Publication Note

No Monday Morning Demand Notes next week as we travel to Palm Springs for the International Dairy Foods Association Dairy Forum. If you are there, hope to say hello! Publication resumes on Monday, February 2.

The Scoreboard

Comment

Last week, we learned that… doctors and consumers got after the opportunity to access Wegovy in pill form. The Food & Drug Administration approved the new delivery system on December 22, with prescription fulfillment starting on January 5. According to published reports, sales ran at a strong pace during the first week. An article posted by CNBC tells the story:

The analysts [at TD Cowen] said around 4,290 prescriptions were filled for Novo Nordisk’s pill during its first full week of launch, with the majority being for the starting dose of the drug. They added that the data from their source or IQVIA likely don’t include prescriptions through Novo Nordisk’s direct-to-consumer pharmacy or its telehealth partners. The analysts said that compares with the roughly 1,900 prescriptions filled for Zepbound during its first full week on the market. Assuming the Symphony data is accurate, the pill “is already outstripping its injectable counterparts at the same stage of their launch,” TD Cowen analyst Michael Nedelcovych wrote in the note.

Novo Nordisk stock rallied 8% on the early results.

Look, one week doesn’t mean anything. We’ll have to monitor uptake over the coming weeks and months. Still, I expect a surge in use because of lower prices ($149 per month at the low end of the dose spectrum) and an easier delivery system (more than 60% of adults have some form of “needle phobia” according to one prominent international study).

Separately, newly published data from Cornell University, appearing in the Journal of Marketing Research, reinforce the importance of the GLP-1 story for the food industry. According to the report, during the first six months on the medications, GLP-1 users reduce grocery store spending by 5.4% and restaurant spending by 8.3%. That recedes in months seven through 12, but -4.1% and -3.9% respectively still count as material. That’s a lot fewer dollars and a lot fewer calories, with potential knock-on effects for pricing and financial performance across supply chains.

* * *

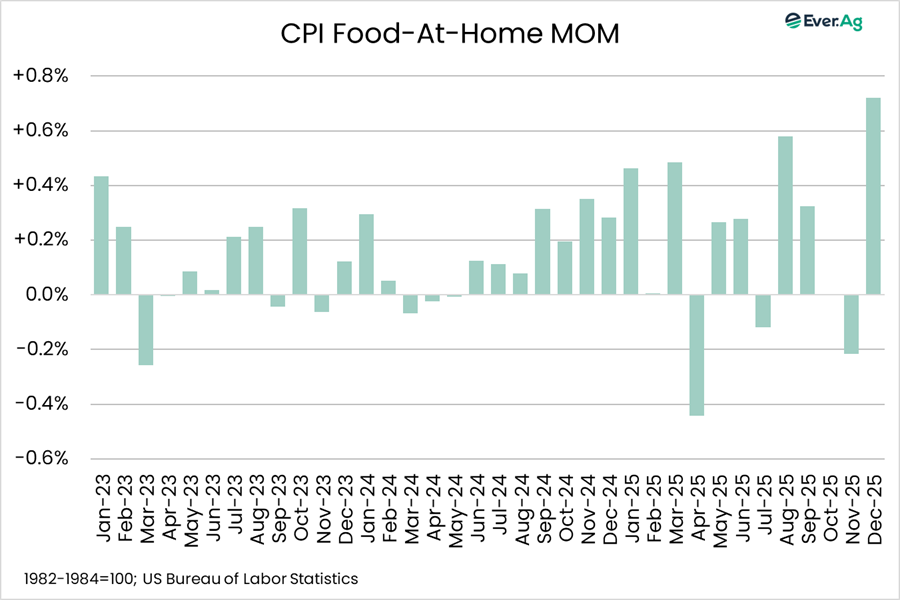

Inflation keeps pushing our buttons. The headline rate for December didn’t seem offensive, with all consumer prices up 0.3% on the month and up 2.7% year-over-year, in line with expectations. Look at the details, however, and one item jumped off the page: food.

