COMMENTARY BY TREY FREEMAN

Cattle markets finished this week with sharp losses on Friday – a function of New World screwworm concerns. The rumor floating around is that New World screwworm was found in the US, sparking producer hedging and long profit taking. USDA APHIS reports cases detected within 400 miles of the US border every Thursday evening. This week’s update included 26 new cases. This follows 15 cases detected the week prior, revealing a pattern of more cases from one week to the next.

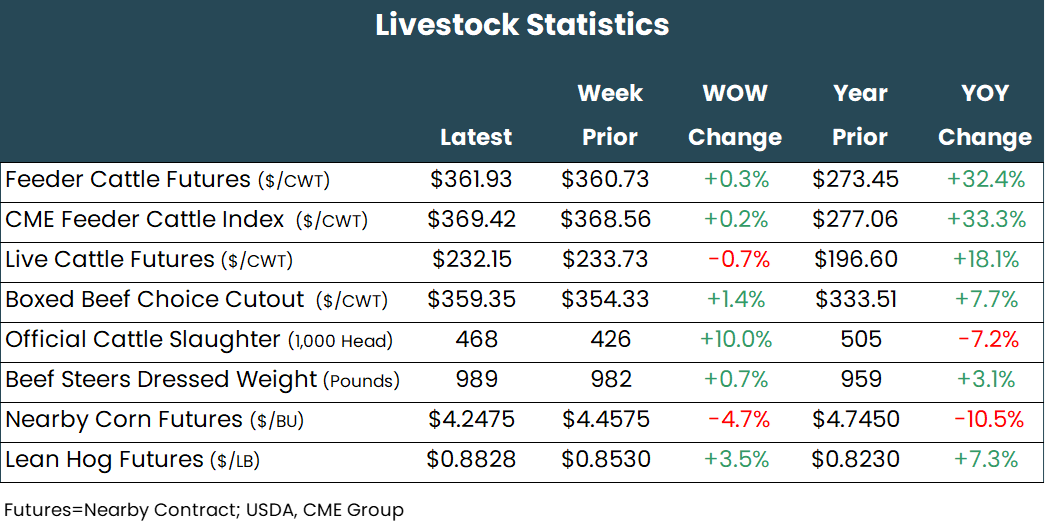

Cash-fed cattle markets were steady for the week at $233 per hundredweight in the South and $232 to $233 in the North, waiting until Friday to develop after the sharp selloff in futures commenced. Dressed trade occurred at $365 per hundredweight.

