The Scoreboard

Comment

Last week, we learned that… everyone loves a good list to start the year. So, let’s kick off 2026 with five “fearless predictions” for the food/ag/consumer space:

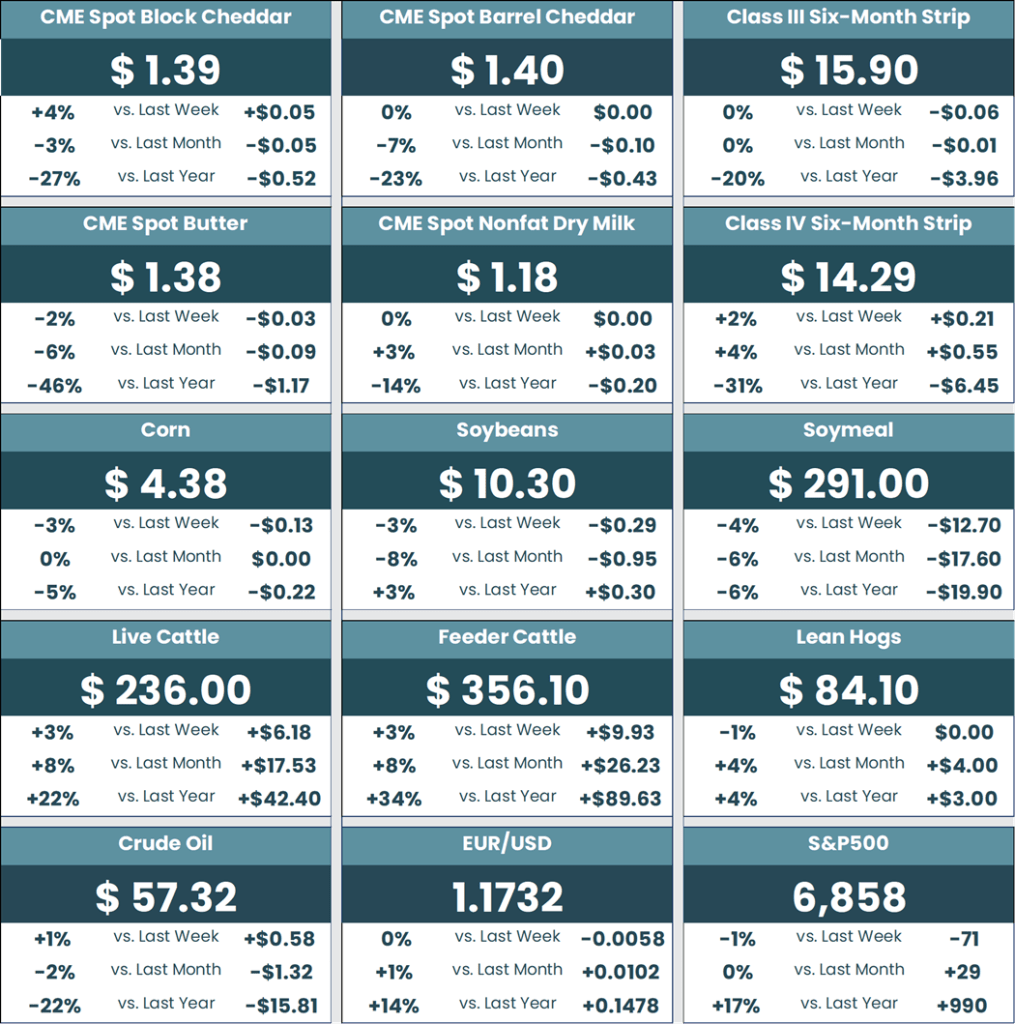

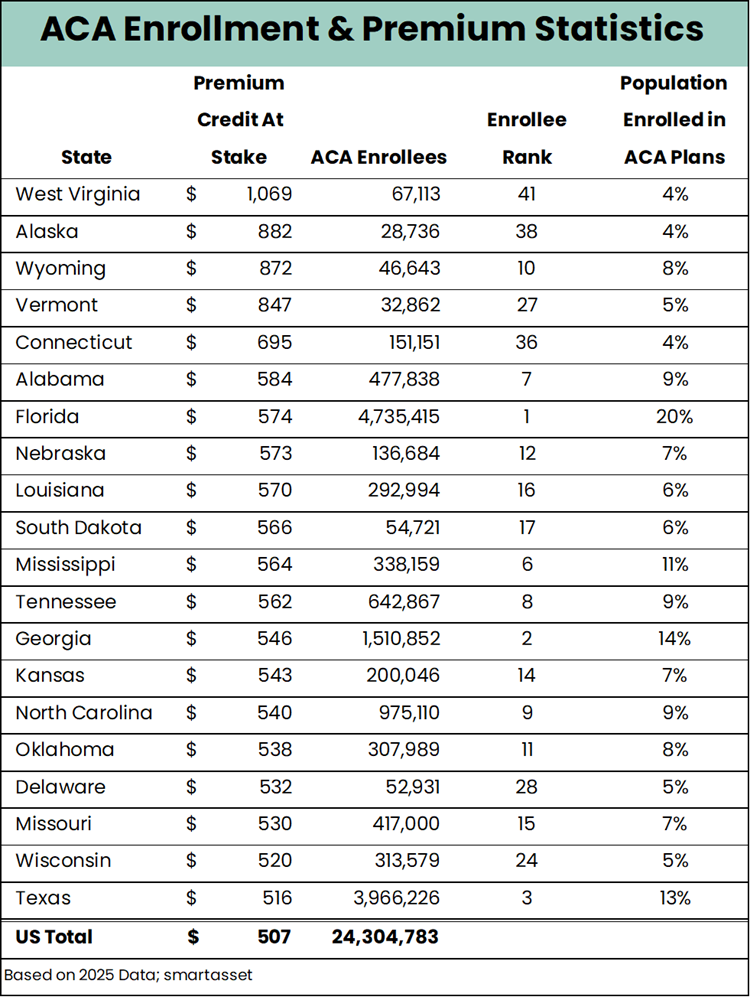

1. Rising healthcare costs and student loan repayment obligations will add wallet pressures in the weeks ahead. Enhanced subsidies for Affordable Care Act participants expired on December 31. As many as 24 million enrollees will encounter higher costs – substantially higher for many. An investment company called SmartAsset published what appears to be credible data showing that, for 24.3 million participants, the average insurance cost will rise from $112 to $619 per month, a $507 increase. That’s a substantial number, especially considering that the people qualifying for subsidies are already lower middle class at best. This table shows the states with the most extensive premium credits at stake:

