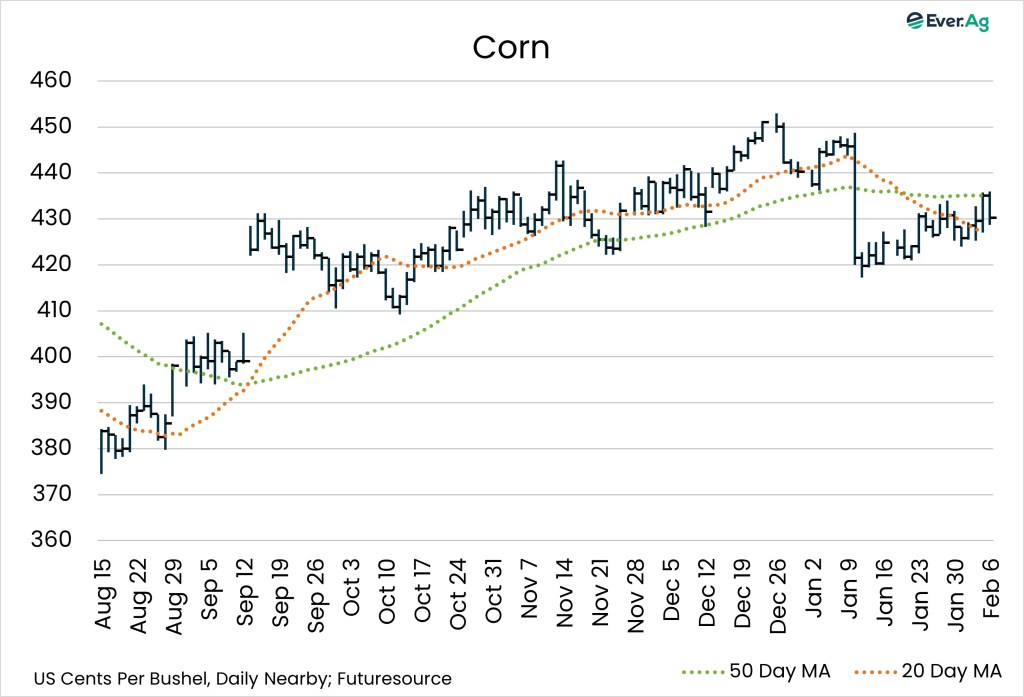

Corn

- March corn futures closed at $4.3025 per bushel, up two cents week-over-week. The May contract finished Friday at $4.3875 per bushel, three cents higher.

- Ethanol production dropped to 956.0 million barrels per day, down 14.2% week-over-week and -14.0% versus 2025. Stocks declined to 25.136 million barrels, down 1.0% on the week and -4.8% year-over-year.

- For the week ending January 29, export sales totaled 1.041 million metric tons for 2025-26 crop and 16,440 metric tons of new crop, both at the lower end of expectations. Accumulated corn exports reached 1.308 billion bushels, far ahead of the five-year average.

CORN COMMENTARY BY LORI NELSEN

- The bearish picture painted by USDA’s January WASDE lingers, and there hasn’t been enough bullish news to pull the market out of its recent range. Export sales have been solid, while lagging shipments allow the market to stabilize somewhat into a tight trading range. At the same time, favorable weather for harvest in South America is keeping the corn market from crossing over resistance levels. Brazil’s harvest still looks to be abundant. While soybeans rallied on news of promising talks with China, that didn’t get the corn market to blink.

- Corn growers and ethanol advocates are still watching for legislation that would allow year-round sales of E15 gasoline. But disagreements about the language created a snag in the latest government funding package. Congressional leaders created an ethanol-focused working group and advanced the rest of the bill. The E15 Rural Domestic Energy Council will study the potential impacts of year-round E15 sales on fuel markets, refineries and rural communities.

- Expectations for a large corn crop planting this Spring doesn’t spell bullish for markets, either. But I would expect to see seasonal price movement higher on good demand from exports and ethanol usage. Frigid weather across the country has some buyers firming basis a bit to try to encourage farmers to haul. Don’t forget February is the December 2026 futures price discovery for crop insurance.

