The Scoreboard

Comment

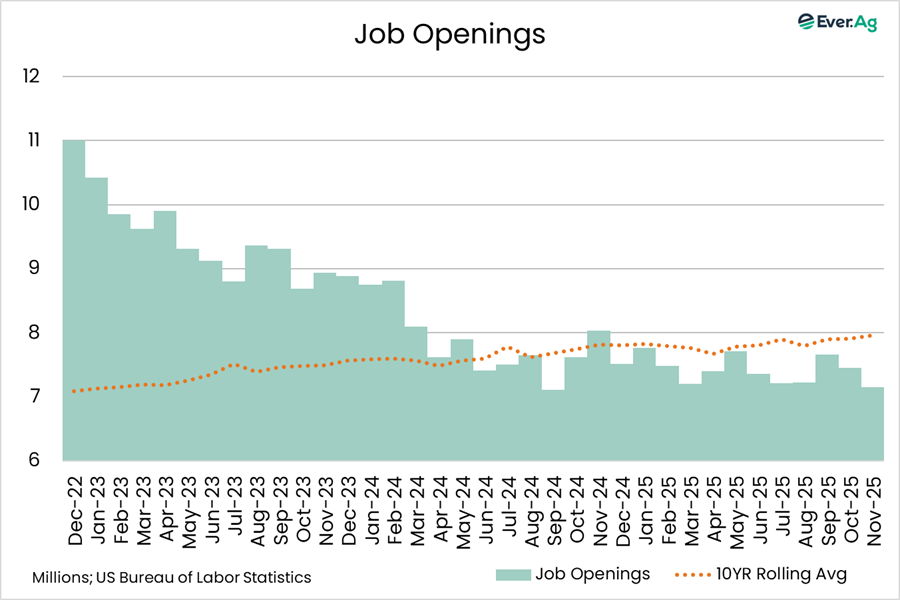

Last week, we learned that… labor market conditions are deteriorating, but the situation doesn’t seem immediately perilous. Anyone inclined to be nervous about employment data found some concerning statistics in the latest Employment Situation and Job Openings and Labor Turnover Survey reports from the US Bureau of Labor Statistics:

- The number of job openings in November dropped to 7.15 million, down from 7.45 million in October and 8.03 million in November 2024.

- The ratio of job openings to unemployed persons dropped to 0.92, the lowest reading since March 2021. A year earlier, we saw more openings than unemployed people by a 1.09 ratio, extending what became a 50-month streak.

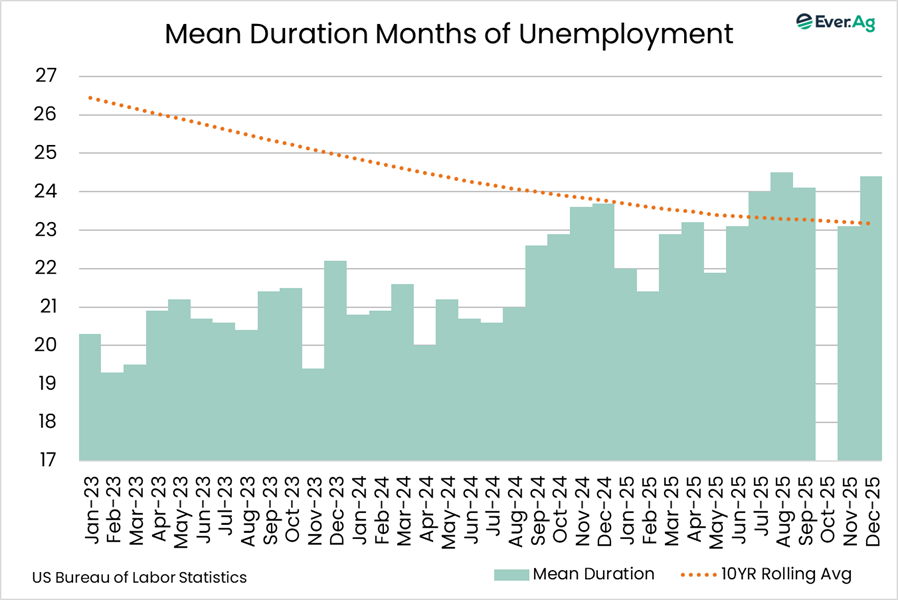

- It’s become more difficult for unemployed persons to find new jobs, with the mean duration of unemployment in December at 24.4 months, up from 23.7 in December 2024.