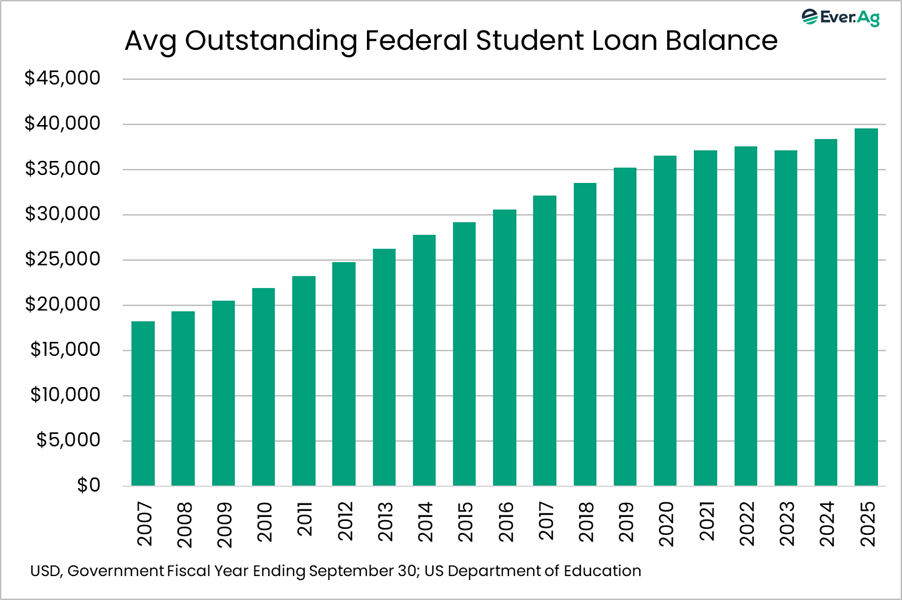

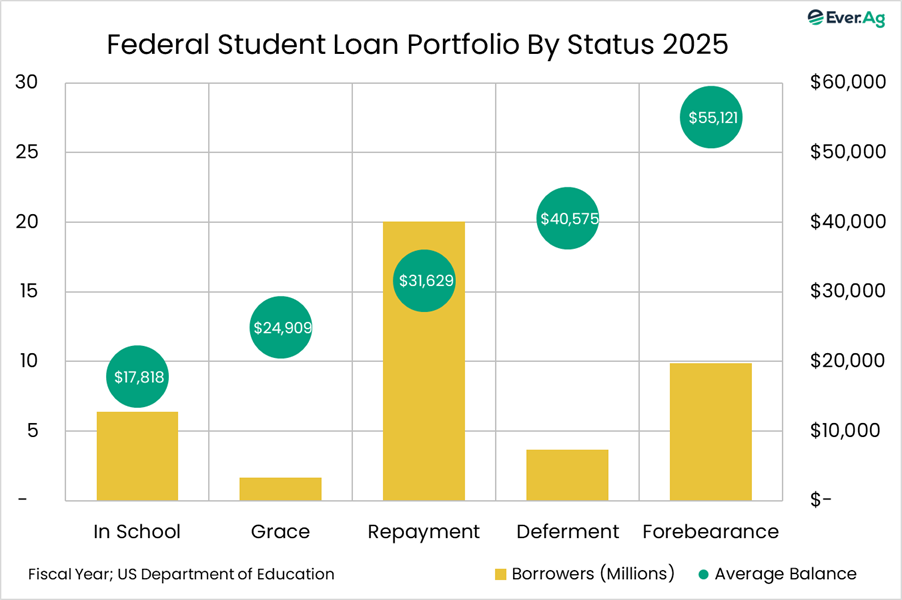

On the student loan front, about 10 million delinquent or defaulted borrowers are seeing the government get more aggressive with collections, including potential for wage garnishment. According to the Education Data Initiative, student loan payments in the US average $523 per month. As of the third quarter of 2025, the Federal Reserve Bank of New York reported that outstanding student loan debt totaled $1.7 trillion, with 9% of loans “seriously delinquent” (90+ days past due).

In one way or another, these developments, left to unfold, will take money out of the wallets of millions of Americans. While the aggregate numbers aren’t likely to be cataclysmic for the US economy, they are large enough on an individual level to generate serious consequences for the people involved. In my estimation, it all adds up to more arguments for continued mediocrity in the consumer spending space, perhaps especially for QSR outlets, as well as “trade-downs” in grocery stores and products.

