COMMENTARY BY TREY FREEMAN

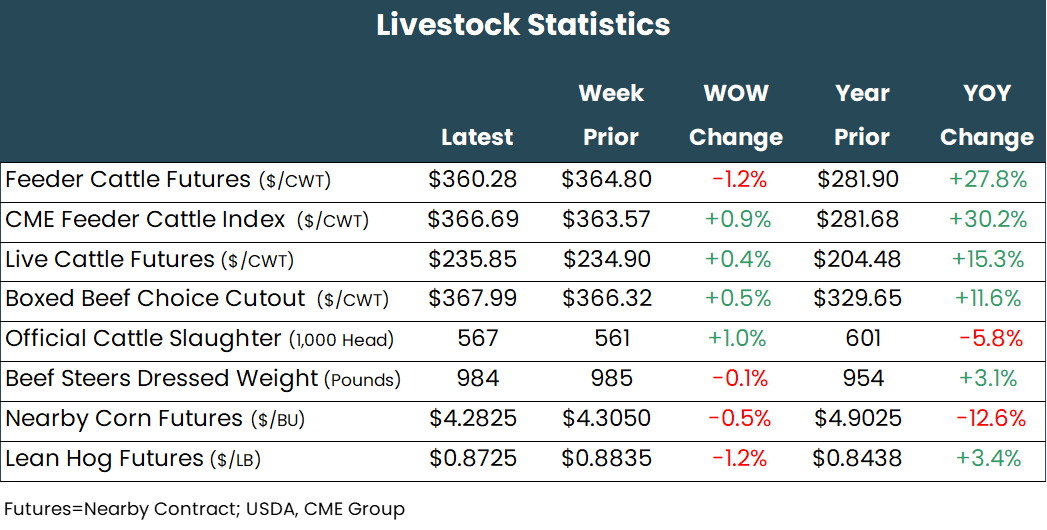

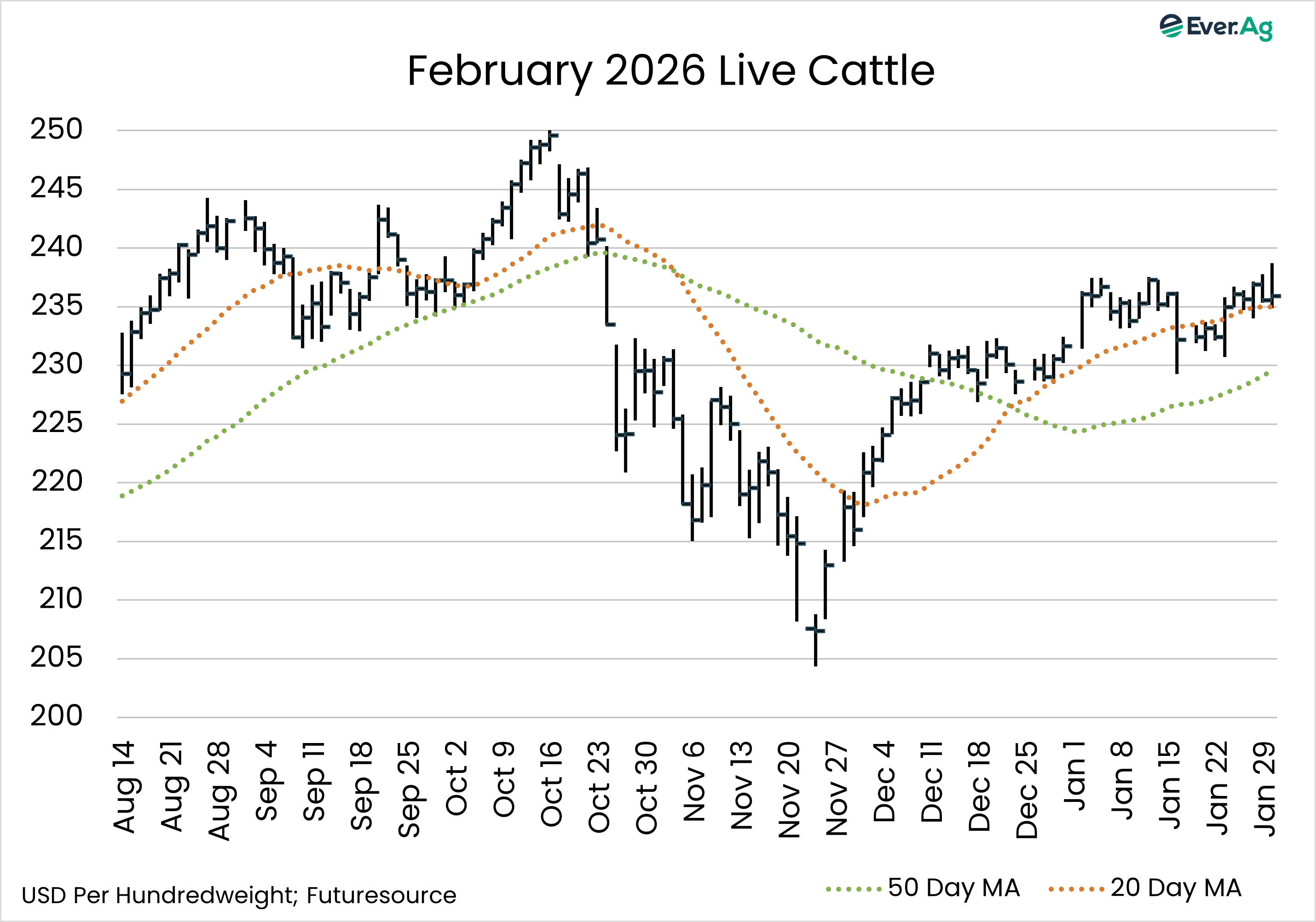

Live cattle futures finished Friday under heavy selling pressure, giving up gains from earlier in the week. All but the nearby February contract posted week-over-week losses. Deferred contracts finished with losses of $0.125 to $1.15 per hundredweight.