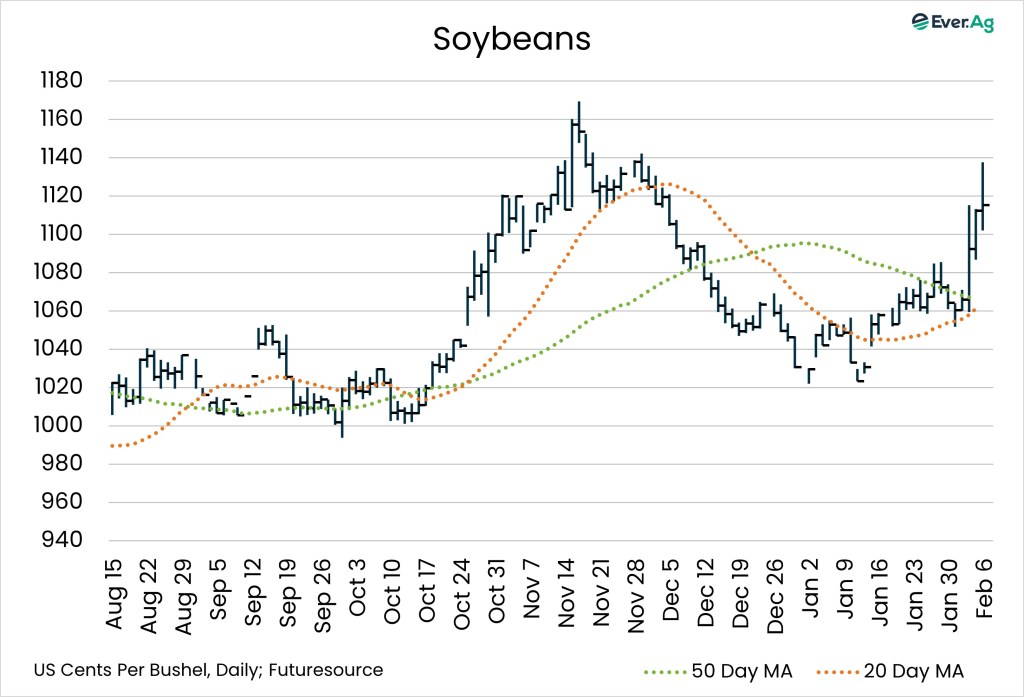

Soybeans

- The March soybean contract ended the week at $11.1525 per bushel, 51 cents higher versus the Friday before. July soybeans closed at $11.3950 per bushel, up 49 cents.

- Old-crop soybean export sales totaled 436,949 metric tons, at the bottom end of expectations. Sales of 2026-27 crop were also at the bottom of the predicted range at 440 metric tons. Accumulated exports reached 805.8 million bushels, well behind the five-year average.

SOY COMMENTARY BY LINDSEY CORE-LINNEBUR

- A tweet by President Trump on Wednesday sent the soy complex sharply upwards on news that China is eyeing additional purchases of US soybeans this crop year. They fulfilled their previous agreement to purchase 12 million metric tons at the start of this year. Now there is discussion that they could increase that by another 8 million metric tons for 2025-26. Should China be buying more US soybeans considering the price of Brazilian beans? No, but both administrations could be looking ahead to further trade deals this Spring.

- Wednesday’s trading volume was the highest in 10 years, with a record 827,000 contracts trading. Higher prices prevailed into the trade on Thursday, with March soybeans climbing above $11.00. New-crop soybeans are trending higher on the board, but they’re not at the level we’re seeing for the 2025-26 crop. That’s despite the 25 million metric tons of potential sales to China that were also mentioned in Wednesday’s announcement.

- Rains in northern Brazil have slowed soybean harvest, but estimates are still expecting a large, potentially record-setting crop again. That will pressure US soybean prices if additional export demand doesn’t surface.

