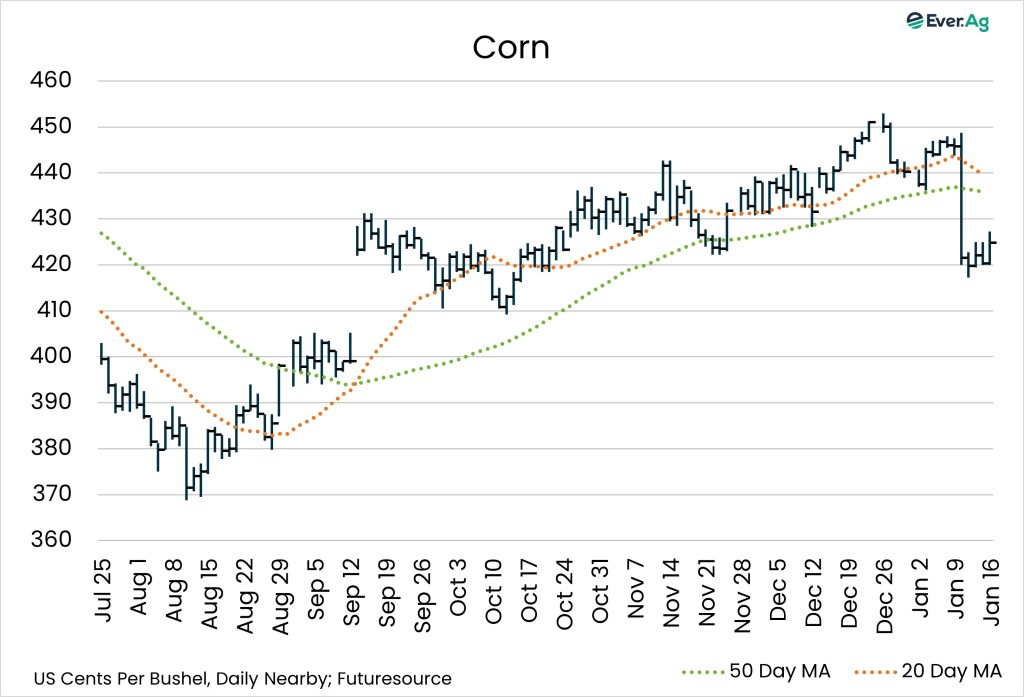

Corn

- According to USDA, US corn production estimates reached 17.021 billion bushels in January, up from 16.752 billion in December and ahead of the consensus call for 16.552 billion. Yield estimates also increased to 186.5 bushels per acre. That compares to 186.0 bushels in the previous report and expectations for 184.0 bushels.

- USDA pegged US January corn ending stocks at 2.227 billion bushels, up from 2.029 billion the previous month and well ahead of expectations for 1.972 billion.

- Harvested corn acre estimates reached 91.300 million acres compared to 90.000 million in December and the consensus call for 89.974 million.

- The March corn contract closed at $4.2475 per bushel, 21 cents lower week-over-week. May futures ended the week at $4.3200 per bushel, down nearly 22 cents.

- Corn accumulated export sales reached 1.141 billion bushels, far ahead of the five-year average of 598.46 million.

- Ethanol production jumped to 1.196 million bushels per day, up 8.9% week-over-week and +9.2% on the year. Stocks totaled 24.473 million bushels, up 3.5% on the week, but down 2.1% versus 2024.

CORN COMMENTARY BY JEN WACKERSHAUSER

- The corn market was shocked this week by a WASDE report that raised both harvested acres and yields. At 186.5 bushels per acre and 191.3 million acres, we have a record yield that blows the old record out of the water by 12.5%. Markets had a swift correction lower on Monday, ultimately finding some support near $4.20 for March and $4.48 for December corn.

- The demand side of the balance sheet also continues to hum along at a strong pace, with feed and residual use getting a boost higher. Ethanol grind is continuing at a pace that will use 44.2 million bushels more this marketing year. Export pace is nearly 5% ahead of the five-year average. Despite a burdensome 2.27 billion bushels balance sheet heading into Spring planting, prices remain in the same range we have mostly traded in since early Fall.