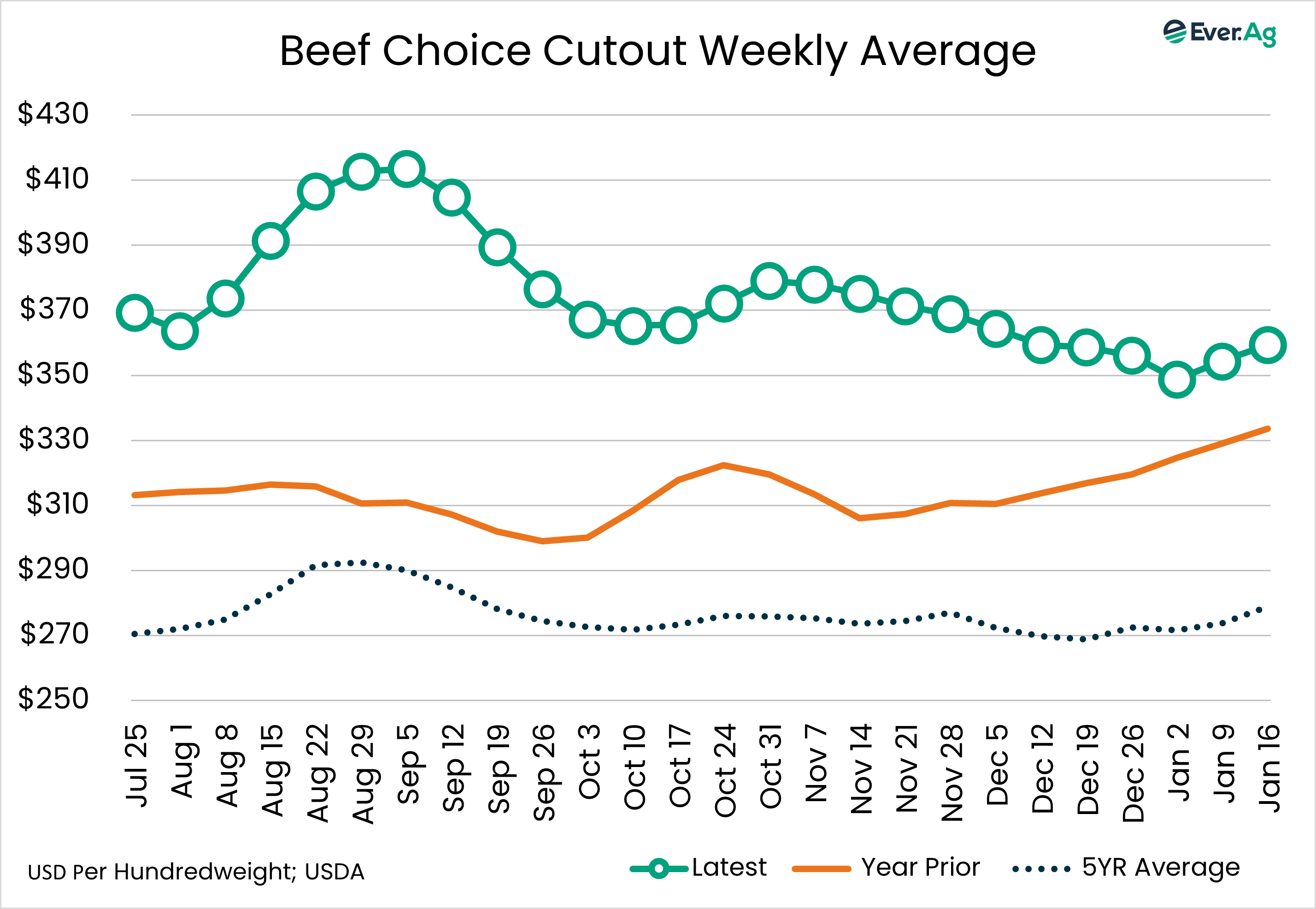

The choice boxed beef cutout averaged $359.35 per hundredweight, $5.02 higher on the week. Boxed beef prices tend to tail off toward the end of January after staging a modest rise through the first of January and then plateauing until mid-March when spring demand picks up. End cuts typically stage a rally through the winter months while the middles face pressure. February will be a tug of war between the two. Traders will keep a close eye on the rib primal as it continues to trade well below year ago levels, averaging nearly $40 per hundredweight under the same week from a year ago, down 7.5%.