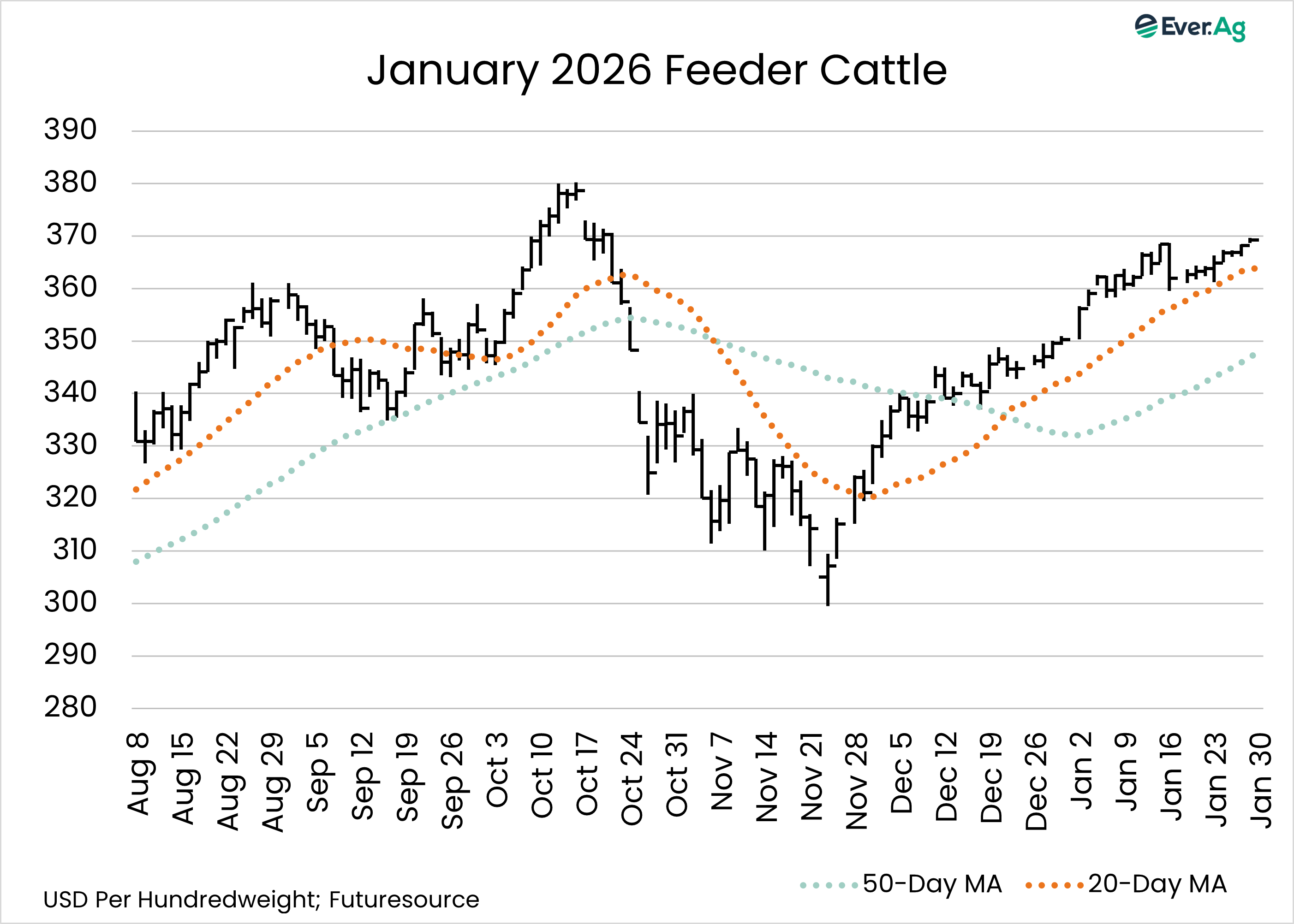

The same went for feeder cattle futures. The nearby March contract finished with a gain of $0.10 per hundredweight, but the remaining contracts finished with weekly losses of $0.475 to $1.275.

Pressure was likely due to a mixture of long profit-taking and producer hedging ahead of this afternoon’s Cattle report. Broad-based selling across commodities in general was also noted on account of a potential government shutdown, likely adding to the losses in cattle futures.

Cash-fed cattle markets were higher this week, with $238 to $241 per hundredweight paid in the South, $2 to $5 higher. In the North, cattle moved at $241 per hundredweight, up $5 from the high-end last week. Dressed trade in the North occurred at $375 to $378 per hundredweight, $7 to $8 higher.

