COMMENTARY BY ABBY GREIMAN

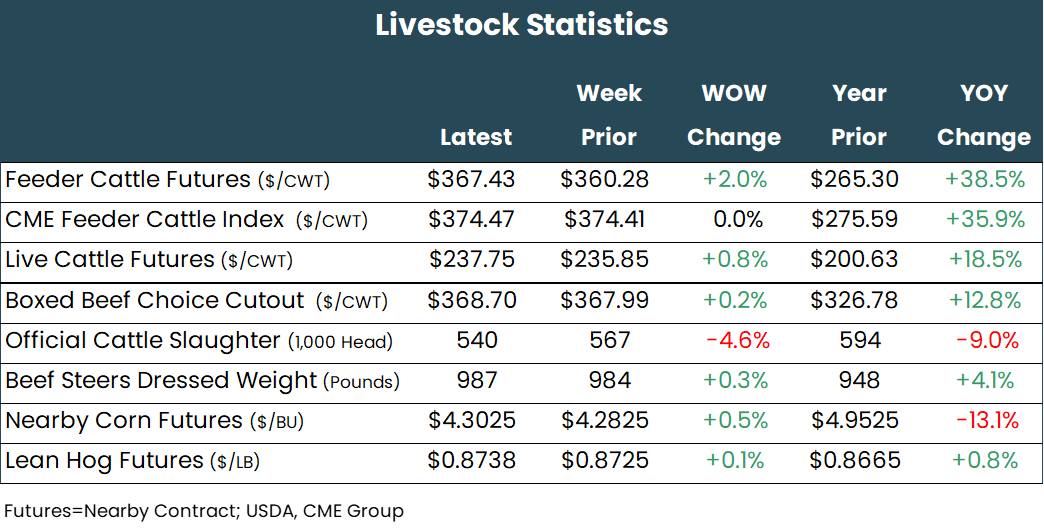

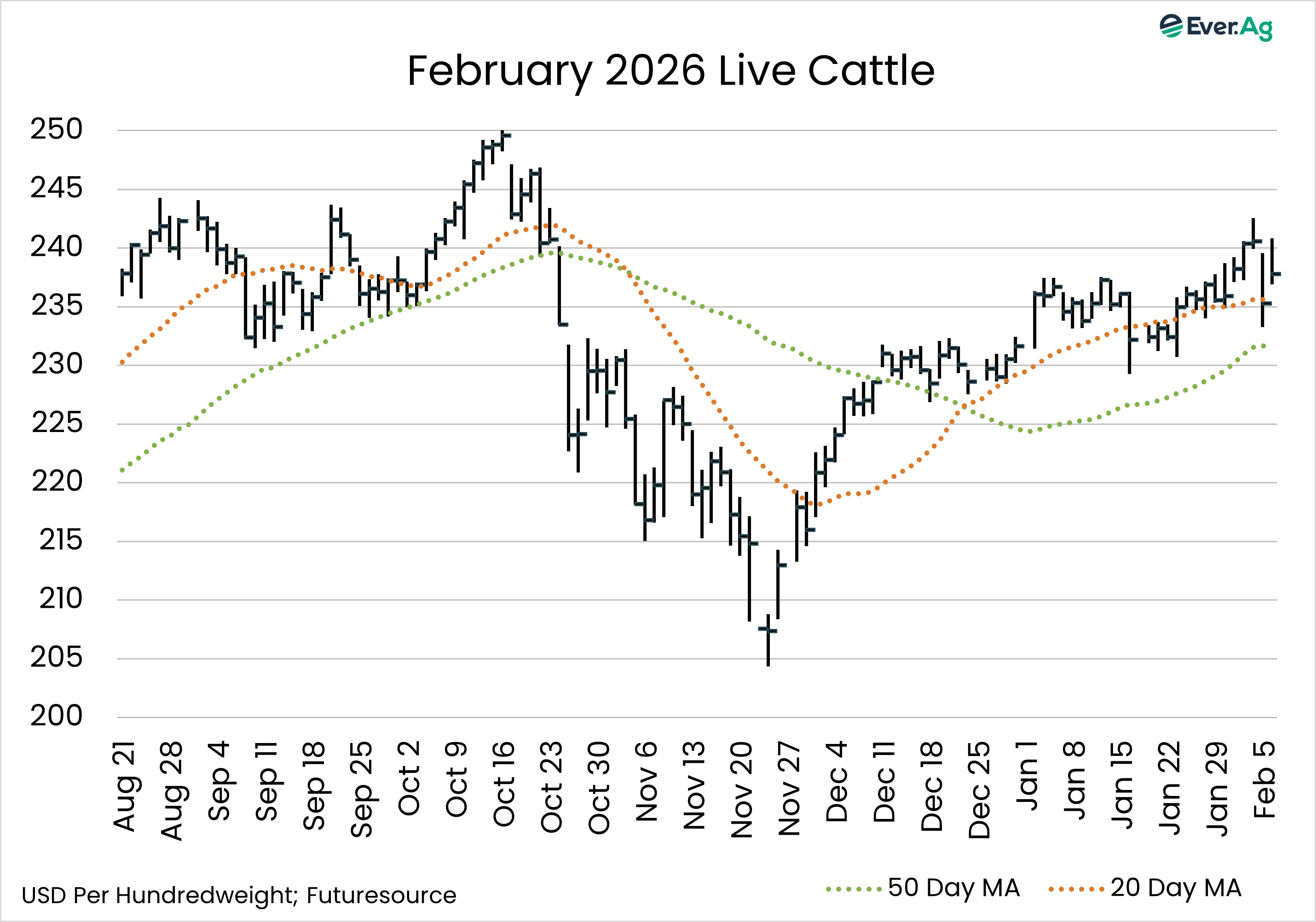

This week was filled with headline trading. April, the most active live cattle contract, posted a $10 swing from the week’s highs to the lows, while the most active feeder cattle contract, March, posted nearly a $13 trading range. But most of the contracts only ended up with small changes week-over-week by today’s close. Live cattle front month February was up $1.90 per hundredweight on the week, while April through August contracts were up $0.45 to $3.175. Feeder cattle front month March was the outlier of the group, up $7.15 on the week, while April through September contracts were up $1.925 to $4.525 per hundredweight.

Cash-fed cattle markets were higher this week, with $238 to $241 per hundredweight paid in the South, $2 to $5 higher. In the North, cattle moved at $241 per hundredweight, up $5 from the high-end last week. Dressed trade in the North occurred at $375 to $378 per hundredweight, $7 to $8 higher.

