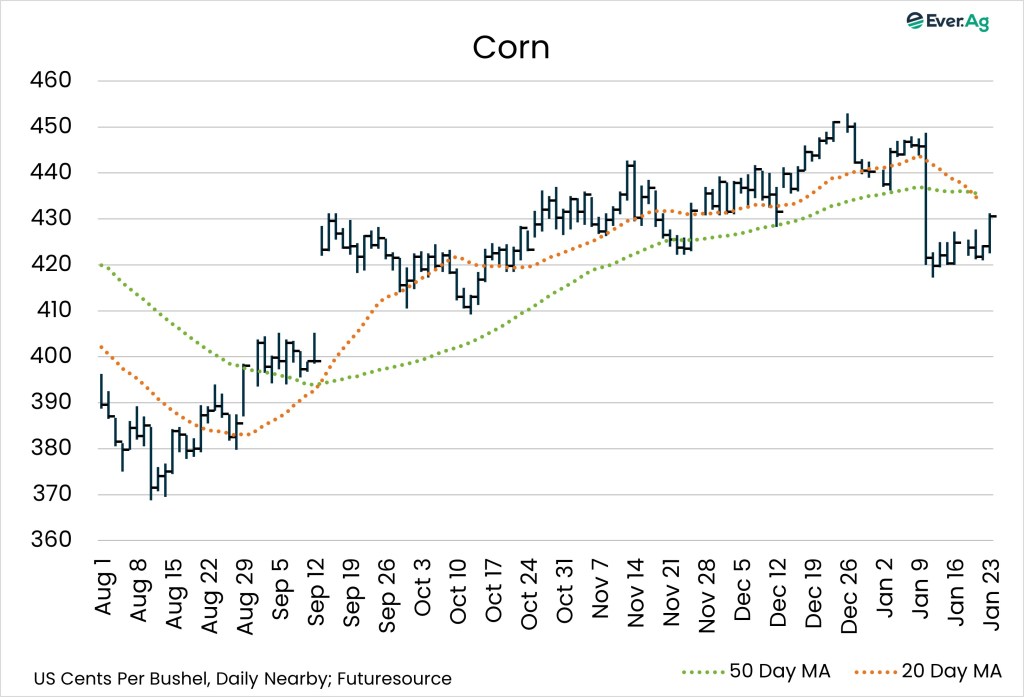

Corn

- March corn futures closed at $4.3050 per bushel, nearly six cents higher week-over-week. The May contract finished Friday at $4.3800 per bushel, up six cents.

- Ethanol production totaled 1.119 million barrels per day, down 6.4% week-over-week, but up 1.8% on the year. Stocks reached 25.739 million barrels, up 5.2% on the week, but down 0.5% versus 2024.

- Accumulated corn exports totaled 1.2 billion bushels, almost double the five-year-average pace of 642.1 million bushels.

CORN COMMENTARY BY JAKE KINGSLEY

- Now almost two weeks removed from the January WASDE report, corn futures settled into a new, tight range about $0.20 below where they spent most of the post-harvest period. A lofty domestic ending stocks number puts a healthy top on trade, while modest global supplies keep the bottom from falling out, at least until the South American crop is better defined in the next month. Support appears to be in place at about $4.15 per bushel, with resistance now forming just shy of $4.30 for the March contract. December futures have settled into a similar pattern, just $0.30 higher in the carry market.

- Ethanol and exports continue to push near record demand in their respective categories, and the trade has factored in their strength for the most part. Questions remain about feed and residual demand, which is also at a record level, though it is unclear how that can be sustained given the static herd sizes year-over-year in the US.

- For the moment, all eyes are on South American weather and the ever-changing geo-political climate. Both prove difficult to predict far into the future, and major headlines from either seem to be the highest risks in the marketplace at this time.

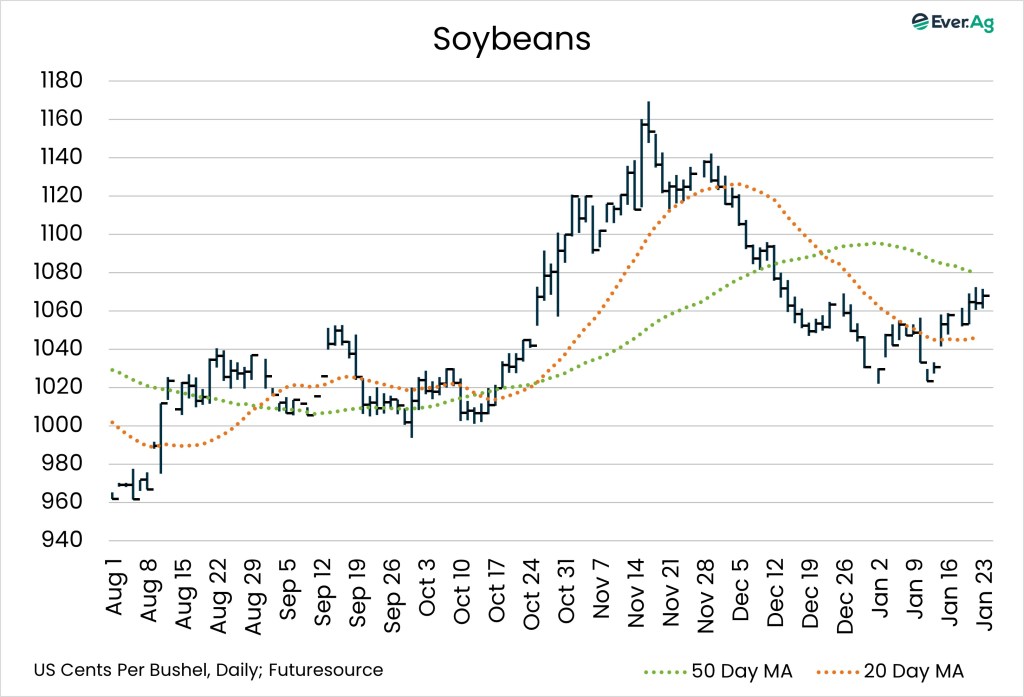

Soybeans

- The March soybean contract settled at $10.6775 per bushel, up a dime on the week. July futures ended the week at $10.9250 per bushel, more than 11 cents higher.