- More people say they are working part-time because that’s all they can find – 1.51 million people in December 2025, compared to 1.195 million in December 2024.

It wasn’t all distressing news, however, as payrolls continued to expand in December, with 50,000 jobs added. The unemployment rate moved lower, too, registering at 4.4%, down from 4.5% in November (which BLS revised lower from 4.6% originally. And wages increased by 3.7% year-over-year, above headline inflation (+2.7%).

It’s not surprising to see less robust labor conditions given weaker GDP growth in early 2025, along with uncertainty around tariffs and broader concerns about economic performance. Remember, as we’ve said more than a few times over the years, employment is a lagging indicator. And the soft patch may not last or may not get much worse because, according to the data, the US economy seems to be in a better place today than a year ago. I’m not especially concerned about rampant unemployment unfolding in the months ahead.

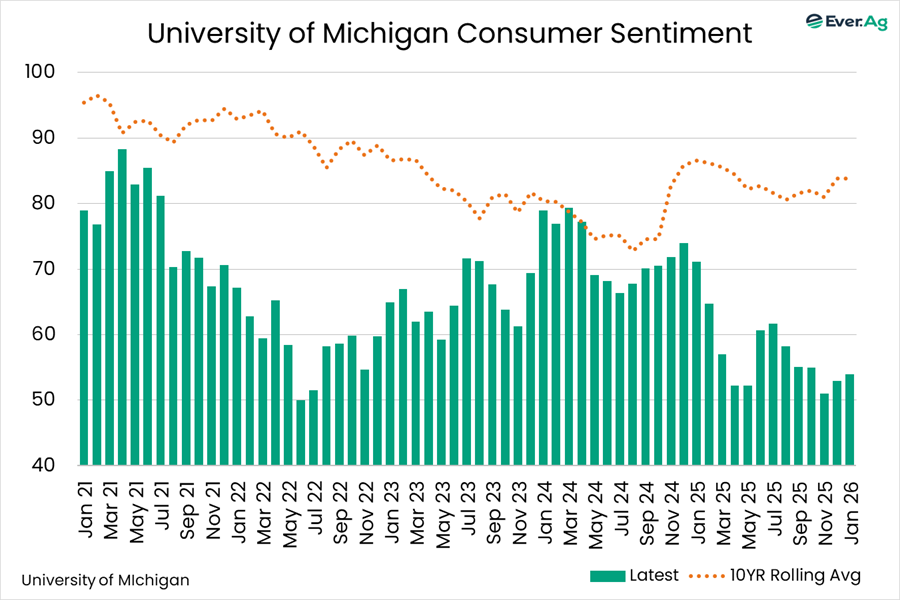

That’s not the same thing as saying there’s no corresponding risk to consumer spending, however, as fears about additional labor market deterioration have the potential to keep weighing on sentiment. The preliminary January reading of the University of Michigan Consumer Sentiment Index rose slightly (54.0 compared to 52.9 in December) but remained well below post-COVID highs (88.3) and the 10-year rolling average (83.8). This article from Marketplace offers some helpful context:

Whatever the numbers say, here’s something that could matter as much, at least to the consumer economy: How worried folks are about holding onto their jobs and income. All through the latter part of 2025, the job market was losing steam, said Bill Adams, chief economist at Comerica Bank. “Job growth hit an air pocket and has really been in low gear since April of this past year,” he said. And Adams said the working public has noticed: “People are more worried about job security, they’re less upbeat about the prospects of being able to find a new job. And that is weighing on how they’re thinking about their own personal finances.” This is evident in the University of Michigan’s consumer surveys, said director Joanne Hsu. “One of the big, overarching patterns of 2025 was a broad deterioration in views and expectations for labor markets — a pretty substantial increase in people expecting unemployment to get worse in the future,” she said. People are worried about their own incomes falling or jobs getting eliminated. Or they may know someone who’s struggling. “Even if the consumer themselves is stable in their job, they talk about how hard the labor market is for a young person in their family, trying to look for a job right now,” Hsu said.

* * *

Are we at “maximum pizza” in the United States? The Wall Street Journal asserted as much in a recent article, noting:

Today, pizza shops are engaged in price wars with one another and other kinds of fast food. Food-delivery apps have put a wider range of cuisines and options at Americans’ fingertips. And $20 a pie for a family can feel expensive compared with $5 fast-food deals, frozen pizzas or eating a home-cooked meal.