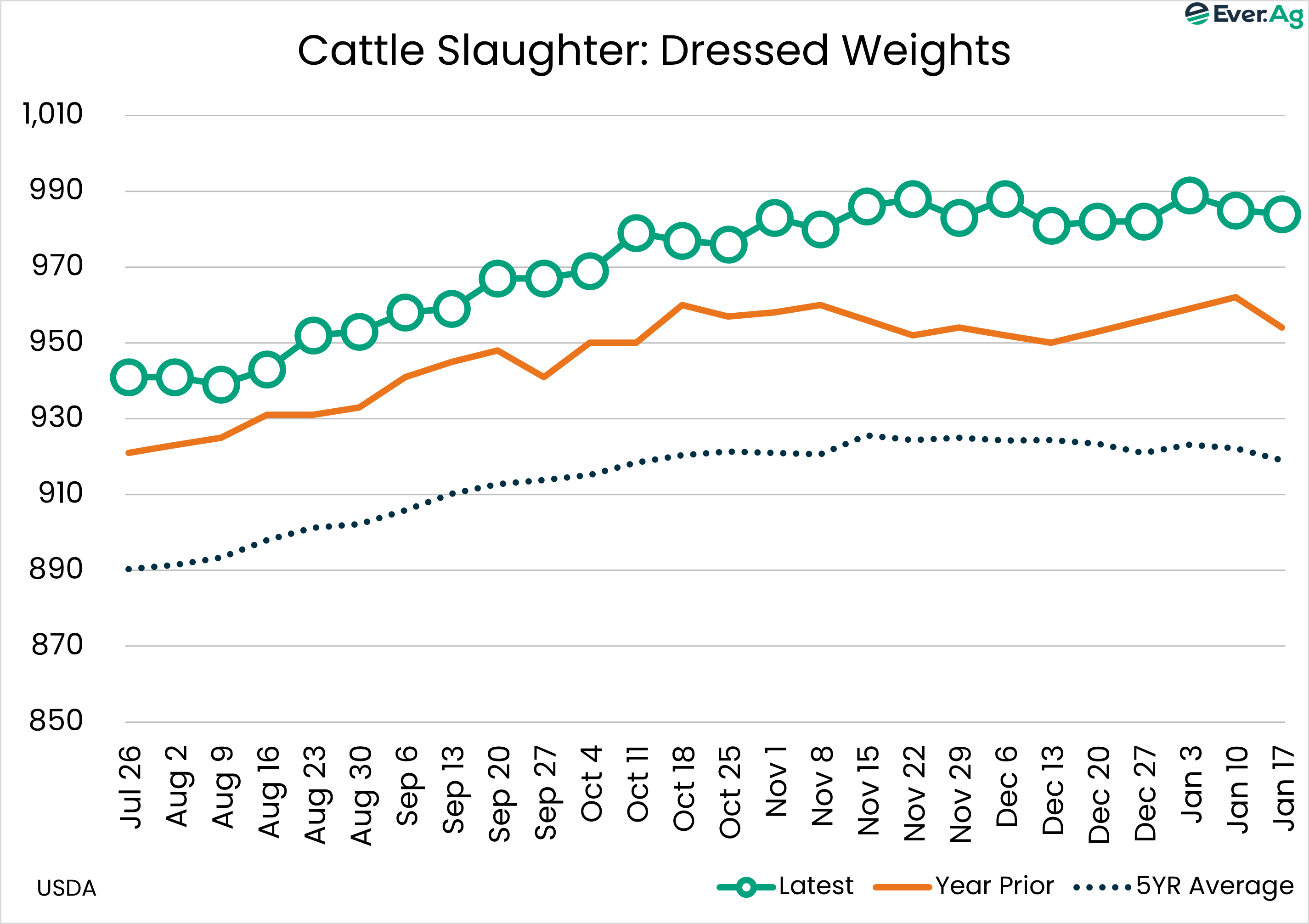

Weekly slaughter is estimated to be 531,000 head, down 4,000 from a week ago and down 71,000 from a year ago.