- US accumulated soybean exports reached 708.15 million bushels, well below the five-year average of 1.18 billion bushels.

SOY COMMENTARY BY COLE WEINKAUF

- Soybeans had a nice bounce back after last week’s bearish WASDE-related trading week. Treasury Secretary Scott Bessent spoke with China’s Vice Premier and reported China has reached the initial 12-million-ton purchase commitment. He said he looks forward to China buying another 25 million tons, although timing is uncertain. US trade representatives said there may be another round of talks with China before presidents Trump and Xi meet in person in April. This announcement has provided some support to a soybean market that has been yearning for bullish news. This recent rally will be very sensitive to the pace of shipments and any evidence of new-crop purchases we see from China. However, how long can we sustain these values with waning exports and a 350-million-bushel ending stocks number?

- The market may also be seeing a boost from deteriorating weather in Argentina’s southern crop regions, which are expected to see a few showers over the next 10 days but remain dry. South central Brazil is also drying down, with crop stress rising in that area. CONAB pegs Brazil harvest at 3% complete. Brazil’s harvest hedge pressure may help beans as we move into February.

- The 200-day moving average still seems to be a factor in March soybeans, so we may need more news to break through more levels of resistance.

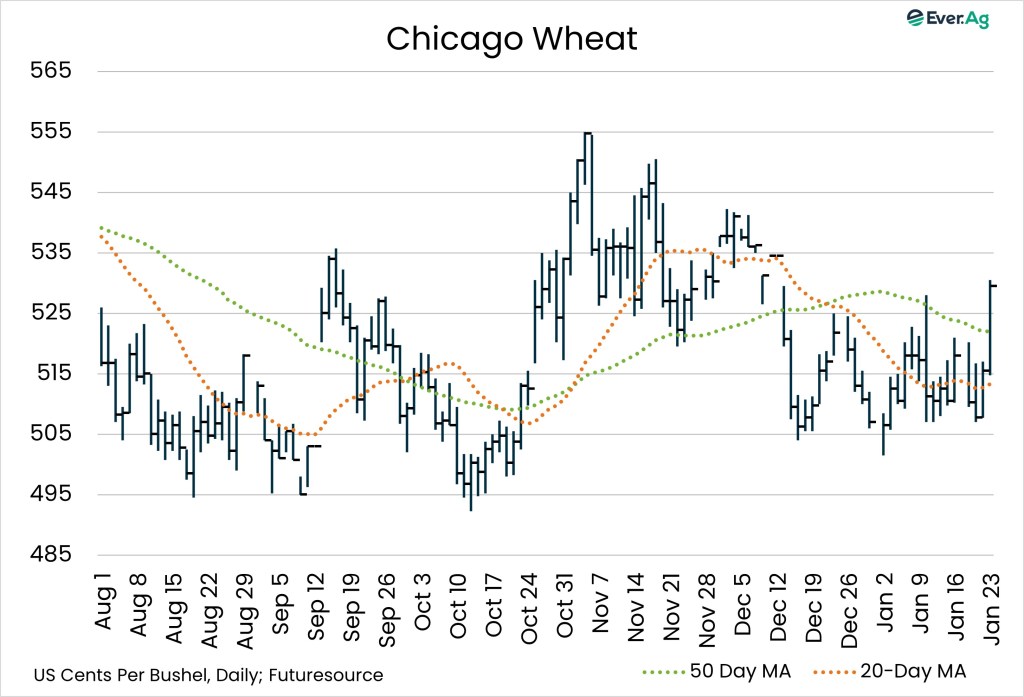

Wheat

- Nearby wheat futures finished Friday at $5.2950 per bushel, 11.5 cents higher compared to the week before.

- Accumulated wheat exports reached 578.3 million bushels compared to 451.2 million on the five-year average.

WHEAT COMMENTARY BY MEG JOHNSTON

- Wheat futures have come down from their January highs but are still carrying some momentum. The week opened with all three wheat futures in the green; however, the markets have been very choppy lately. While the futures markets continue to trade above the October and December lows, market traders are waiting for real bearish or bullish news to give more direction. Until then, wheat markets will continue to chop.

- Current geopolitical tensions, the upcoming extreme cold and some fund short covering could offer some bullish support to the wheat futures markets. We are expecting a large winter storm from the Northern Plains to the Upper Midwest. The moisture from the storm should be beneficial to these areas, but if they don’t get enough snow cover before the cold temperatures arrive, it could kill the winter wheat sown through the Northern Plains during the Fall.

Futures and options on futures trading involves significant risk and is not suitable for every investor. Information contained herein is strictly the opinion of its author and not necessarily of Ever.Ag and is intended for informational purposes. Information is obtained from sources believed reliable but is in no way guaranteed. Opinions, market data and recommendations are subject to change at any time. Past results are not indicative of future results. Jon Spainhour maintains financial interest in the commodity contracts mentioned within this research report at the time it is published. Katie Burgess, Kathleen Wolfley, Erica Maedke, Jake Kingsley, Cole Weinkauf and Meg Johnston do not maintain financial interest in the commodity contracts mentioned within this research report at the time of publication. This report is in the nature of a solicitation.