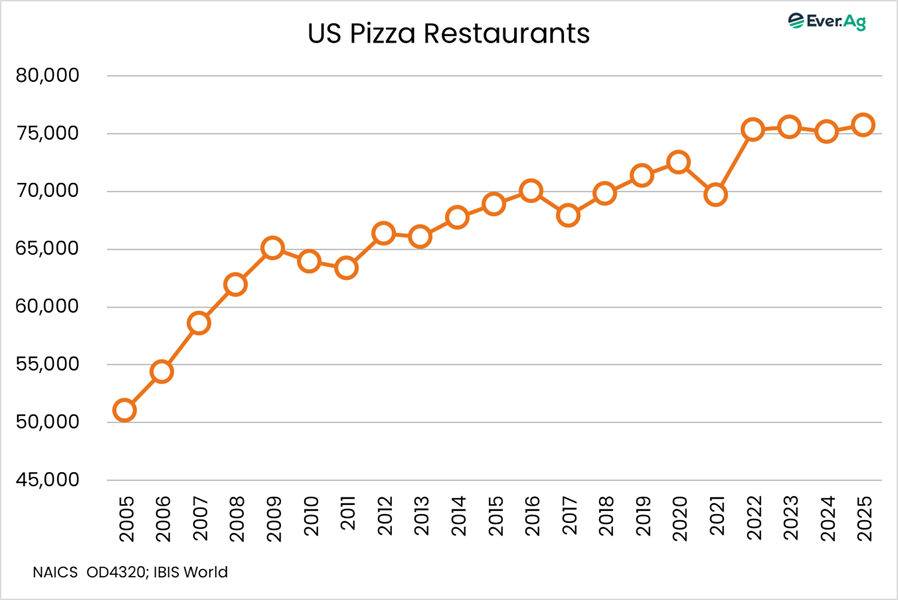

We’ve seen slowing growth in the pizza restaurant industry in recent years. IBIS world data shows a 35% increase in the number of pizza outlets from 2005 to 2015, a 9% increase from 2015 to 2022 and no increase, really, since then.

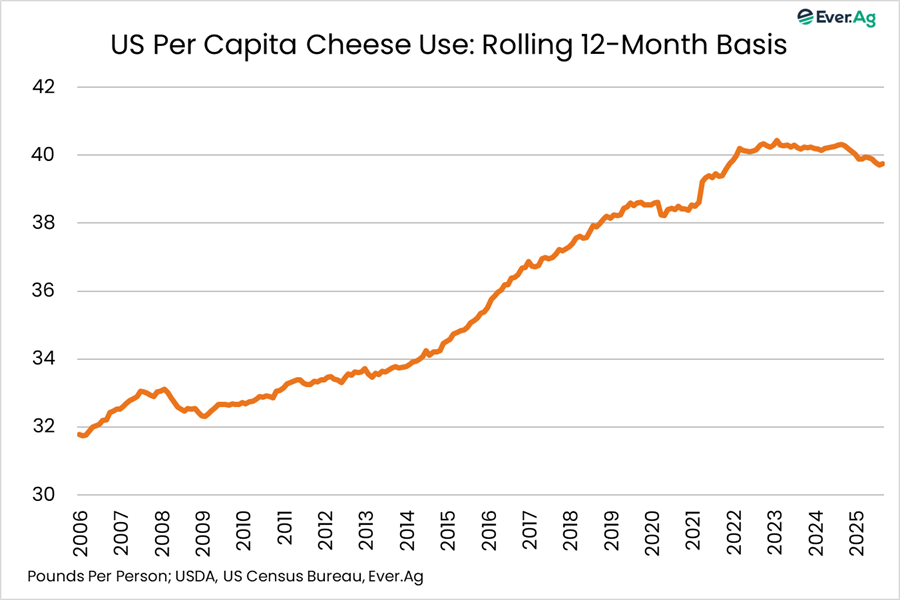

This matters for cheese consumption. It’s probably not a coincidence that our measure of per-capita cheese consumption began to flatten out at about the same time as pizza outlet expansion.