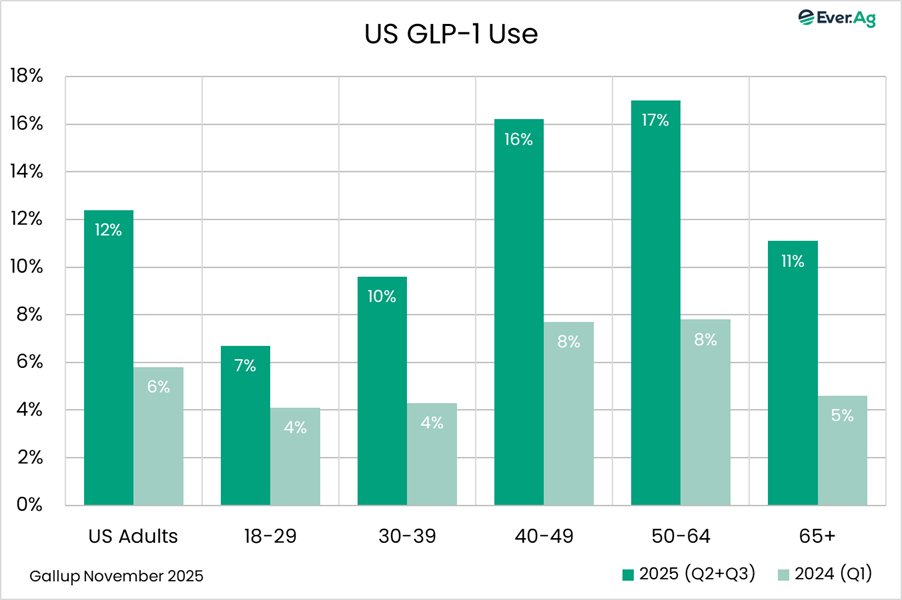

2. We’re not even close to done with the GLP-1 story. Simply put, taking GLP-1 medications will be easier and less expensive. FDA’s December approval of Wegovy in pill form will accelerate adoption. Published reports suggest that Novo Nordisk will price Wegovy pills at $149 per month for the lowest dose for people paying cash, compared to $349 for the injectable version. Analysts expect Eli Lilly to bring pills to the market, too. In November, Gallup reported that 12% of American adults use a GLP-1 medication. That number will almost certainly be higher by the end of 2026. That means more people eating fewer calories, likely bad news for snacks and fast food (and by extension cheese demand), but good news for protein supplementation.

3. Propelled by relentless focus on “value” and “deals,” we will see better restaurant performance in 2026. Go to the websites for “Big Pizza.” What do you see? Deals! Good deals, at least on the surface. “Choose any two for $6.99 each” at Domino’s. A “4.99 for 2 large pizzas” promo at Little Caesars. The “Big New Yorker” extra-large pie at Pizza Hut sells for $10. Just about every advertisement for casual dining chains – Chili’s, Applebee’s, Red Robin – features pricing.