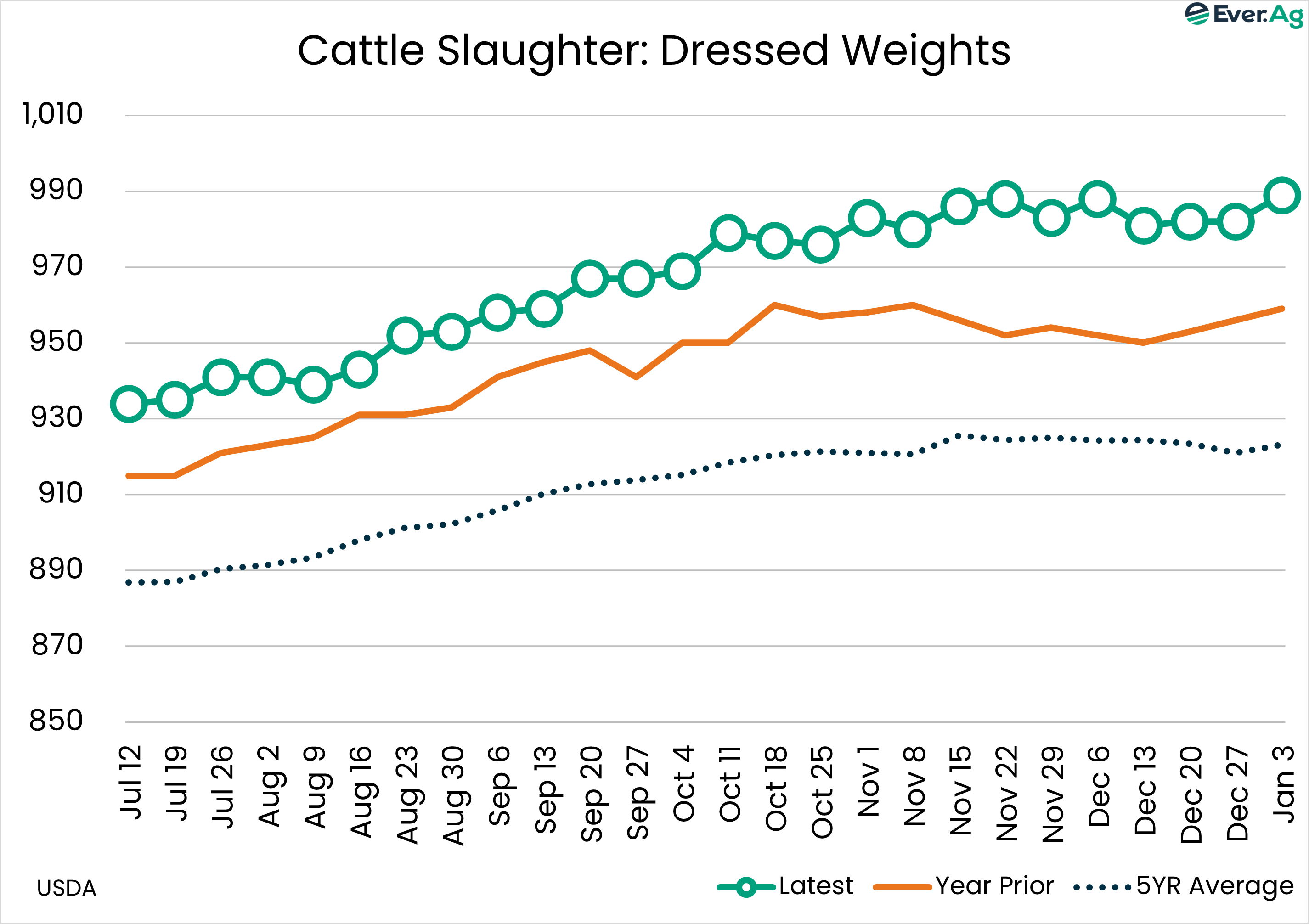

USDA estimated weekly slaughter to be 562,000 head, up 9,000 from a week ago and down 39,000 from a year ago. Recent slaughter data revealed dressed steer weights at a staggering 989 pounds, a new record. Dressed heifer weights were reported at 900 pounds, also a record.

