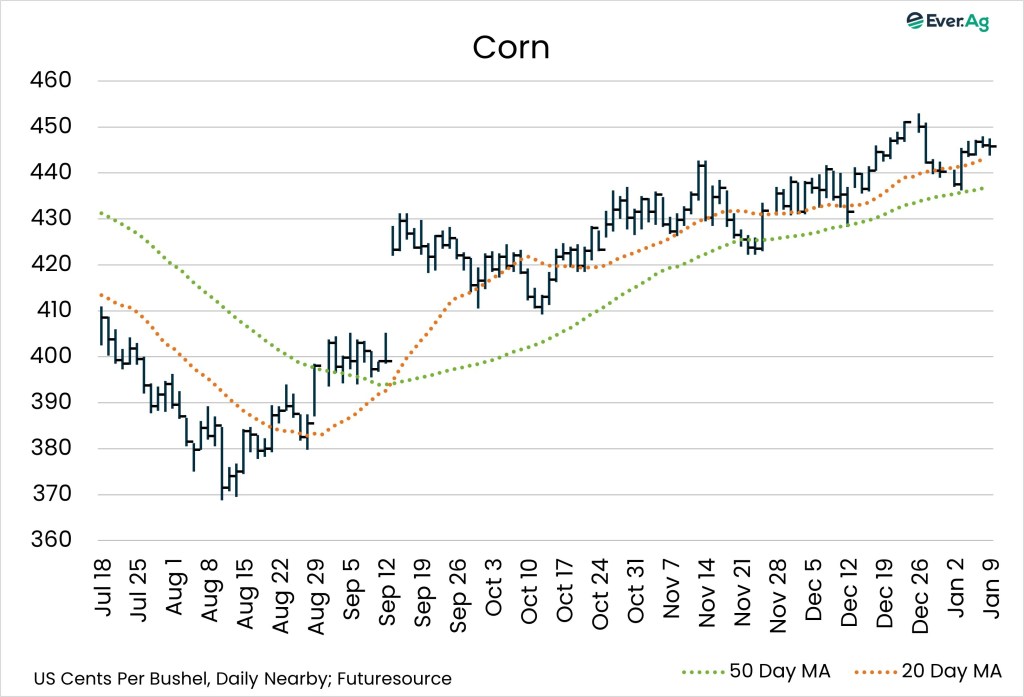

Corn

- March corn settled at $4.4575 per bushel, up more than eight cents week-over-week. The May contract ended the week at $4.5375 per bushel, also more than eight cents higher.

- Ethanol production declined to 1.098 million barrels per day, down 2.0% on the week and -0.4% versus 2025. Stocks totaled 23.652 million barrels, up 3.1% week-over-week, but down 2.1% on the year.

- As of January 1, accumulated corn export sales totaled 1.079 billion bushels, far ahead of the five-year average of 530.45 million.

CORN COMMENTARY BY NATALIE MCCARTY

- Corn markets have continued in a sideways, rangebound chop with a very modest uptrend. Since harvest, March corn has traded from a low of $4.2550 per bushel on October 14 to a high of $4.4325 on November 14. The 200-day moving average line, which is currently at $4.4500, has proved to be a firm retracement level so far with little news to break it out of the range.

- However, on Monday, January 12, USDA will issue its highly anticipated WASDE and quarterly Grain Stocks reports. With this only being the second report since the government reopened and the first with any real distance behind it, it is being watched carefully. The January report is also the final yield adjustment for the 2025-26 crop year. Expectations are that current yield is too high and trade estimates could decline.

- Corn supplies are large, but demand is very good. Exports are up 30% from a year ago versus the USDA forecast of +12%. Commitments are 63% of the USDA forecast, above the historical average of 54%. Shipments are up 65% over last year. First quarter corn exports sent to Mexico were the strongest on record. Additionally, Japan and Korea, two of our trop trading partners, had strong year-over-year increase.

- As soybean and other commodity prices continue to falter, many farmers are looking at planting corn again for the coming year.

