COMMENTARY BY ABBY GREIMAN

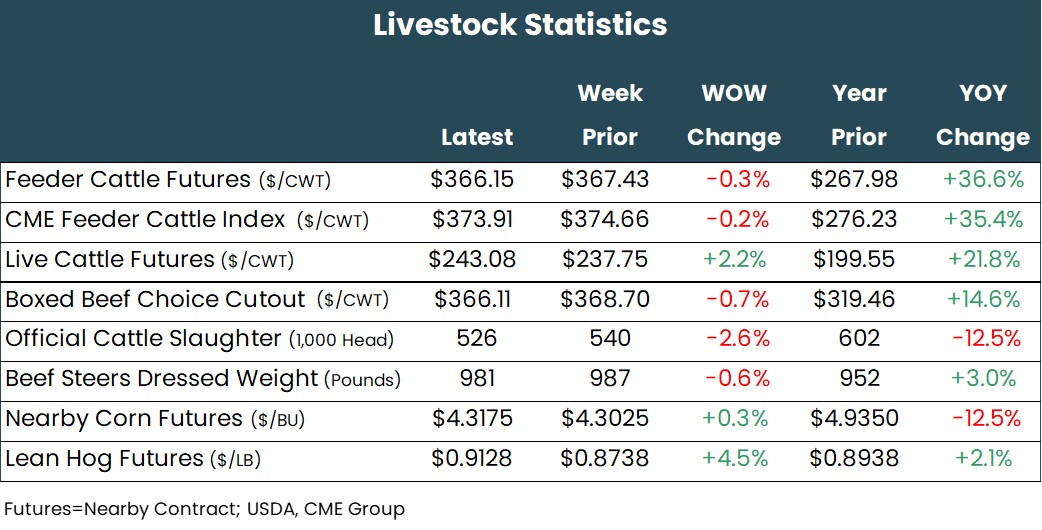

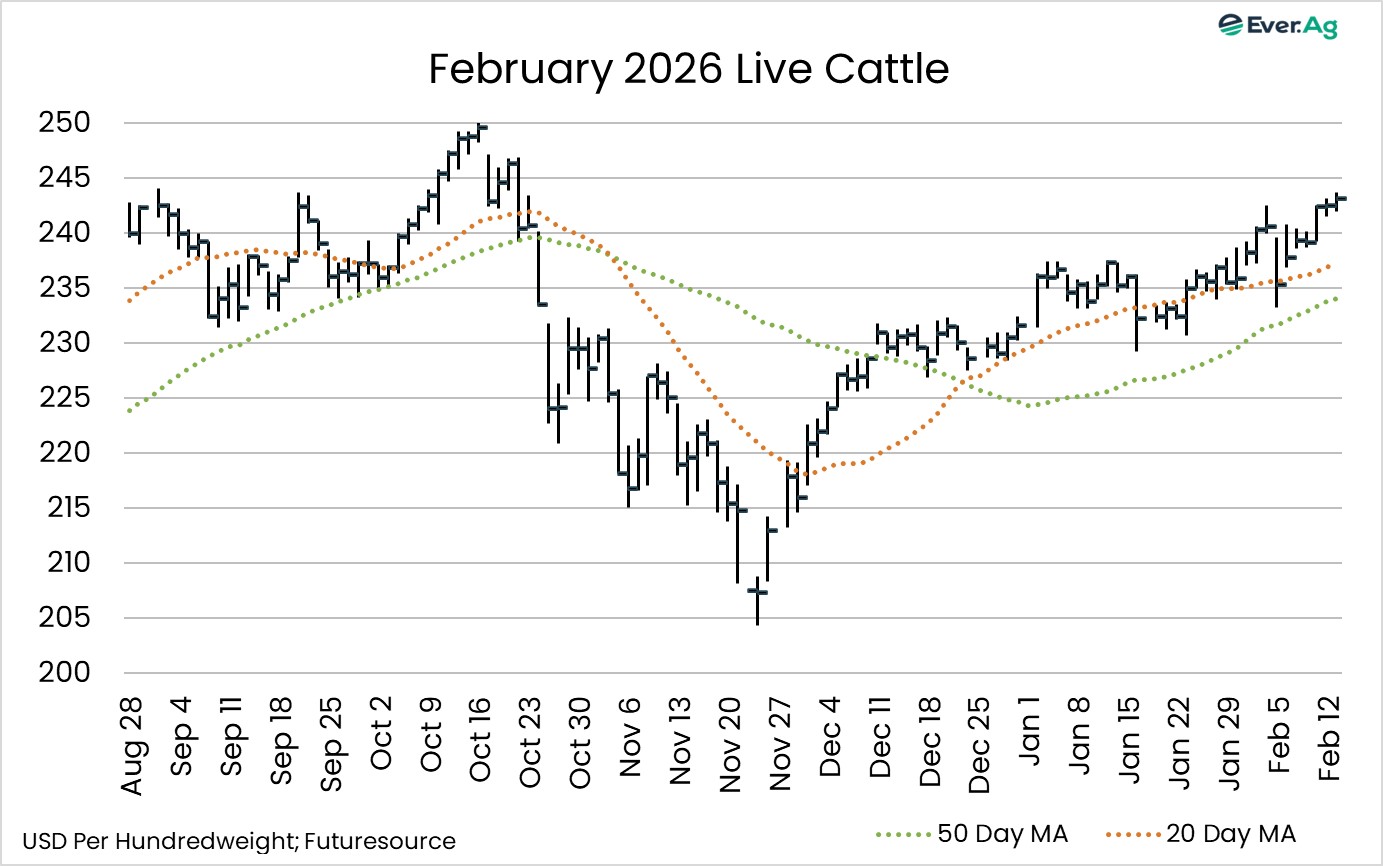

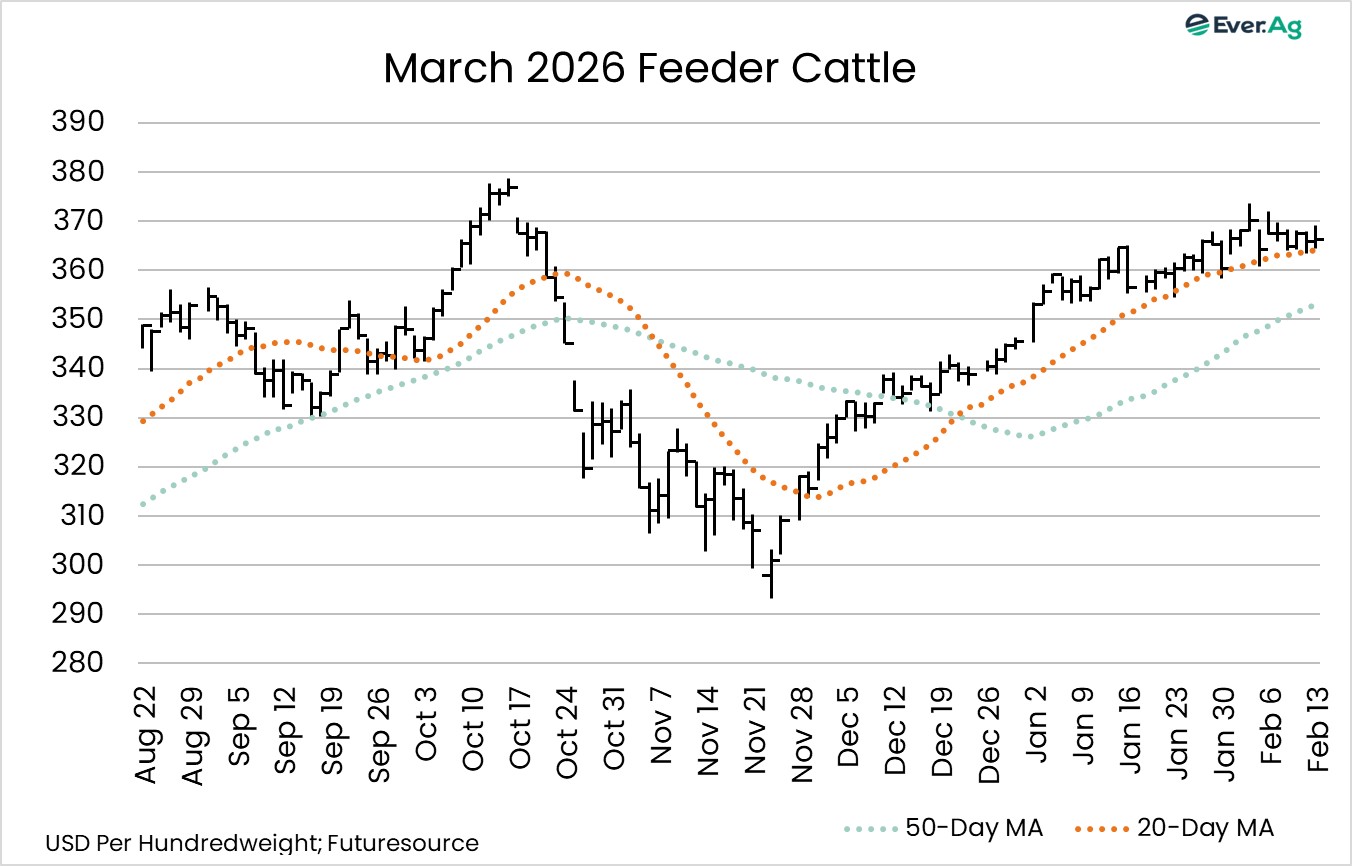

Cattle markets were uneventful this week, with little news on the wire to spark moves one way or another. Markets did catch a bit of strength on Wednesday, which accounted for most of the week-over-week change in futures. Live cattle front month February finished the week up $5.325, while