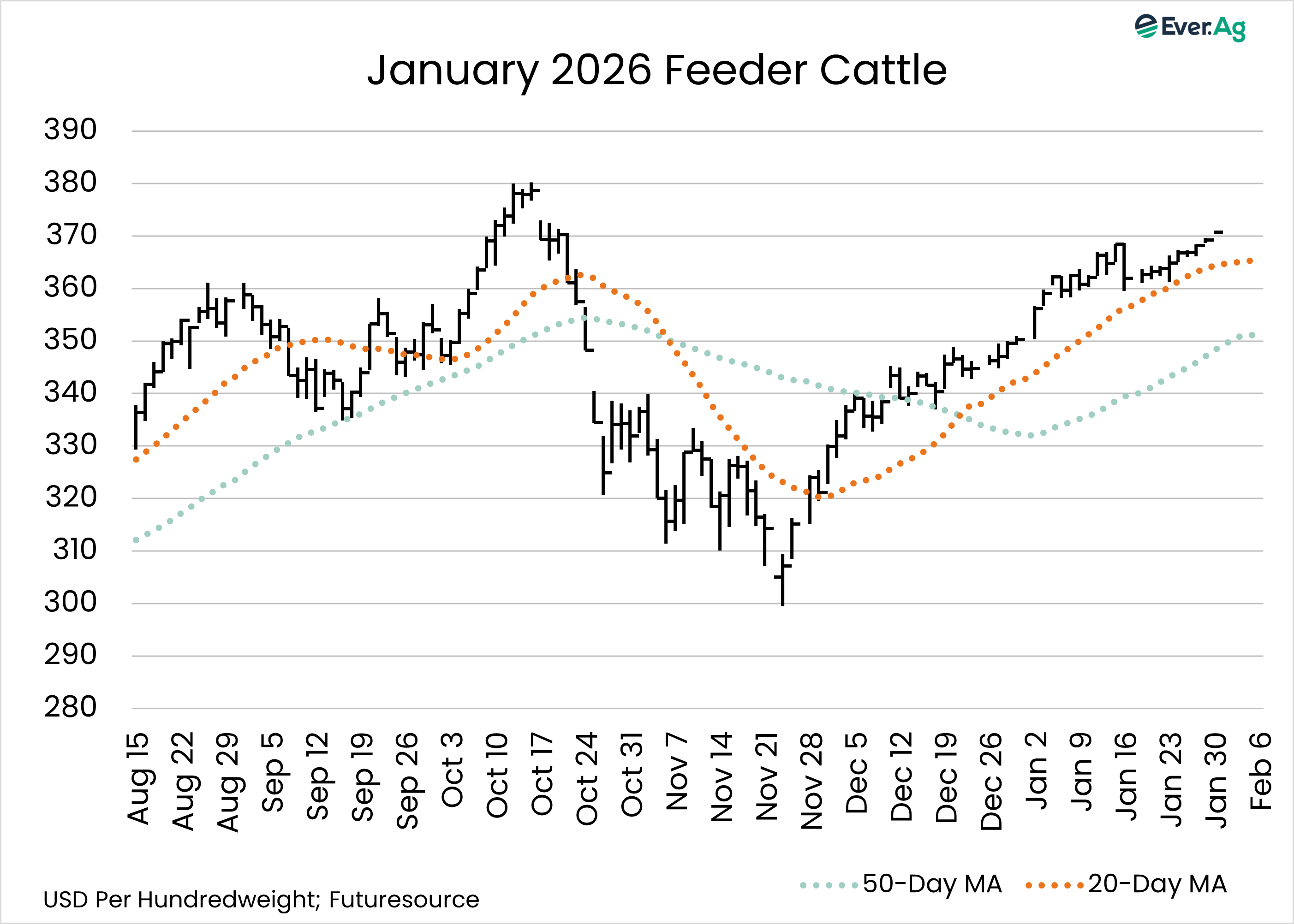

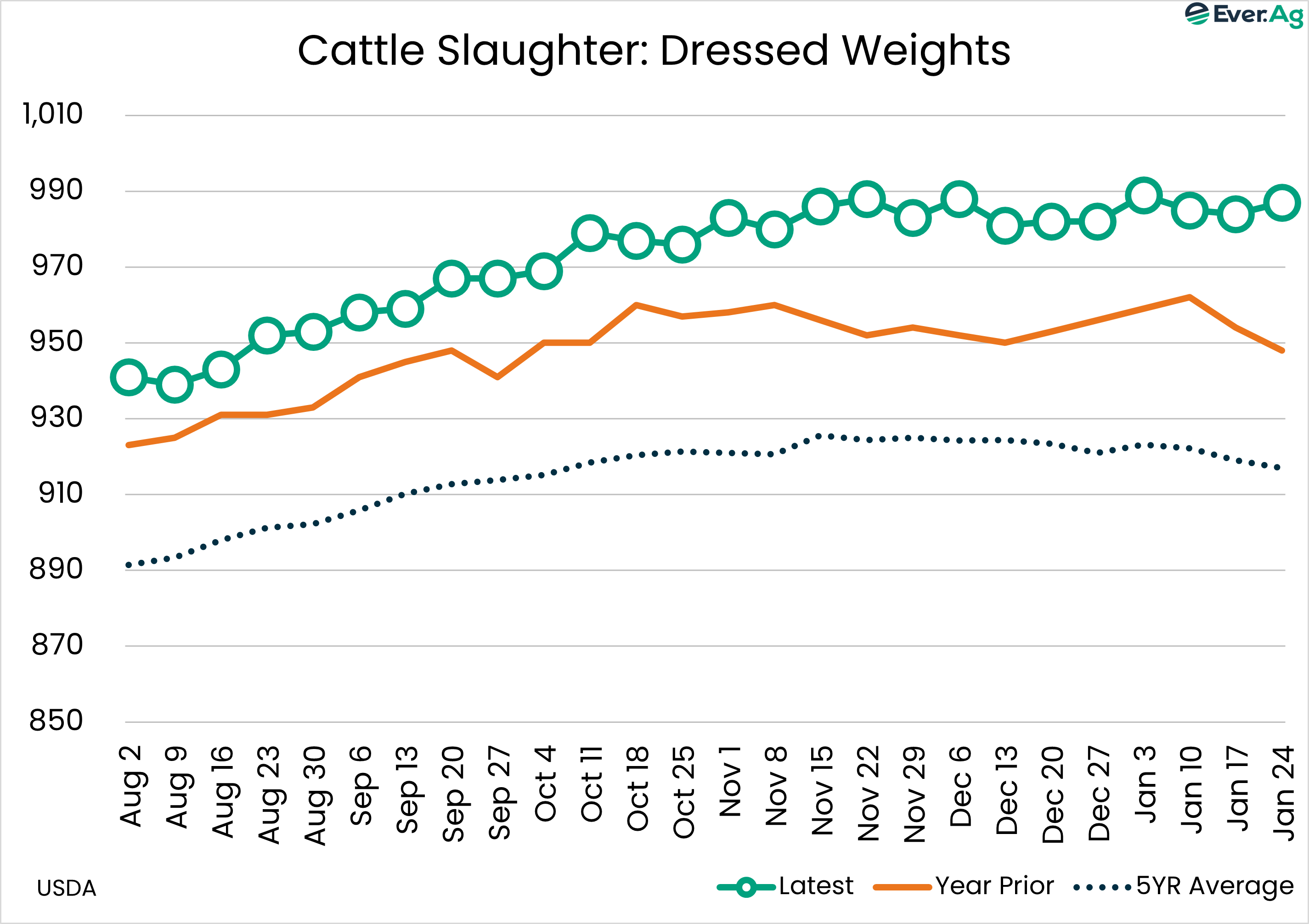

Weekly slaughter is estimated to be 531,000 head, down 4,000 from a week ago and down 71,000 from a year ago.

There were a variety of factors that influenced these wild swings, with the major pullback on Thursday caused by the news of a potential strike by union workers at a large packing plant. Friday started with a major recovery from Thursday’s sell off but moderated towards the end of the session, potentially impacted by the expectation that President Trump was signing the much talked about trade deal with Argentina. This is the same deal that was discussed last Fall that was the initial impetus for the break off historical highs. This would increase the tariff-free quota of beef from Argentina from 20,000 tons to 100,000 tons. Questions about Argentina’s ability to supply this increased quota remain as lean beef trimmings make up the majority of imports.

Moving back to domestic fundamentals, cash trade moved higher despite Thursday’s pullback. Initial bids began to come in Thursday at $238 per hundredweight in the North, steady with the low end of last week’s range. But cattle feeders held out and continued to push the market higher. By the end of the week, most of the trade occurred at $242 to $245 in the South and $240 to $244 in the North, mostly $1 to $4 higher than last week. A price of $245 matches the all-time high that was set early last Fall, with no end in sight to cattle feeders’ leverage. This was also with 536,000 head slaughtered for the week, compared to 528,000 head last week and 577,000 head in the same week last year.

Cash feeder cattle trade has also continued to stay strong, as prices steadied after last week’s poor weather impacted sales around the country. The feeder cattle index spent the week in the $374 to $375 range. This is also approaching the all-time high from last Fall, which was set at $376.51 per hundredweight.