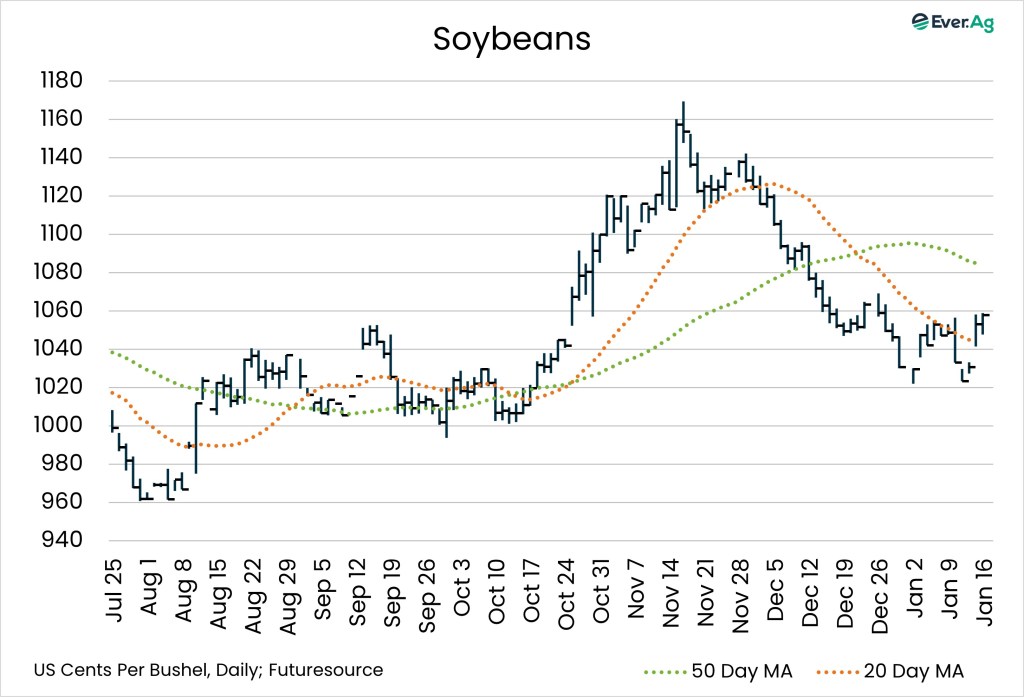

Soybeans

- In its January WASDE report, USDA pegged US soybean production at 4.262 billion bushels compared to 4.253 billion in December and the consensus call for 4.229 billion. Yield was unchanged on the month at 53.0 bushels per acre, but ahead of expectations for 52.7 bushels.

- US soybean ending stock estimates totaled 350 million bushels, well above December’s 290 million and expectations for 292 million.

- USDA estimated harvested soybean acres at 80.400 million compared to 80.300 million in December and the consensus call for 82.561 million acres.

- March soybeans closed at $10.5775 per bushel, down almost five cents on the week. The July contract finished Friday at $10.8125 per bushel, 6.5 cents lower.

- US soybean accumulated export sales totaled 660.80 million bushels compared to 1.180 billion bushels on the five-year average.

SOY COMMENTARY BY VERL PRATHER

- The soybean market has found its way back near lows set on the first trading day of the year. USDA’s highly anticipated January WASDE report added additional cushion to the US ending stock estimate. However, traders have not reacted as negatively as one may have suspected. Strong yields were confirmed, and cracks in export demand are beginning to be reconciled.

- Analysts may argue that export expectations are still too high given that Brazil’s crop will be here before we know it. But on the other hand, we continue to hear about China purchasing US soybeans that should have been bought from Brazil, given price differentials. This may have some traders hopeful that China will exceed the 12-million-metric-ton commitment made in the Fall and lessen the future revisions of export demand expectations. As a result, it appears that some extra premium is built into current market prices. Regardless, it seems that fundamentals of the soybean market would need to change significantly to retest the highs made back in November.

- Looking forward, export demand will remain a hot topic for soybeans. The US stands around 155 million bushels behind the pace needed to meet current export expectations. There are massive price implications in the difference between a 350 million bushel ending stock and a 500 million bushel ending stock, if exports are reduced in the future. So, market participants should plan according if weekly export sales begin to lose steam.

