Corn

- March corn futures closed at $4.2825 per bushel, more than two cents lower on the week. The May contract finished Friday at $4.3575 per bushel, down 2.25 cents.

- Ethanol production totaled 1.114 million barrels per day, down 0.4% on the week, but up 9.8% year-over-year. Stocks declined to 25.400 million barrels, down 1.3% week-over-week and on the year.

- Accumulated corn exports reached 1.263 billion bushels, far ahead of the five-year average of 686.9 million.

CORN COMMENTARY BY JON BAHR

- Corn found a little strength this week, as the March contract was able to push slightly above the $4.30 mark. Anticipation of positive news around E-15 talks is helping push the market. New crop hasn’t come along quite as fast as old crop but is still moving up. Old crop is now about 10 cents higher after the lows that followed the January WASDE report.

- Corn demand remains strong. We are still 10-15 cents lower on old-crop corn than we were pre-report, which is attracting buyers, both globally and domestically. We would expect exports to stay strong in the near future, but I would not be surprised if we see buying slow down now that we are up towards $4.30 per bushel. Ethanol margins weakened slightly, but we are still seeing very nice production from the ethanol industry.

- I believe corn has found its new range from $4.20-$4.35. Certainly, if we get positive news from these E-15 talks, that could break us out of this range. Keep in mind, even with positive news, this will not be an immediate fix or reflection on demand. We will need to see more plants come online to really make a big impact.

Soybeans

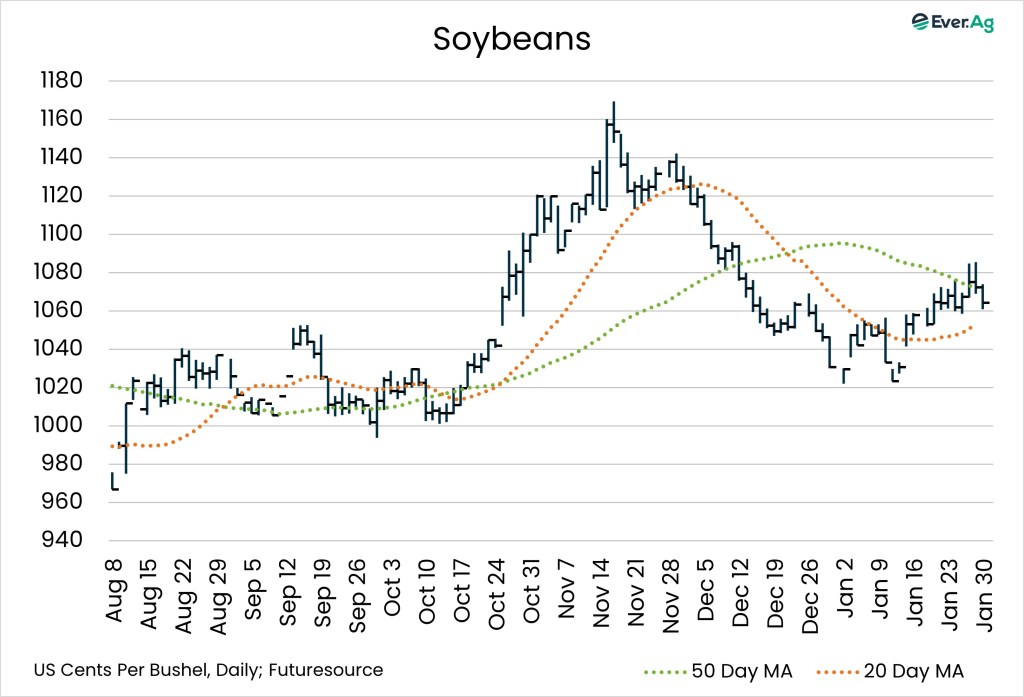

- The March soybean contract settled at $10.6425 per bushel, down 3.5 cents week-over-week. July soybean closed at $10.9050 per bushel, two cents lower.

- US accumulated soybean exports totaled 754.8 million bushels compared to the five-year average of 1.241 billion bushels.

SOY COMMENTARY BY NATALIE MCCARTY

- China has met the commitment to buy 12 million metric tons of soybeans. Unfortunately, this is only about half of their normal imports from the US, and China is now turning its purchasing power back to Brazil. With large crops coming on in both Argentina and Brazil, the chances of China buying additional soybeans from the US does not look likely. Price spreads are favoring South America. This leaves a lot of soybeans in the US looking for homes, which caps sustained rallies.

- Thankfully, soybean crush rates are strong, creating an outlet for soybeans. December crush volume was the second highest ever. However, without clarity on the biofuels program, soy oil stocks are increasing. This month’s reported oil stocks were at a 19-month high.

- For the feed buyers, this crush rate keeps soymeal pricing competitive versus other protein sources. Exports of soybean meal have been strong. However, increased competition from the upcoming 2026 Argentine crop will taper those prospects, pushing more meal to US feeders. Argentina typically crushes their soybeans and is the world’s largest exporter of soybean meal. The US is second. With canola meal rallying due to a trade truce between Canada and China, speak to your nutritionist to see how soybean meal fits in your rations.

Wheat

- Nearby wheat futures ended the week at $5.3800 per bushel, 8.5 cents higher compared to the previous Friday.

- Accumulated wheat exports reached 592.2 million bushels compared to 467.3 million on the five-year average.

WHEAT COMMENTARY BY JENNI BIRKER

- Weather has been a dominant driver in the wheat market this week, with the US Plains locked in a deep freeze. Prolonged cold can pressure the sensitive winter wheat crop, though a blanket of snow across parts of the region may offer crucial insulation. In South America, rising temperatures and declining moisture are stressing crops, with Argentina posting temperatures above 100 degrees. At the same time, Ukraine faces a sharp drop in temperatures next week, with forecasts calling for readings between 0 and -20 degrees. Much of southern Ukraine lacks snow cover, elevating the winterkill risk.

- Outside of weather, wheat is supported by a weakening US dollar after a brief bounce. Weekly export sales are expected to land between 275,000 and 600,000 tons, offering additional demand-side interest. Argentina’s cheap wheat has recently pressured global prices, but mills there now report difficulty sourcing enough quality grain, raising questions about future availability.

- For now, the bulls appear to have control as we weigh tightening quality supplies against mounting global weather risks.

Futures and options on futures trading involves significant risk and is not suitable for every investor. Information contained herein is strictly the opinion of its author and not necessarily of Ever.Ag and is intended for informational purposes. Information is obtained from sources believed reliable but is in no way guaranteed. Opinions, market data and recommendations are subject to change at any time. Past results are not indicative of future results. Brian Fletcher, Jon Spainhour, Jon Bahr and Jenni Birker maintain financial interest in the commodity contracts mentioned within this research report at the time it is published. Erica Maedke and Natalie McCarty do not maintain financial interest in the commodity contracts mentioned within this research report at the time of publication. This report is in the nature of a solicitation.