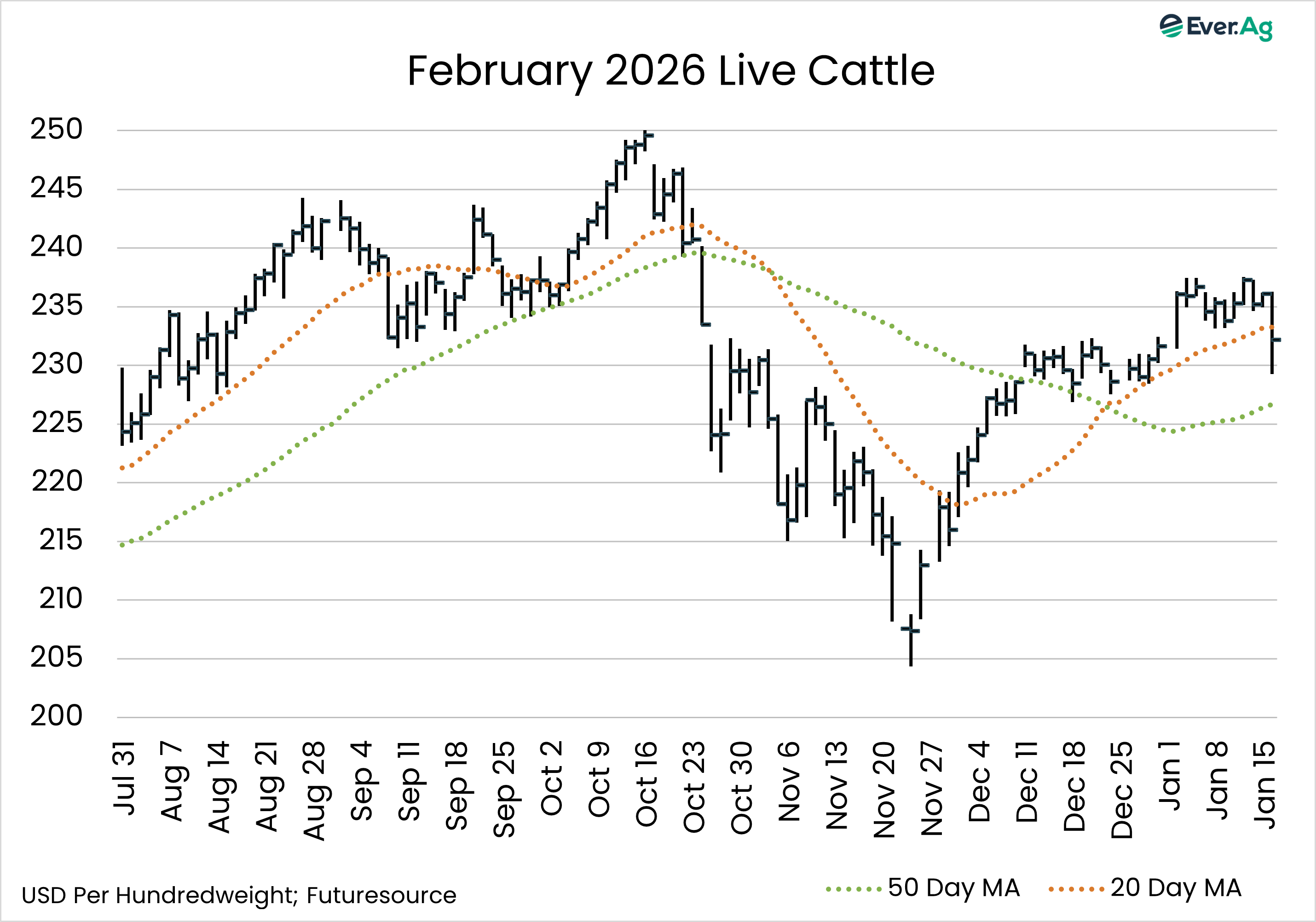

February live cattle posted an outside week lower, finishing with losses of $1.575 per hundredweight on the week and right on track with the 100-day moving average of $232.15. Further out, contracts managed to close above the previous week’s lows as well as above their respective 100-day moving averages, finishing unevenly steady for the week.