- On December 31, USDA announced that the Farmer Bridge Assistance payment would be $44.36 bushels per acre for corn. Please visit with your FSA office to ensure you have all needed paperwork submitted. Farmers should see the payments by the end of February.

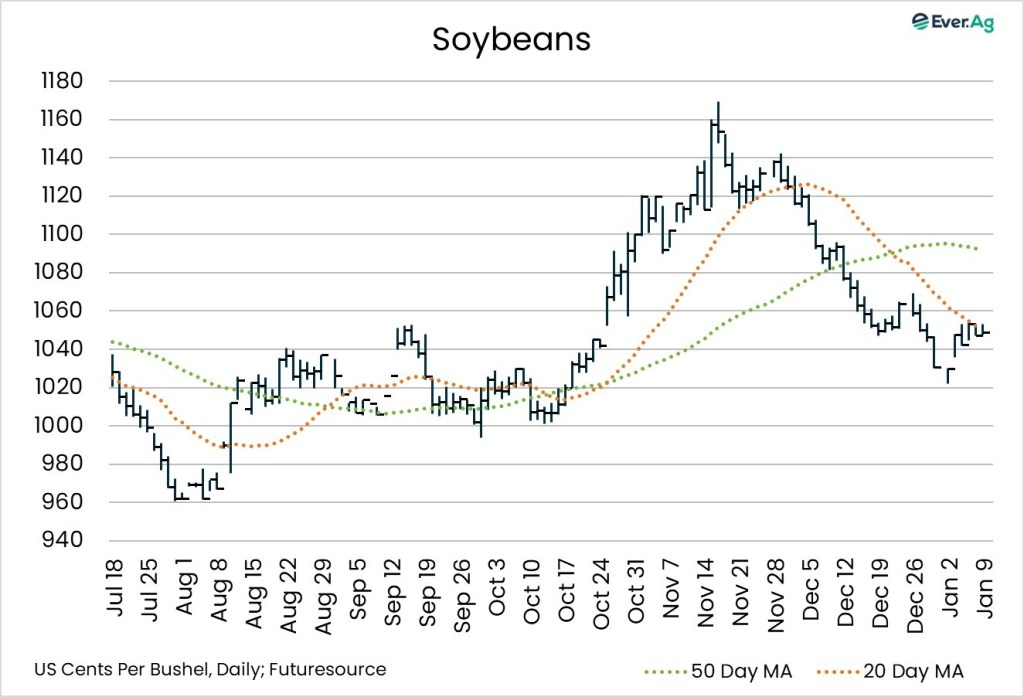

Soybeans

- January soybean futures closed at $10.4850 per bushel, 19 cents higher on the week. March soybeans finished Friday at $10.6250 per bushel, up almost 17 cents.

- US soybean accumulated export sales reached 600.63 million bushels, far below 1.054 billion bushels on the five-year average.

SOY COMMENTARY BY LORI NELSON

- China stepped in with soybean purchases this week, giving some support to the market, which had a tough end of December. However, total US soybean shipments remain sharply below last year, and uncertainty persists around the pace and durability of Chinese buying.

- Weather also remains a dominant driver in the market, with uneven rainfall and rising heat risks in parts of Brazil’s Central-West region and ongoing dryness in Argentina’s Pampas. While Brazil is still on pace for a record crop, forecast volatility raises risk premium as soybeans enter critical pod-setting stages.

- If Brazil’s crop does end up at record levels, it could limit any upside rallies in the US as the size of Brazil’s crop pressures US export competitiveness. Traders remain confident global supplies will be ample if the weather stabilizes.

- Meanwhile, the Farm Services Agency recently announced that through the Farmer Bridge Program, soybean farmers will receive $30.88 per acre at the end of February.