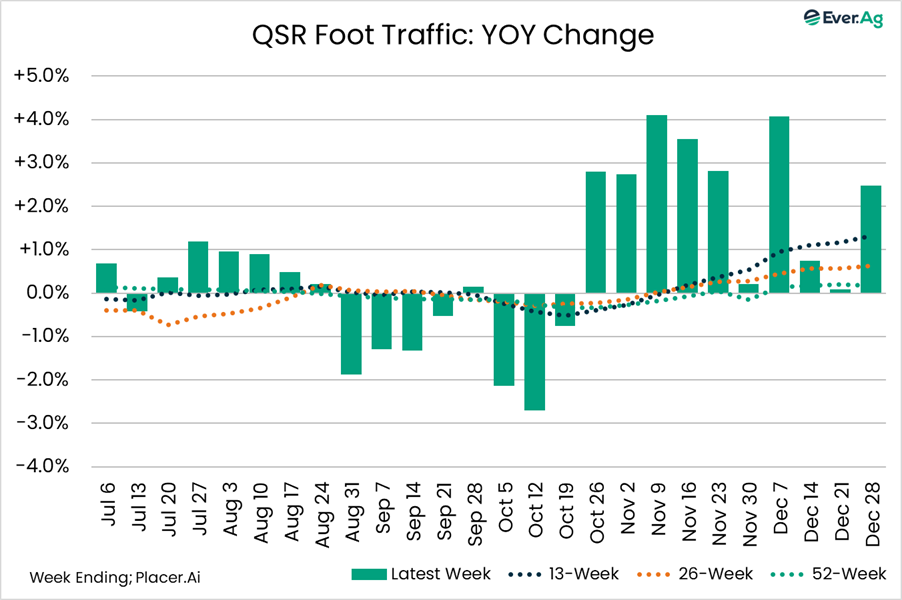

Last year wasn’t great for restaurants. According to Placer.ai traffic data, visits to all restaurants and QSR outlets came in slightly below year-prior levels. Sit-down outlets saw a 0.7% decline for the 52 weeks ending December 28, with QSR up 0.2%. “Big Pizza” gained 1.2%, with “Big Burger” at +0.7%. But we saw some better numbers at year-end, particularly in the QSR space. Over the last 10 weeks of 2025, QSR visits increased by an average of 2.1% compared to -0.8% for the prior 10-week period. Some of that bump likely came from the SNAP benefits miss in November. Bang-up promotions at McDonald’s and Burger King, featuring the Grinch and SpongeBob, respectively, helped push December figures. So maybe it was all a flash in the pan. At the same time, if the first part of 2026 looks like the last part of 2025, for whatever reason, that will be a good news story for consumptive demand, certainly relative to what we saw for most of last year. Up is up. All the promotional activity we’re seeing suggests that restaurant chains will keep pushing for wallet share. And, as you should know by now, we cannot underestimate the laziness of the American consumer. It’s a drag to cook and eat in every night! Especially when you can buy two pizzas for $5!