April through August contracts were up $1.575-$3.375 with strength in the nearby months. Feeder cattle front month March was down $1.275, while the April through September contracts were up $0.65-$3.675, with strength in the deferred months.

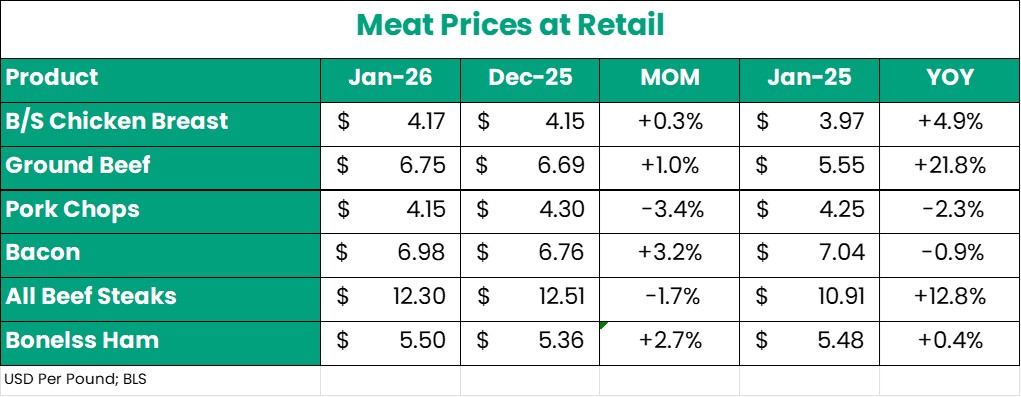

Updated beef prices for January were perhaps the most interesting news of the week. USDA’s all fresh beef retail price was $9.465 per pound, down about 1% from December 16% higher than January 2025. The Bureau of Labor Statistics’ retail meat prices provide a look under the hood. They reported ground beef prices at $6.75 per pound, up 1% over December and 21.8% over January 2025. In contrast, the all beef steaks price was $12.30 per pound, down 2.7% from December but still up 12.8% over last January. This isn’t necessarily surprising as demand typically slumps a bit in January following the holidays.