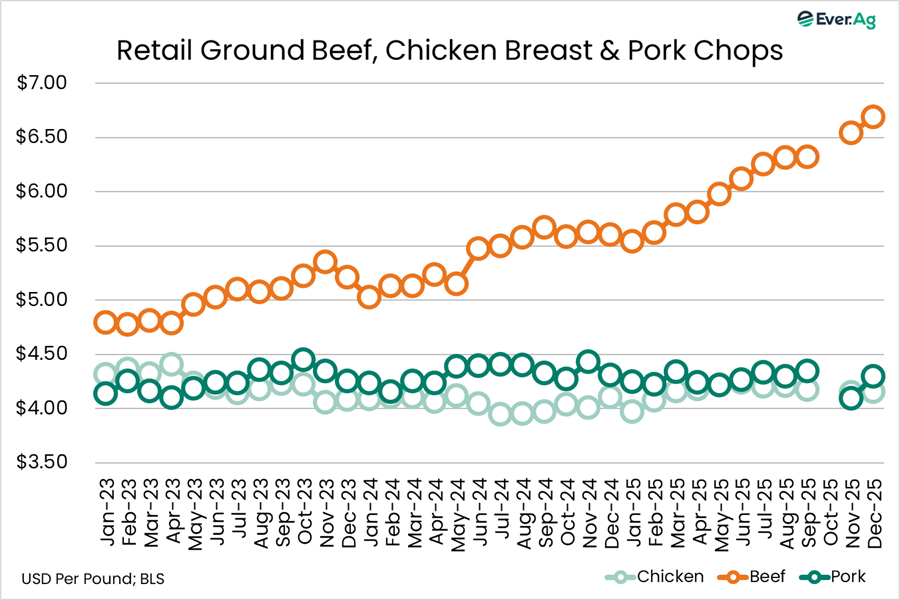

Food prices increased 0.7% from November to December, the largest month-to-month increase since August 2022. Grocery stores and restaurants participated equally. Beef prices continued to grow at a dizzying pace, with ground beef at a new record high of $6.69 per pound, up 2.2% on the month and up 19.3% year-over-year. Pork chops gained 4.9%. Dairy product prices increased by 0.9%. Fruits and vegetables also got more expensive, with prices up 0.5% from November. The Ever.Ag Breakfast Index caught a break, though, as costs for eggs, bacon and coffee moderated, allowing the price per serving to ease to $1.99, down 1.9% on the month and down 10.8% year-over-year.

Economists and pundits can talk all they wish about how inflation seems to be under control. Consumers aren’t likely to believe them or care about their opinions when seeing the cost of feeding their families move higher and higher, month after month. “Affordability” remains an issue at the dinner table, which means it’s an issue for politicians, who will grasp for solutions, and for the food industry, which fears eroding demand.