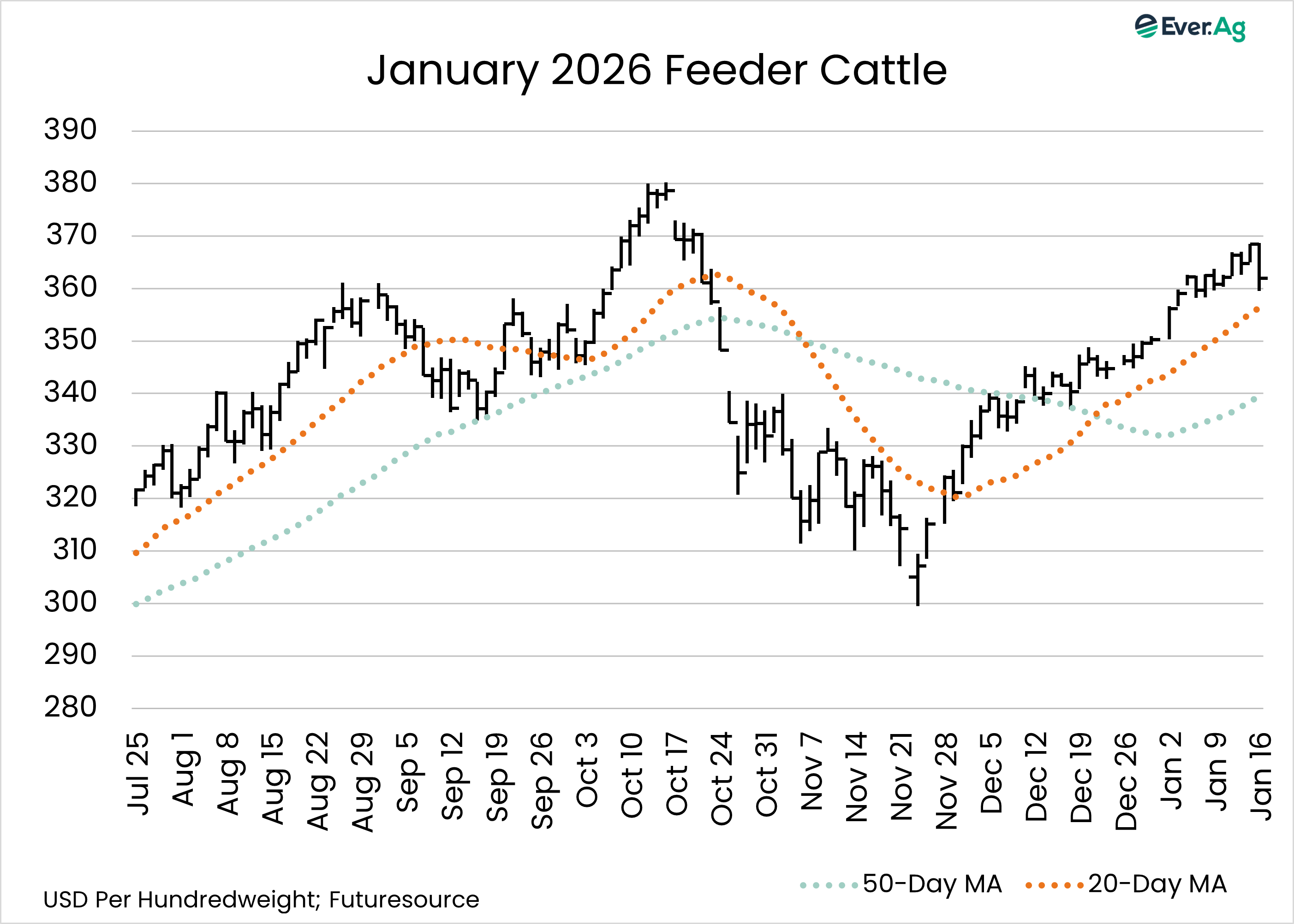

Feeder cattle futures closed higher with January up $1.20 per hundredweight and March through August up $1.325 to $1.950. Feeder cattle sustained less chart damage than live cattle, although March feeders did close below their 10-day moving average for the first time since late November.

Futures and options on futures trading involve significant risk and are not suitable for every investor. Information contained herein is strictly the opinion of its author and not necessarily of Ever.Ag and is intended for informational purposes. Information is obtained from sources believed reliable but is in no way guaranteed. Opinions, market data and recommendations are subject to change at any time. Past results are not indicative of future results. Trey Freeman and Matt Wolf maintain financial interests in the commodity contracts mentioned within this research report at the time it is published. Reproduction or redistribution is prohibited by law. Ever.Ag Insurance Services is an affiliate of Ever.Ag and is a licensed insurance agency in the following states: AZ, CA, CO, CT, FL, GA, ID, IL, IN, IA, KS, KY, LA, ME, MD, MA, MI, MN, MO, MT, NE, NV, NH, NM, NY, NC, ND, OK, OH, OR, PA, RI, SD, TN, TX, UT, VT, VA, WA, WV, WI, WY. This agency is an equal-opportunity employer.