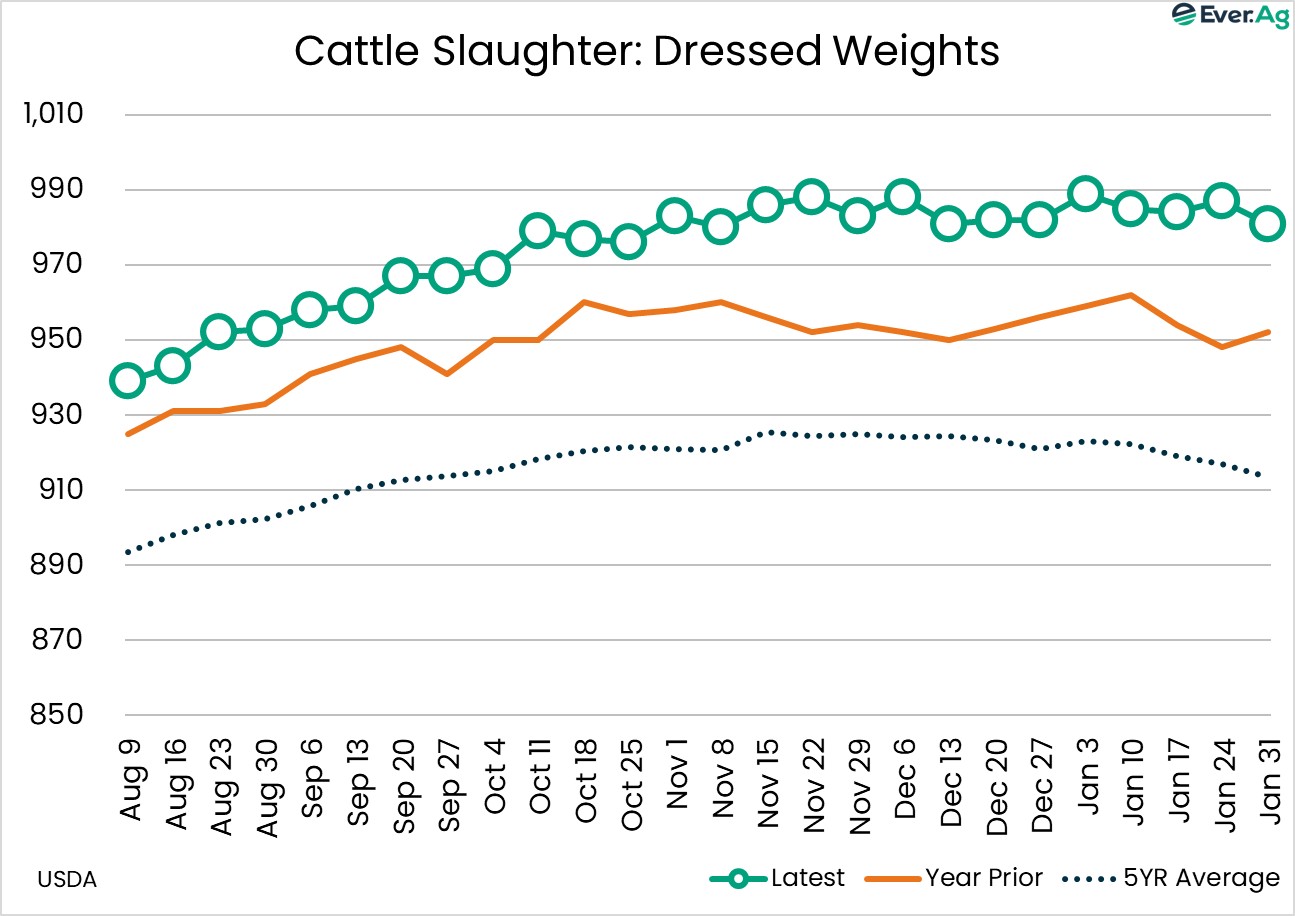

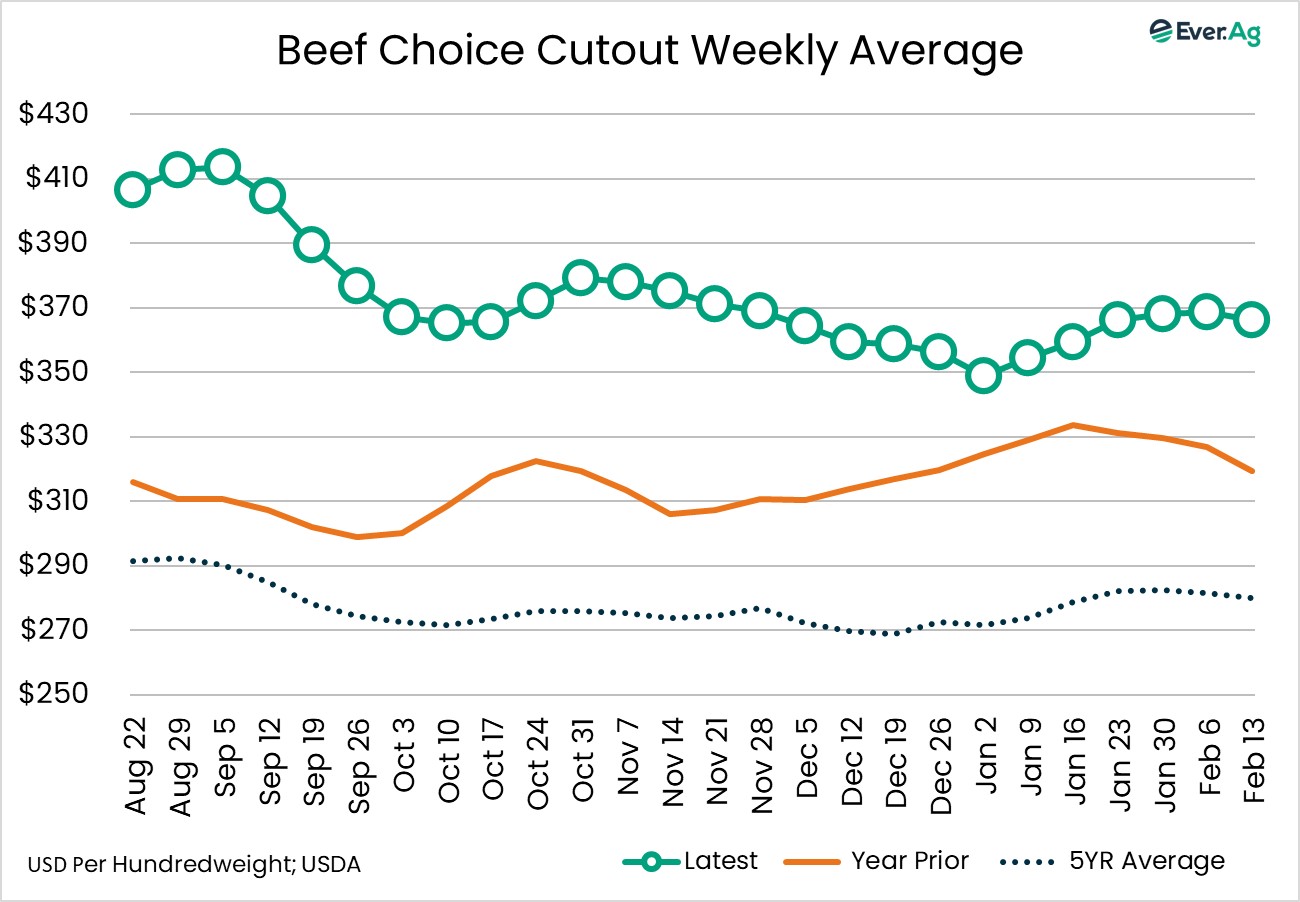

On the packer side of the meat equation, the cutout price also fell into a slump this week. The spot Choice cutout was down $4.86 week-over-week and Select was down $1.11. As we’ve been talking about, this is on par with typical seasonality. Expect February to have sideways to lower cutout prices as we all wait for spring grilling season to start. Packers have responded accordingly by keeping kills light. This week ended at 541,000 head, compared to 536,000 last week and 561,000 last year. Based on daily numbers, packers appear to be cutting hours on Fridays to maintain as much efficiency as possible.

Cash trade developed late again this week, with most of the trade occurring Friday afternoon. The North traded around $245 per hundredweight live, up $1 from the top end of last week’s market, and $382 per hundredweight dressed, up $4. The South was stronger at $246-$249, up $1-$4 and at new record highs for the region. Cash feeder cattle trade was – you guessed it – steady, with the feeder index ranging from $373.83 to $374.66 per hundredweight for the week.