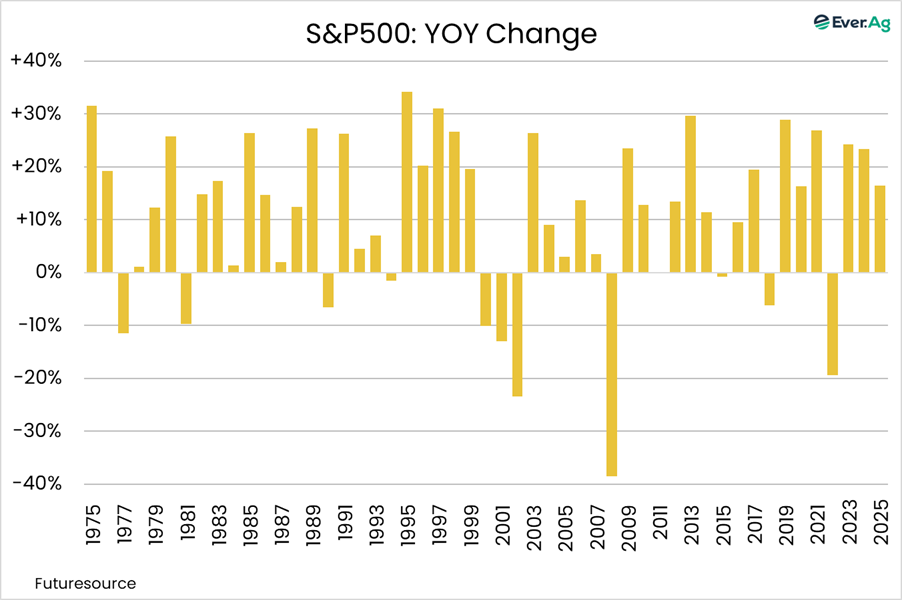

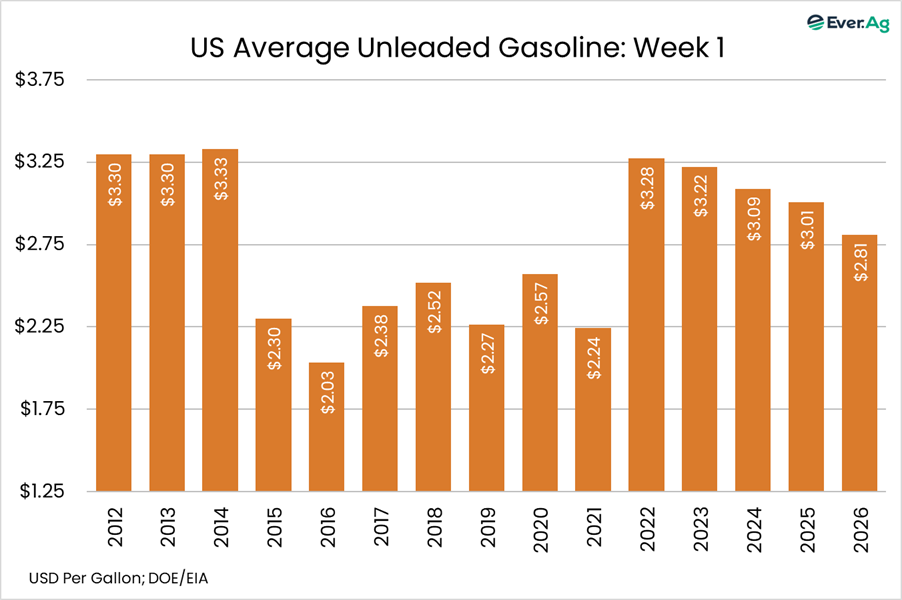

4. Economic and consumer sentiment data will continue to show “bifurcation” between upper and lower-income households, but not without at least a few bright spots. In November 2022, the Morning Consult “Economic Health Index” showed a 2.8 percentage point gap between upper-income (>$100,000) and lower-income (<$50,000) households. In November 2025, that gap widened to 9.8 points. Lingering inflation for what I call the “unavoidables” (food, shelter), as well as developments such as the expiration of ACA subsidies, will keep the pressure on lower-income households. Meanwhile, upper-income households just enjoyed a big year in the equity markets, with the S&P500 up 17% and the Wall Street consensus calling for another 11% gain in 2026. Things could tilt away from the upper-income cohort—and from the economy overall—if we see white-collar unemployment move sharply higher. Lower-income households might feel a little better about their circumstances and have a little extra money to spend if gasoline prices remain in check, as analysts generally expect. Here, too, I see more arguments for a lot of “meh” performance in the consumer space.

5. Expect more government goodies as November approaches. With the Senate and House likely up for grabs, we could see additional calls for lower interest rates, various payments or subsidies or tax breaks or programs targeting teetering constituencies, as well as who-knows-what-else.