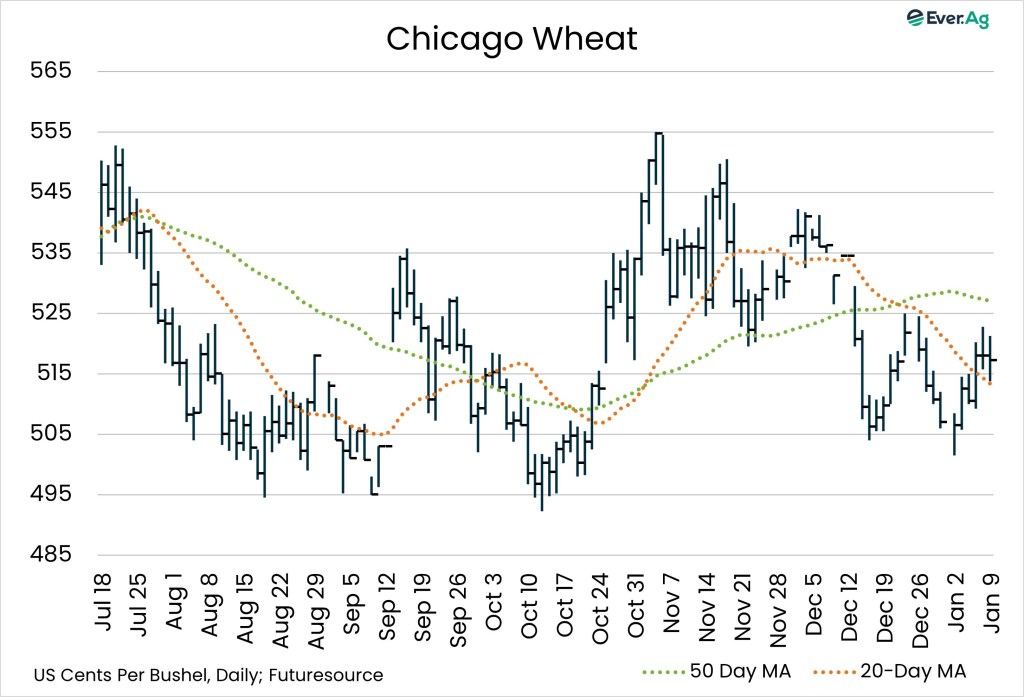

Wheat

- Nearby wheat futures ended the week at $5.1725 per bushel, up almost 11 cents compared to the Friday before.

- Accumulated US wheat export sales totaled 553.45 million bushels, ahead of the five-year average of 406.15 million.

WHEAT COMMENTARY BY LINDSEY CORE-LINNEBUR

- Winter wheat ratings took a hit in the Plains states in December, with 40% of the winter wheat growing area in the United States experiencing drought conditions. Comparatively, last year at this time, 26% of the growing area was experiencing drought. The Kansas rating of 60% good/excellent was below last month’s 62%. Colorado came in at 43%, down from 69% the previous month. Rain this week provided some relief in some areas but was largely limited in the Western Corn Belt and Northern Plains. A weak La Nina will hopefully transition to more neutral conditions sometime between January and March. If the US sees a shift to El Nino conditions this summer, it would be favorable for finishing off the wheat crop ahead of harvest.

- The WASDE report will be released on Monday, January 12, and wheat prices have rallied in anticipation. Expectations are for US ending stocks at 896 million bushels, down from 901 million in December. Analysts also expect a decrease in winter wheat seeding.

Futures and options on futures trading involves significant risk and is not suitable for every investor. Information contained herein is strictly the opinion of its author and not necessarily of Ever.Ag and is intended for informational purposes. Information is obtained from sources believed reliable but is in no way guaranteed. Opinions, market data and recommendations are subject to change at any time. Past results are not indicative of future results. Brian Fletcher, Jon Spainhour and Lori Nelsen maintain financial interest in the commodity contracts mentioned within this research report at the time it is published. Erica Maedke, Mark Majoros, Natalie McCarty and Lindsey Core-Linnebur do not maintain financial interest in the commodity contracts mentioned within this research report at the time of publication. This report is in the nature of a solicitation.