The only other noteworthy topic this week came from USDA’s WASDE report. This is more of a reactive report and doesn’t really affect markets, but it can still provide a good big picture view. USDA projected US beef production at 25.92 billion pounds, up from 25.735 in the January report based on continued heavy carcass weights. This, combined with a slight increase in imports, raised per capita consumption by 0.6 pounds. USDA also lifted the average fed steer price for 2026 from $236 per hundredweight in the January report to $240 per hundredweight in February.

Futures and options on futures trading involve significant risk and are not suitable for every investor. Information contained herein is strictly the opinion of its author and not necessarily of Ever.Ag and is intended for informational purposes. Information is obtained from sources believed reliable but is in no way guaranteed. Opinions, market data and recommendations are subject to change at any time. Past results are not indicative of future results. Trey Freeman and Matt Wolf maintain financial interests in the commodity contracts mentioned within this research report at the time it is published. Reproduction or redistribution is prohibited by law. Ever.Ag Insurance Services is an affiliate of Ever.Ag and is a licensed insurance agency in the following states: AZ, CA, CO, CT, FL, GA, ID, IL, IN, IA, KS, KY, LA, ME, MD, MA, MI, MN, MO, MT, NE, NV, NH, NM, NY, NC, ND, OK, OH, OR, PA, RI, SD, TN, TX, UT, VT, VA, WA, WV, WI, WY. This agency is an equal-opportunity employer.