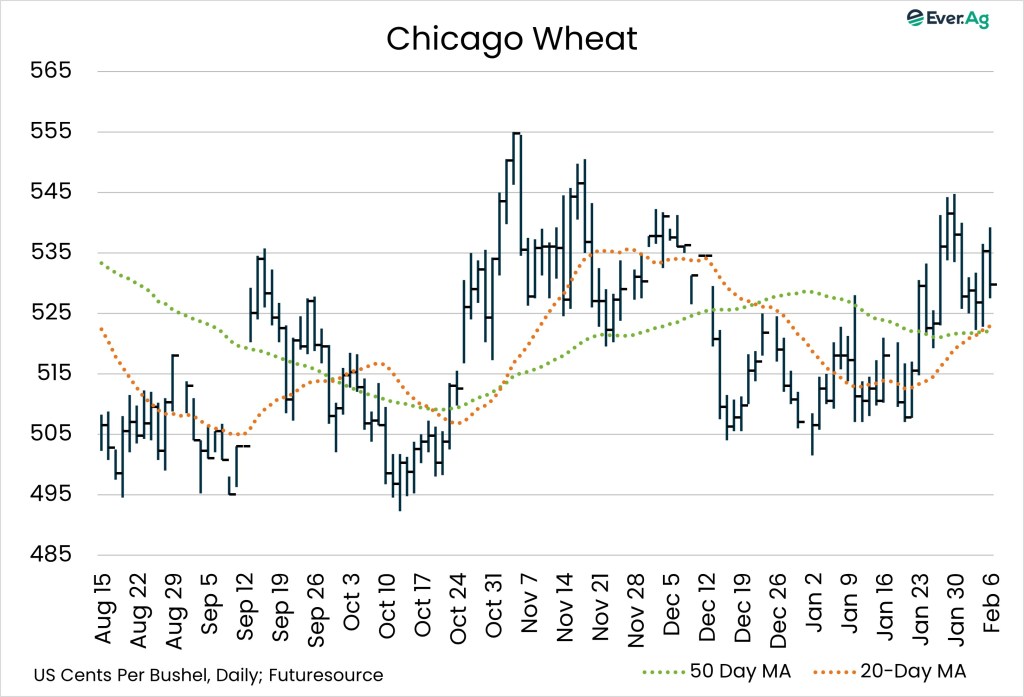

Wheat

- Nearby wheat futures settled at $5.2975 per bushel, down more than eight cents on the week.

- US old-crop wheat export sales reached 373,877 metric tons, at the bottom of expectations. New-crop sales totaled 41,000 metric tons, at the higher end of the predicted range. Accumulated exports remain ahead of the five-year average at 607.0 million bushels.

WHEAT COMMENTARY BY JEN WACKERSHAUSER

- It’s rinse and repeat in the wheat market. As we watch President Trump tweets drive soybeans higher, wheat is stuck in a range. With March wheat spending the week between $5.21 and $5.40, it continues to tread water. Cold January weather in both Ukraine and the US Great Plains caused some short-term worries, but above-average temperatures are in the forecast, and little damage seems to have occurred during the extreme weather. That has taken away some of the worries about winter kill in the dormant wheat crop.

- Without winter weather concerns, there is not a ton of new information in the wheat market this time of year. Soybeans and corn may dictate where wheat goes from here.

Futures and options on futures trading involves significant risk and is not suitable for every investor. Information contained herein is strictly the opinion of its author and not necessarily of Ever.Ag and is intended for informational purposes. Information is obtained from sources believed reliable but is in no way guaranteed. Opinions, market data and recommendations are subject to change at any time. Past results are not indicative of future results. Matt Gould, Jon Spainhour, Lori Nelsen and Jen Wackershauser maintain financial interest in the commodity contracts mentioned within this research report at the time it is published. Abby Bauer, Erica Maedke and Lindsey Core-Linnebur do not maintain financial interest in the commodity contracts mentioned within this research report at the time of publication. This report is in the nature of a solicitation.