* * *

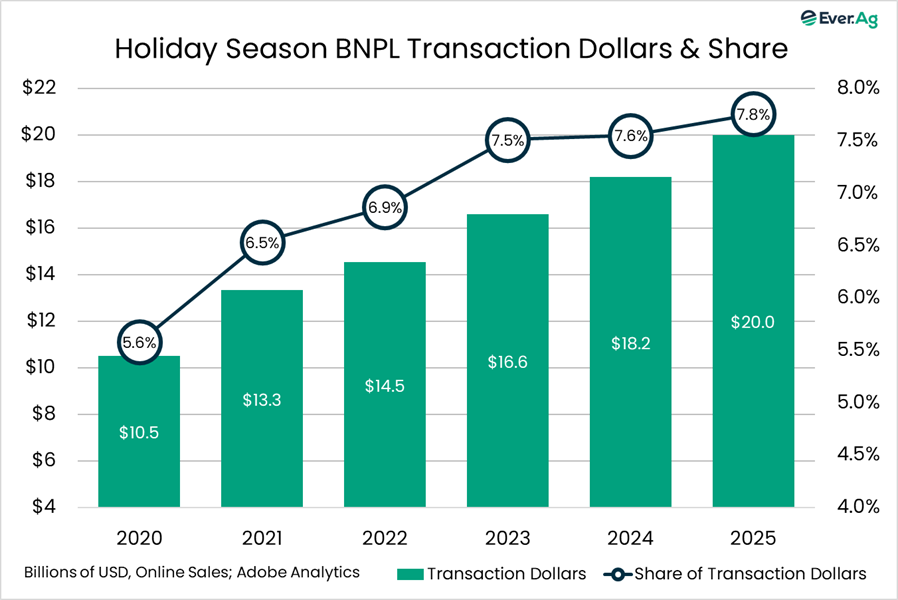

Are we seeing evidence that “Buy Now Pay Later” plans won’t be much more than a niche avenue for consumers? BNPL use increased during the recent holiday season, with Adobe Analytics reporting $20.0 billion in BNPL transactions, up about 10% year-over-year. But transaction share did not change much from 2024, or 2023 for that matter: 7.8% compared to 7.6% and 7.5%. It’s there. Some people find BNPL attractive. Some may not have other choices. Some may not be able to pay the bills. But we’re going to have to see a lot more growth before I believe BNPL is a ticking debt time bomb.

* * *

Fluid milk sales faltered in November. According to USDA data, conventional + organic volume totaled 38.45 billion pounds, down 1.8% year-over-year. That took year-to-date sales to -0.8% and 12-month rolling sales to -0.5% year-over-year. For the first 11 months of 2025, lost volume totaled 304 million pounds, enough milk to make 15 truckloads of cheese per week.

Now that President Trump signed the Whole Milk for Healthy Kids Act, will we see milk sales improve? Bringing whole and 2% milk back into school cafeterias means bringing back better-tasting options, which should help boost sales. It’s not clear, however, that volumes will surge overnight. For one thing, school districts will likely have to find some additional funds to pay at least a little more for milk. For another thing, after an extended absence, it may take some time to convince some kids that they’ll like the “new” milk better.

* * *

Retail sales of cheese and butter aren’t looking robust as 2026 gets underway. For the week ending January 11, Circana reported natural cheese volume sales down by more than 3%, taking the four-week rolling total to about negative 1%. Butter & butter blend sales dropped by more than 6%, also dragging the four-week rolling total to about -1%. Pricing remained off the holiday season lows, with cheese at an average of $4.96 per pound, down three cents on the week and down 5% year-over-year. Butter: $4.88 per pound, down seven cents on the week and down 6% year-over-year.