* * *

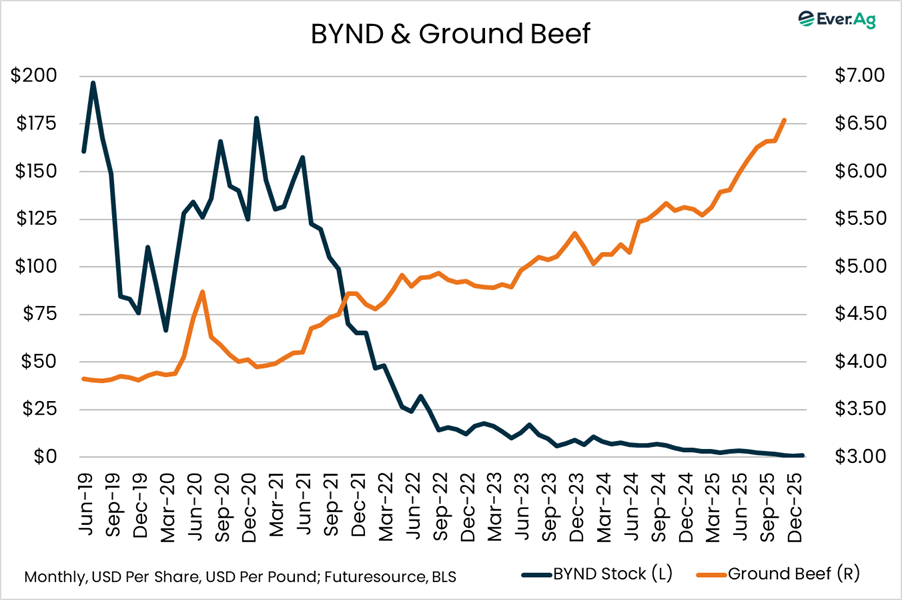

Department of Fun (and Relevant) Facts: In July 2019, when Beyond Meat stock hit its high of about $235, you could buy about 62 pounds of ground beef with one share of BYND. Now, with BYND trading at less than $1, you can buy seven shares of the stock with one pound of ground beef. It looks as though BYND is going to the big grill in the sky. Things seem bleak, with Q3 sales at just $70.2 million, down 13% year over year and down 34% from the 2021 peak. At one point in 2019, shortly after an IPO, the company was worth $14 billion. On Friday, the market cap sat at just under $400 million.

Consumers don’t like the way the products taste, don’t like the label or both. People will try new things, especially if they feature alleged environmental and/or health benefits. But it turns out that labels that simply say “beef,” “chicken,” or “milk” may have more appeal than ingredient lists that run to 10+ or 20+ items. (Based on scanner data, it appears as though “alt milk” volume sales declined in 2025, making it four years in a row with sliding purchases.)

* * *

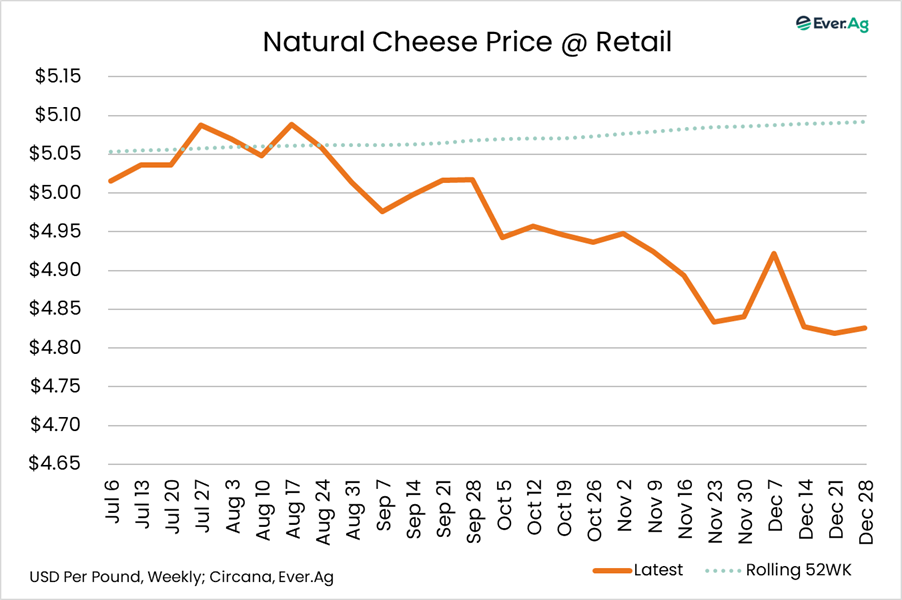

Butter and cheese sales fared okay during the holiday season. After a strong showing around Thanksgiving, butter & butter blend sales settled back ahead of Christmas. According to Circana data, sales for the 13 weeks ended December 28 increased 1.4% year over year. Natural cheese? Identical growth. For the 52 weeks ending December 28, butter volume sales increased 1.2%, while cheese volume increased 1.1%. Positive numbers are positive numbers, but sales didn’t really impress. The last 2025 price averages came in at $4.83 per pound for natural cheese (-5% YOY) and $4.53 for butter & butter blends (-8% YOY).

Futures and options on futures trading involves significant risk and are not suitable for every investor. Information contained herein is intended for informational purposes and is obtained from sources believed reliable but is in no way guaranteed. Past results are not indicative of future results. Any data contained herein is proprietary and may not be copied, disseminated, or used without the express written permission of Ever.Ag Insights.