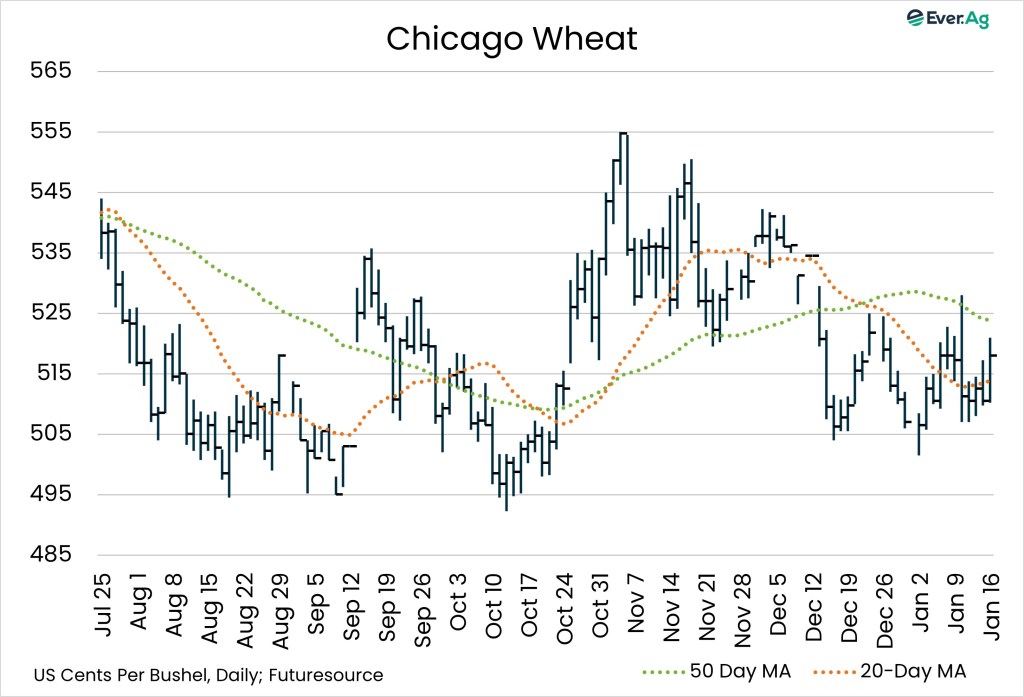

Wheat

- According to USDA’s WASDE report, US wheat ending stocks for January totaled 926 million bushels, up from 901 million the month before and ahead of predictions for 896 million.

- Nearby wheat futures ended the week at $5.1800 per bushel, nearly one cent higher versus the previous Friday.

- Accumulated US wheat export sales totaled 564.6 million bushels, ahead of 440.6 million on the five-year average.

WHEAT COMMENTARY BY BRANDON WEIGEL

- This week’s January WASDE and quarterly Grain Stocks reports created a massive shakedown across the entire complex, sending markets into a tailspin. Wheat was not left out, despite only minor adjustments to estimates.

- The outlook for wheat in Monday’s report called for slightly larger supplies, modest declines in domestic use, unchanged exports and increased ending stocks to the tune of 25 million bushels, now anticipated at 926 million bushels.

- Global wheat supplies for the year ahead are also forecast higher on the back of increased production in Argentina and Russia. That offsets some losses in Turkey. Higher use is also forecast in Russia, Ukraine and Morocco.

- Wheat markets appear to already have a lot of bearish news priced in. The world knows that there’s no shortage of wheat supplies, but the market continues to find comfort and support at $5.00. Wheat continues to be managed money’s largest net short position in the grain complex, which likely mitigates risk of a further downside washout but also keeps rallies modest. If you give the market a broader sweeping bullish headline however, short squeeze pressure would provide the opportunity for a more substantial topside move. There doesn’t appear to be anything major on the horizon as of mid-January.

Futures and options on futures trading involves significant risk and is not suitable for every investor. Information contained herein is strictly the opinion of its author and not necessarily of Ever.Ag and is intended for informational purposes. Information is obtained from sources believed reliable but is in no way guaranteed. Opinions, market data and recommendations are subject to change at any time. Past results are not indicative of future results. Jon Spainhour, Jen Wackershauser, Verl Prather and Brandon Weigel maintain financial interest in the commodity contracts mentioned within this research report at the time it is published. Erica Maedke and Kathleen Wolfley do not maintain financial interest in the commodity contracts mentioned within this research report at the time of publication. This report is in the nature of a solicitation.