* * *

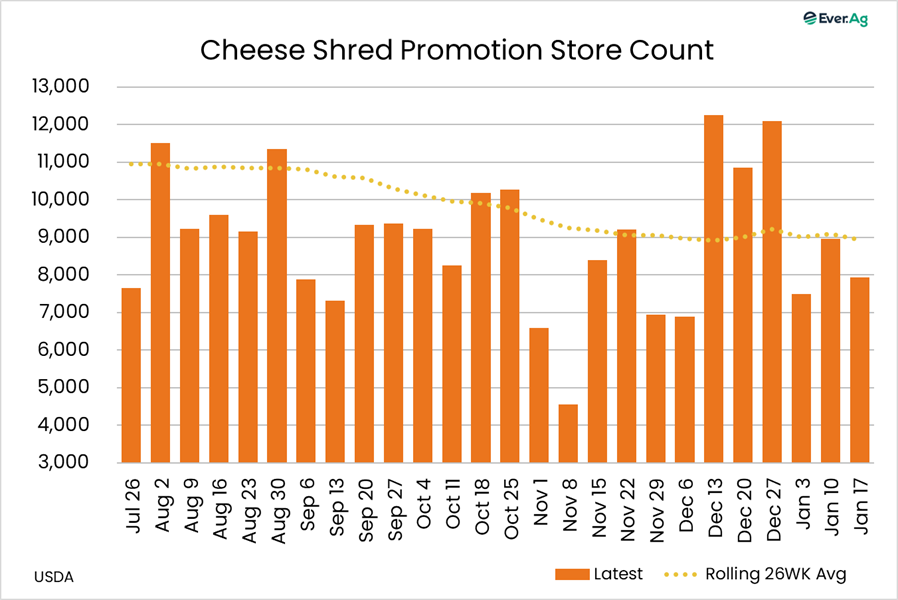

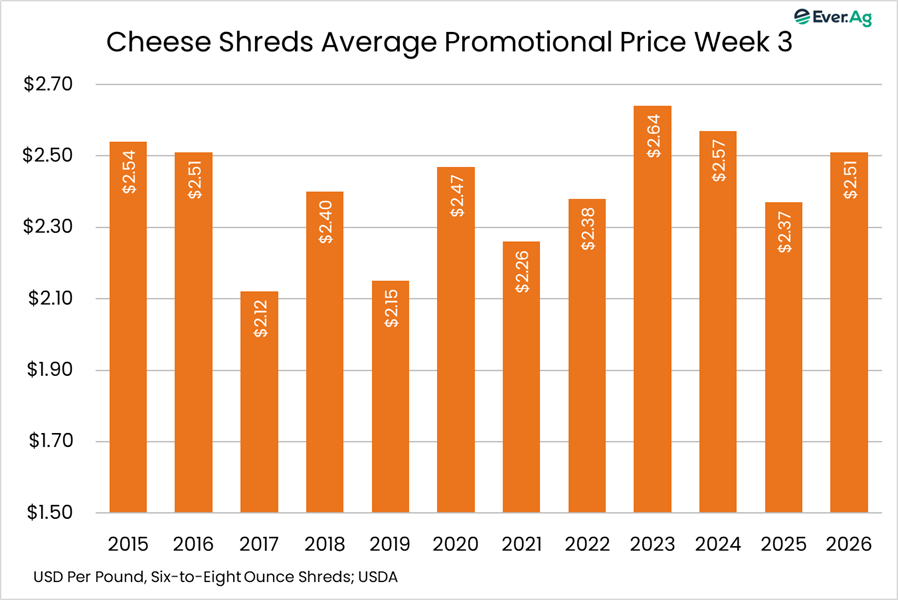

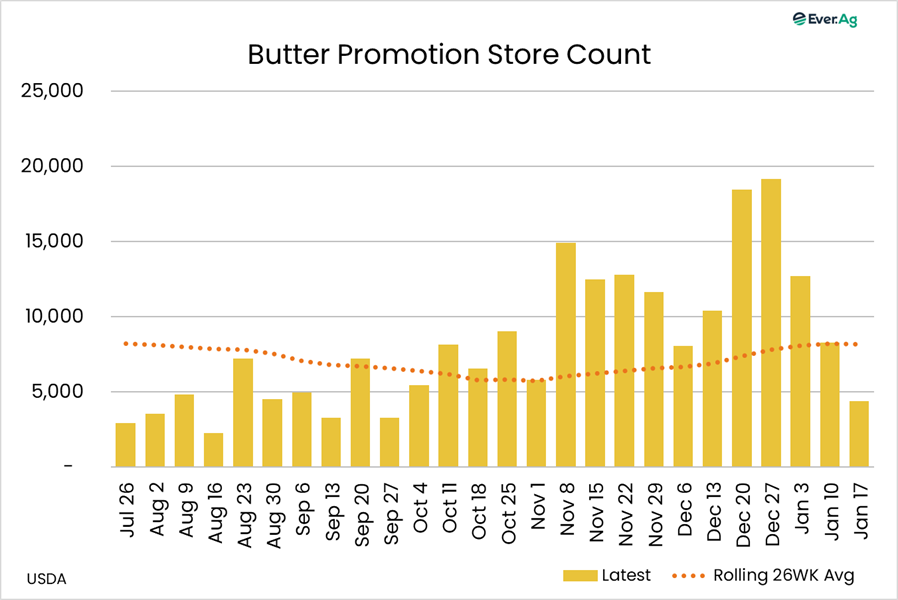

It seems possible that so-so promotional activity isn’t helping the cause for cheese and butter sales. USDA data shows that, for the week ahead, a total of 7,927 grocery stores are featuring six-to-eight-ounce cheese shreds, down 12% from the week prior and 31% from the same week in 2025. Average price: $2.51 per package, down six cents on the week but up 6% year-over-year. Butter deals are also priced higher than year-prior levels: $4.62 per pound, up 7% year-over-year and up 50 cents on the week. Store count drops to 4,418 outlets, down 47% on the week but up 16% year-over-year.

Futures and options on futures trading involves significant risk and are not suitable for every investor. Information contained herein is intended for informational purposes and is obtained from sources believed reliable but is in no way guaranteed. Past results are not indicative of future results. Any data contained herein is proprietary and may not be copied, disseminated, or used without the express written permission of Ever.Ag Insights.