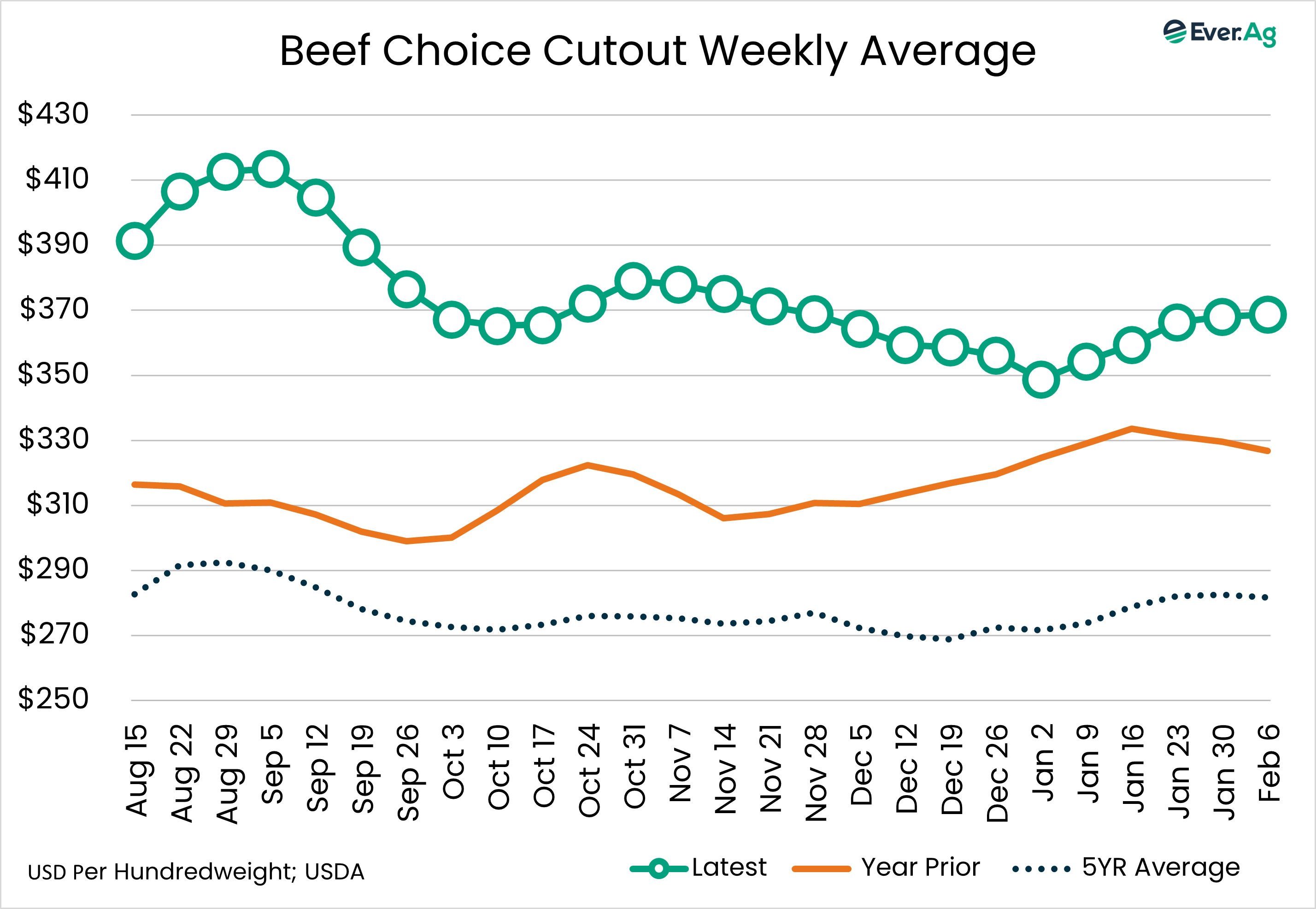

On the meat side, cutout was choppy throughout the week but ultimately ended up with a $3.77 gain on the Choice and a $2.59 gain on the Select week-over-week. This follows a similar pattern as last January, before values slumped into February. It is yet to be seen if the same will happen this year, or if extremely tight kill levels will keep the meat supported. The rib primal has found some support in the past week or two, while the end meats weakened just a touch. Though the cutout ultimately ended up with small increases, the larger increase in cash fed cattle prices will continue to keep significant pressure on packer margins.

Futures and options on futures trading involve significant risk and are not suitable for every investor. Information contained herein is strictly the opinion of its author and not necessarily of Ever.Ag and is intended for informational purposes. Information is obtained from sources believed reliable but is in no way guaranteed. Opinions, market data and recommendations are subject to change at any time. Past results are not indicative of future results. Trey Freeman and Matt Wolf maintain financial interests in the commodity contracts mentioned within this research report at the time it is published. Reproduction or redistribution is prohibited by law. Ever.Ag Insurance Services is an affiliate of Ever.Ag and is a licensed insurance agency in the following states: AZ, CA, CO, CT, FL, GA, ID, IL, IN, IA, KS, KY, LA, ME, MD, MA, MI, MN, MO, MT, NE, NV, NH, NM, NY, NC, ND, OK, OH, OR, PA, RI, SD, TN, TX, UT, VT, VA, WA, WV, WI, WY. This agency is an equal-opportunity employer.