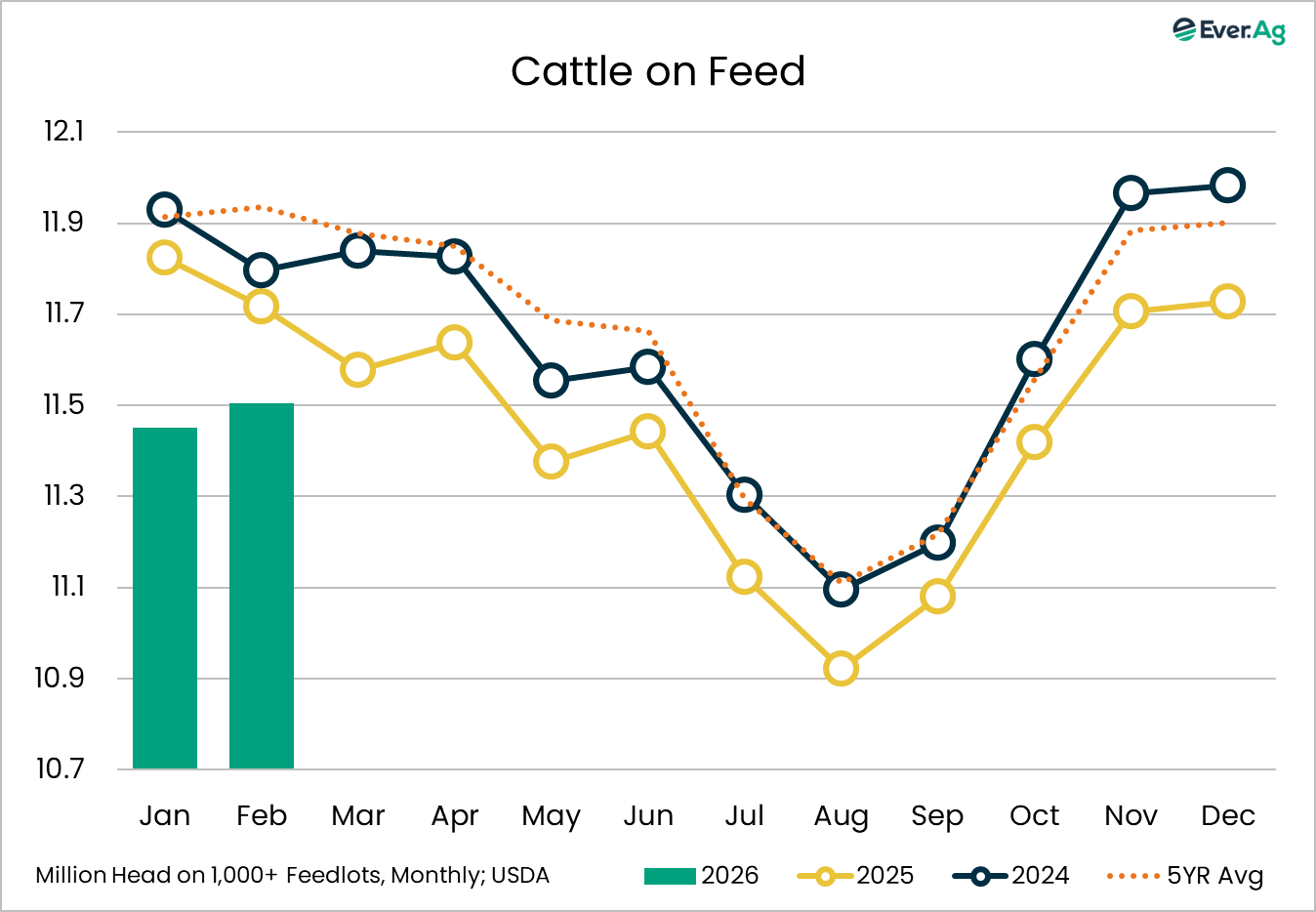

The February Cattle on Feed report came out on Friday and matched pre-report expectations. Cattle on feed as of February 1 totaled 98.2% of last year compared to the average trade guess of 98.4%. Feeders placed 95.3% as many cattle as last January, compared to the average estimate of 96.0%. Feedlots marketed 87.0% as many cattle as a year ago, right in line with the estimate. January 2026 had one fewer business day, compared to 2025, which partly explains the large difference in the marketings number. However, with the extremely small kills that we have seen over the past few weeks, I expect marketings to continue running well below year ago. This will moderate the supply of feedlot cattle in favor of the packer and could slow the cash rally we’ve seen lately.

Futures and options on futures trading involve significant risk and are not suitable for every investor. Information contained herein is strictly the opinion of its author and not necessarily of Ever.Ag and is intended for informational purposes. Information is obtained from sources believed reliable but is in no way guaranteed. Opinions, market data and recommendations are subject to change at any time. Past results are not indicative of future results. Trey Freeman and Matt Wolf maintain financial interests in the commodity contracts mentioned within this research report at the time it is published. Reproduction or redistribution is prohibited by law. Ever.Ag Insurance Services is an affiliate of Ever.Ag and is a licensed insurance agency in the following states: AZ, CA, CO, CT, FL, GA, ID, IL, IN, IA, KS, KY, LA, ME, MD, MA, MI, MN, MO, MT, NE, NV, NH, NM, NY, NC, ND, OK, OH, OR, PA, RI, SD, TN, TX, UT, VT, VA, WA, WV, WI, WY. This agency is an equal-opportunity employer.