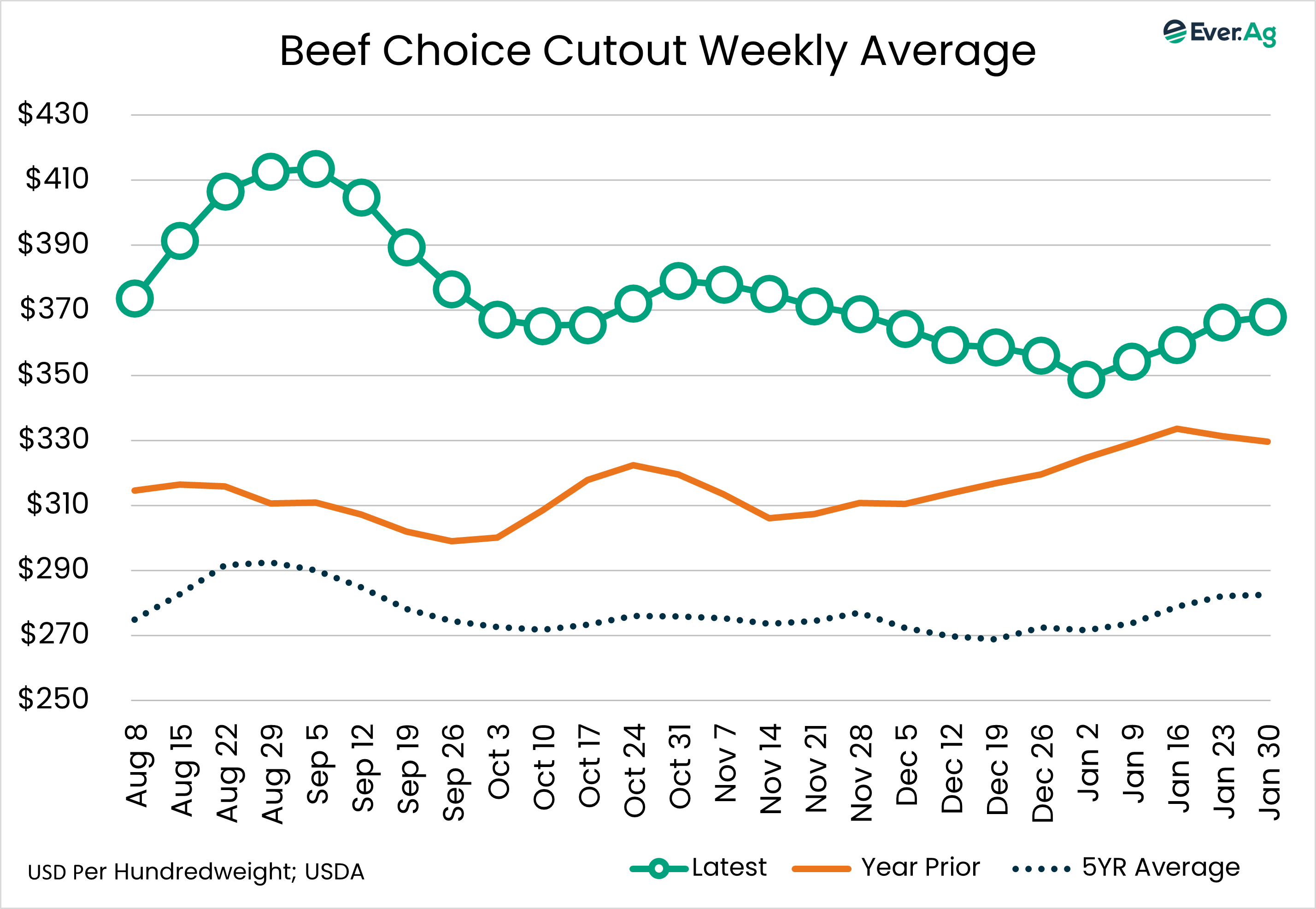

The boxed beef cutout appears to have wrapped up its seasonal push higher than is typically seen in January. Prices were $367.99 per hundredweight, $1.67 lower on the week. February is normally the biggest trough of the year for boxed beef prices.

