Corn

- USDA’s February WASDE report was neutral for corn, with USDA making few adjustments to previous estimates. US corn ending stocks totaled 2.127 billion bushels, slightly behind 2.227 in January.

- March corn ended the week at $4.3175 per bushel, up 1.5 cents compared to the Friday before. The May contract closed at $4.4200 per bushel, more than three cents higher.

- Ethanol production climbed to 1.110 million barrels per day, up 16.1% on the week and +2.6% year-over-year. Stocks totaled 25.247 million barrels, up 0.4% week-over-week, but down 1.7% versus 2025.

- For the week ending February 5, 2025-26 corn crop export sales were above expectations at 2.069 million metric tons. New-crop sales reached 60,000 metric tons, within expectations. Accumulated exports reached 1.367 billion bushels compared to 768.2 million on the five-year average.

CORN COMMENTARY BY VERL PRATHER

- The corn market has had a much less exciting week in comparison to other row crops. In fact, futures seemed to trade in both directions largely because of action in wheat and soybeans. Despite USDA’s reduction to ending stocks for the 2025 crop year early in the week, nearby futures are near levels seen a week prior. Meaning, the increase in corn export demand had largely already been baked into the market. As we look forward, a potential shakeup to the narrow trading range between $4.20 and $4.35 may live just a week away. USDA’s Ag Outlook Forum will give the market a preview of what economists believe to be the potential amount of corn acres this Spring.

- Meanwhile, domestic corn processors seem to be getting all the corn they need for nearby delivery windows. We have watched plenty of ethanol plants begin to build a slight carry on their bid sheets in an effort to entice corn bushels to come to town later on. In addition to the basis movement, the narrow carry in corn futures is finally starting to widen out a bit as it has traded shy of the values that one would come to expect given a greater than 2-billion-bushel carry-out estimate.

Soybeans

- In its February WASDE report, USDA left US soybean ending stock estimates unchanged at 350 million bushels.

- The March soybean contract settled at $11.3300 per bushel, nearly 18 cents higher on the week. July soybeans ended the week at $11.6050 per bushel, up 21 cents.

- Soybean export sales were soft again, with old-crop sales below expectations at 281,798 metric tons. Sales of the 2026-27 crop totaled 1,300 metric tons, at the lower end of the predicted range. Accumulated export sales reached 847.3 million bushels, well below the five-year average of 1.350 billion.

SOY COMMENTARY BY BRANDON WEIGEL

- Last week’s excitement in the soy complex has certainly trickled over into this week. Despite most feeling that this rally lacks fundamental sustainability, funds are buying into the excitement created last week by President Trump’s announcement that China may buy more US soybeans for the 2025-26 marketing year. If fulfilled, the additional 8 million metric tons would take their total commitments up to 20 million, still keeping total bean exports shy of USDA’s current forecasted goal in the balance sheet. There is widespread doubt around China fulfilling this supposed commitment.

- In Tuesday’s February WASDE report, USDA left the domestic soybean balance sheet unchanged. They did, however, increase Brazilian soybean production estimates by 2 million metric tons to a record 180 million. Some private estimates have this number pegged closer to 185 million metric tons.

- Brazilian bean FOB export prices remain $0.80-$1.10 per bushel under that of US Gulf prices for May. That’s adding more question marks around why China would buy additional US beans in a time of cheaper, abundant harvest supplies from South America. If China does buy more US soybeans, it would be seen as a politically driven move.

- Soybean harvest in Brazil continues to progress at a strong pace. As of Monday, Mato Grasso bean harvest reached 40% complete versus 28% a year ago. Some areas of Argentina have experienced hot, dry weather but most have more favorable nearby forecasts. Good and excellent ratings continue to track about in line with the five-year average.

