Corn

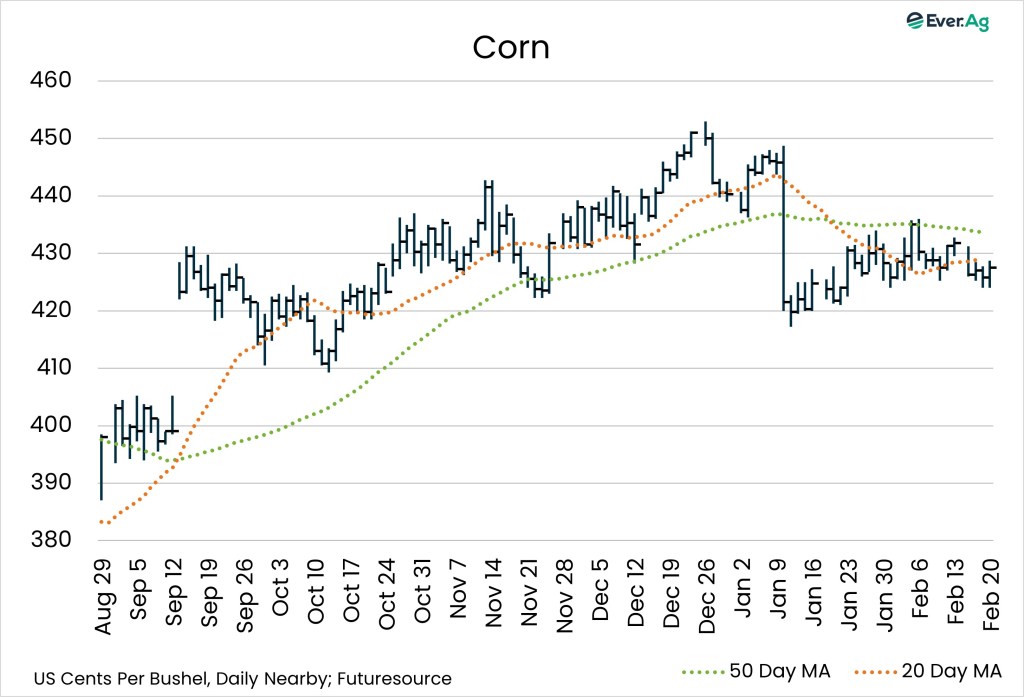

- March corn futures closed at $4.2750 per bushel, more than four cents lower on the week. The May contract ended the week at $4.3975 per bushel, down more than two cents.

- USDA estimates US planted corn acres at 94.0 million in 2026, down from 98.8 million last year. Harvested acre estimates decreased to 86.1 million acres compared to 91.3 million in 2025.

- Ethanol production rose to 1.118 million barrels per day, up 0.7% week-over-week and +3.1% versus 2025. Stocks totaled 25.588 million barrels, up 1.4% on the week, but down 2.4% year-over-year.

- Corn export sales performed as expected, with 1.470 million metric tons of 2025-26 crop and 65,700 metric tons of new crop sold. Accumulated corn exports reached 1.431 billion bushels compared to the five-year average of 818.0 million bushels.

CORN COMMENTARY BY COLE WEINKAUF

- Corn remains trapped in a stagnant, sideways market this week with very little news to trade. USDA’s Ag Outlook Forum took place this week, and corn acreage was estimated at 94 million with a trendline yield of 183. This brings us down 7.4% in production year-over-year. We are still looking at plenty of corn acres hitting the balance sheet, though. With strong production, USDA estimates ending stocks coming in at 1.8 billion bushels.

- Corn export inspections for 2026 so far are just over 35.7 million metric tons, a 44% increase versus 2025. Corn exports continue to be the bright spot in the market, but Argentina is now the cheapest option for corn buyers on the world market.

- Brazilian corn planting slowed a bit this week as there has been a lot of moisture in the northern part of the country. They are still on track with last year’s pace but lag behind the five-year average. This moisture could give the corn crop a great start. However, if they push planting into late February and early March, the crop does run the risk of pollinating in the hot and dry season. Argentina, on the other hand, has had an ideal growing season so far for corn and good-to-excellent ratings sit at the top end of the five-year range.

Soybeans

- March soybeans settled at $11.3750 per bushel, up 4.5 cents week-over-week. July futures finished Friday at $11.6600 per bushel, 5.5 cents higher.

- At its Ag Outlook Forum, USDA estimated planted soybean acres this year at 85.0 million, up from 81.2 million in 2025. Harvested acreage increased from 80.4 million acres to 84.0 million.

- For the week ending February 12, US soybean export sales were in the expected range. Old-crop sales totaled 798,216 metric tons, and 66,000 metric tons of 2026-27 crop sold. Accumulated export sales totaled 894.7 million bushels, well behind the five-year average of 1.406 billion.

SOY COMMENTARY BY MEG JOHNSTON

- Soybean futures saw continued strength this week, managing to hold on to most of their gains for February. Forecasts from USDA’s Ag Outlook Forum showed an increase in planted soybean acres to 85 million acres in 2026, with yield remaining unchanged at 53 bushels per acre. They increased export demand slightly, most likely due to the recent conversations between China and US governments regarding US soybean exports. This is still a forecast, not actual planted acreage information, but it does indicate that US farmers are likely to switch more acres from corn to soybeans.

- Soybean futures reacted accordingly to this news, and we saw old-crop soybean futures remain unchanged to up just slightly, while new-crop contracts started working in the red.

- South American soybeans continue to rate highly with harvest forecasts at 48.5 million metric tons, which continues to add bearish pressure to our soybean market.

Wheat

- Nearby wheat futures ended the week at $5.7350 per bushel, up nearly 25 cents versus the previous Friday.

- US wheat export sales were at the lower end of expectations with 287,974 metric tons of 2025-26 crop and 18,500 metric tons of new crop sold. Accumulated wheat sales reached 640.2 million bushels, ahead of the five-year average of 511.5 million bushels.

WHEAT COMMENTARY BY JON BAHR

- Wheat struggled to choose a direction early in the week, but some bullish news towards the end of the week led to a strong finish. Headlines of major wildfires in Oklahoma’s panhandle pushing into Kansas raised concerns around the wheat crop.

- While wildfire headlines have been taking a front seat this week, USDA released new-crop projections at the Ag Outlook Forum. They did not make any big changes from last year. For 2026 acres, they estimated 45.0 million, down just a bit from 45.3 million in 2025. Keeping the balance sheet pretty much the same as the 2025 crop year, the Agency predicted ending stocks at 933 million, up just 2 million bushels.

- Wheat has struggled to find any movement in recent months, but now with some new news, it is finally making a push. We are getting to the time of year when we transition to Spring and producers see how the crop handled the winter conditions. Depending how much impact these fires actually have on wheat crops, this market could have room to continue the excitement in the near term.

Futures and options on futures trading involves significant risk and is not suitable for every investor. Information contained herein is strictly the opinion of its author and not necessarily of Ever.Ag and is intended for informational purposes. Information is obtained from sources believed reliable but is in no way guaranteed. Opinions, market data and recommendations are subject to change at any time. Past results are not indicative of future results. Jon Spainhour and Jon Bahr maintain financial interest in the commodity contracts mentioned within this research report at the time it is published. Tiffany LaMendola, Kathleen Wolfley, Phil Plourd, Erica Maedke, Cole Weinkauf and Meg Johnston do not maintain financial interest in the commodity contracts mentioned within this research report at the time of publication. This report is in the nature of a solicitation.