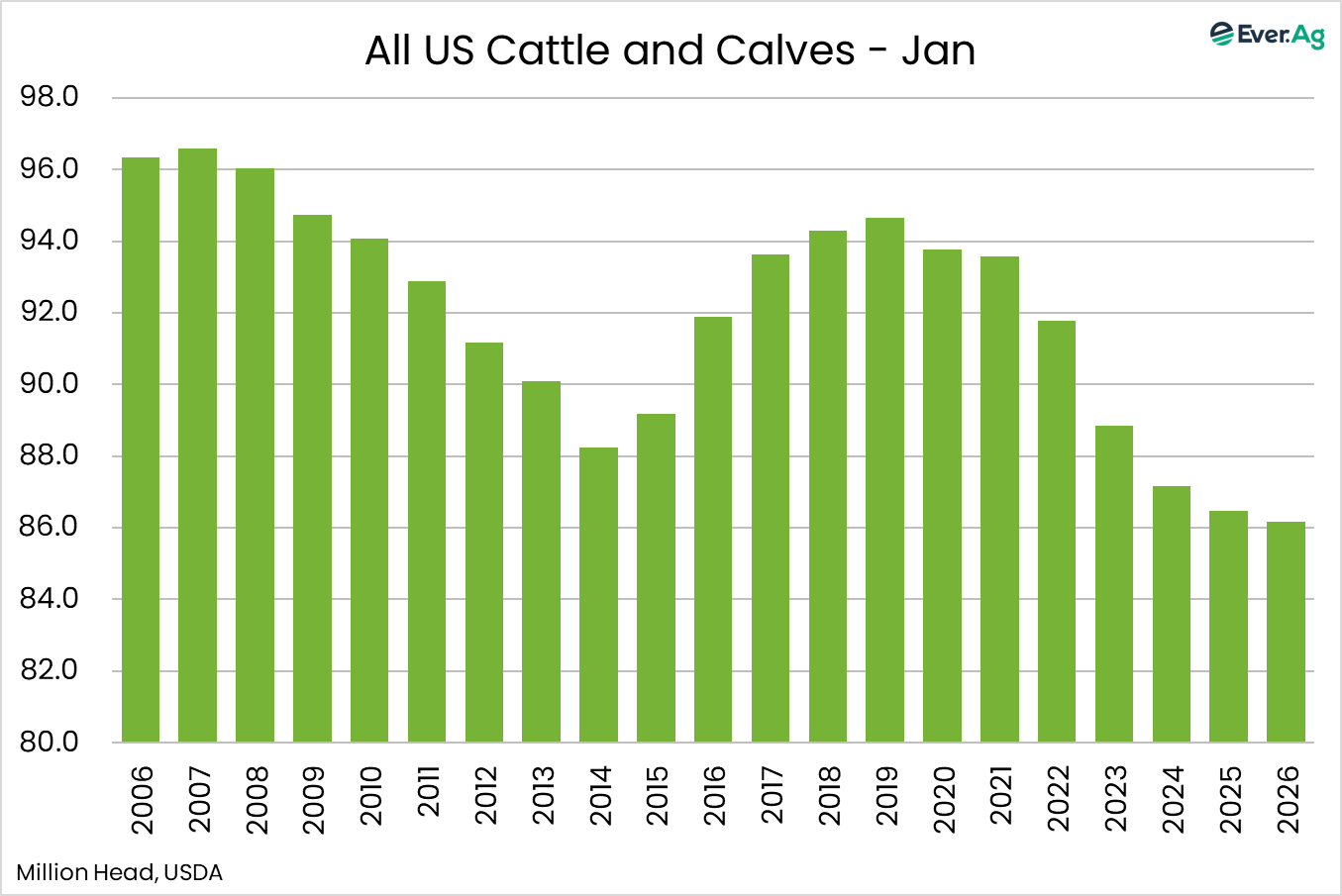

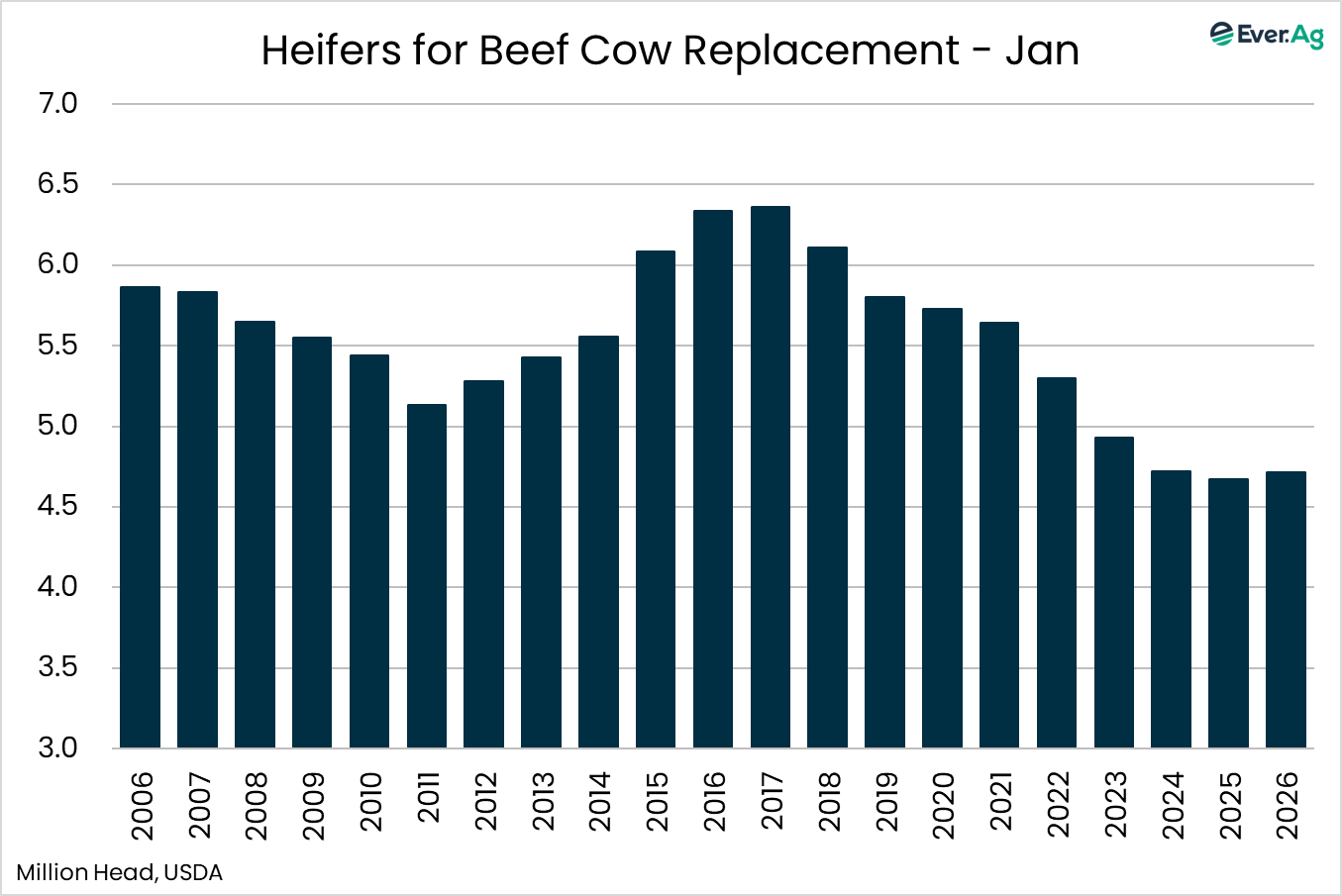

In its Cattle report, USDA pegged the “all cattle and calves” inventory at 86.2 million head as of January 1. That was 99.6% of last January’s inventory and slightly below estimates for 99.7%. Beef cows and heifers that have calved came in at 99% (27.6 million head) versus expectations for 100.4%. Heifers for beef calf replacement came in at 100.9% (4.7 million head) compared to expectations of 101.7%. All heifers 500 pounds or more came in at 99.4% (18.0 million head) versus expectations of 98.8%.

The report leans neutral to slightly bullish, showing overall herd stabilization and a small gain in heifer retention. The heifers for beef cow replacement came in higher than year-ago levels after eight consecutive years of decline. Overall, the report suggests that tight supplies persist, but the market has entered the very early stages of herd rebuilding.

Futures and options on futures trading involve significant risk and are not suitable for every investor. Information contained herein is strictly the opinion of its author and not necessarily of Ever.Ag and is intended for informational purposes. Information is obtained from sources believed reliable but is in no way guaranteed. Opinions, market data and recommendations are subject to change at any time. Past results are not indicative of future results. Trey Freeman and Matt Wolf maintain financial interests in the commodity contracts mentioned within this research report at the time it is published. Reproduction or redistribution is prohibited by law. Ever.Ag Insurance Services is an affiliate of Ever.Ag and is a licensed insurance agency in the following states: AZ, CA, CO, CT, FL, GA, ID, IL, IN, IA, KS, KY, LA, ME, MD, MA, MI, MN, MO, MT, NE, NV, NH, NM, NY, NC, ND, OK, OH, OR, PA, RI, SD, TN, TX, UT, VT, VA, WA, WV, WI, WY. This agency is an equal-opportunity employer.