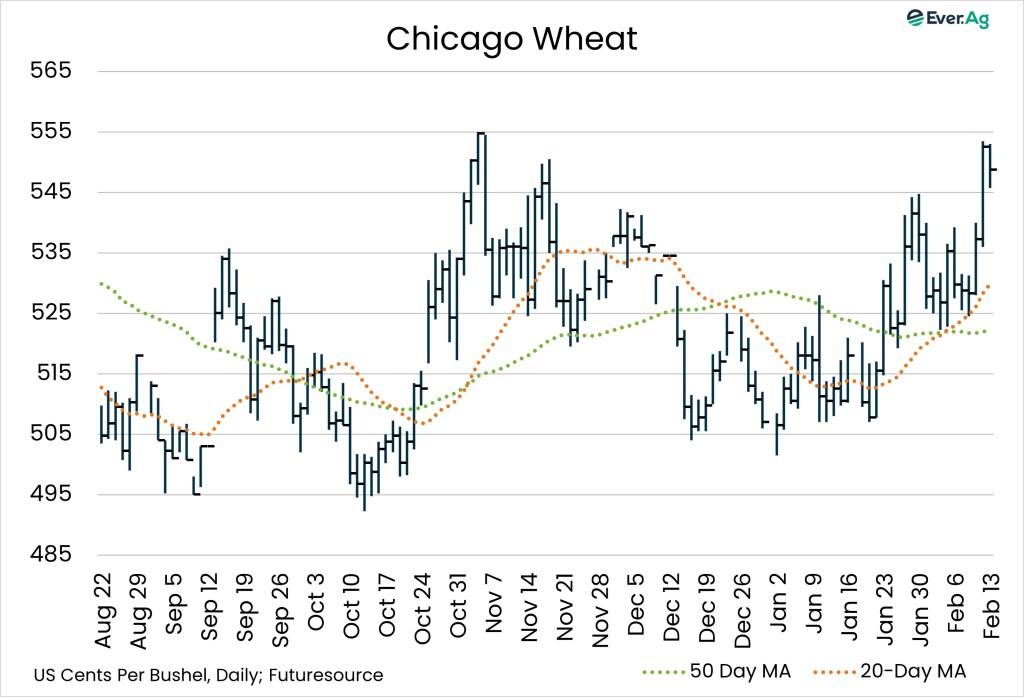

Wheat

- USDA pegged US February wheat ending stocks at 931 million bushels, up slightly from 926 million in January.

- Nearby wheat futures closed at $5.4875 per bushel, up 19 cents week-over-week.

- Old-crop wheat export sales were at the top of the expected range, with 487,998 metric tons sold. New-crop sales were within expectations at 13,915 metric tons. Accumulated exports reached 628.3 million bushels compared to 498.8 million on the five-year average.

WHEAT COMMENTARY BY JAKE KINGSLEY

- Wheat futures were quiet in the first half of the week before rallying past January highs on Thursday. The move follows the rest of the commodity market’s strength as political tensions and economic uncertainty push cash out of stocks and into grains. While still within arm’s reach of the range traded thus far in 2026, both Chicago and Kansas City futures are now testing highs not seen since November. Expect the strengthening trend to continue in the short term and volatility to remain a factor well into Spring.

- Traders are concerned about dry weather in Argentina as that crop matures and persistent drought conditions over a large swath of the US growing region. Though it is still early in the growing season, some premium is likely to remain in the market. Until forecasts indicate significant widespread precipitation is on the way to provide relief, wheat prices may continue to gain strength.

- Soybeans have been the market leader in the past few weeks, primarily rallying on President Trump’s post indicating more soybean sales to China could be in the works. The $0.75 per bushel run has been dragging corn and wheat along for the ride to a lesser extent. Until the trend reverses, wheat will be underpinned somewhere near $5.50 on the March contract.

Futures and options on futures trading involves significant risk and is not suitable for every investor. Information contained herein is strictly the opinion of its author and not necessarily of Ever.Ag and is intended for informational purposes. Information is obtained from sources believed reliable but is in no way guaranteed. Opinions, market data and recommendations are subject to change at any time. Past results are not indicative of future results. Brian Fletcher, Jon Spainhour, Verl Prather and Brandon Weigel maintain financial interest in the commodity contracts mentioned within this research report at the time it is published. Kathleen Wolfley and Jake Kingsley do not maintain financial interest in the commodity contracts mentioned within this research report at the time of publication. This report is in the nature of a solicitation.