While it’s possible that pizza could get its mojo back because of price promotion, reliable satisfaction or some other reason, I wonder if there’s literally little room for further expansion, since you can now find pizza just about anywhere, something that wasn’t true 15 or 20 years ago. Casey’s, the Midwest-based convenience store chain, brought pizza to thousands of rural communities. The company now has more than 2,900 stores, nearly double the number in 2010 (1,531). According to the company, about two-thirds of Casey’s stores operate in communities with populations of 20,000 or lower. Casey’s sells 40 million whole pies a year; it’s now the fifth-largest pizza purveyor in the US.

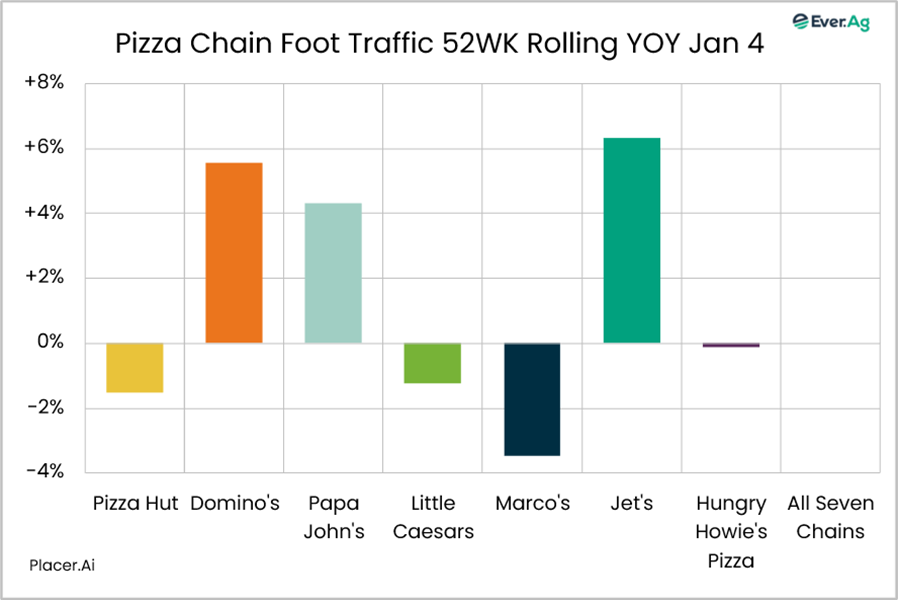

As for the here-and-now, Placer.Ai’s foot traffic data reflects malaise. For the 52 weeks ending January 4, activity across seven leading pizza chains was flat compared with the year-prior period.

* * *

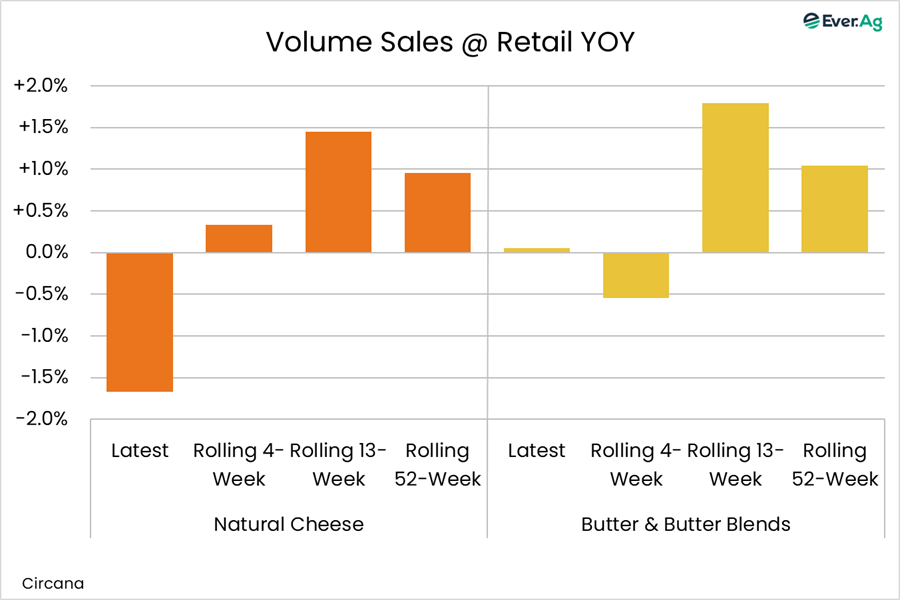

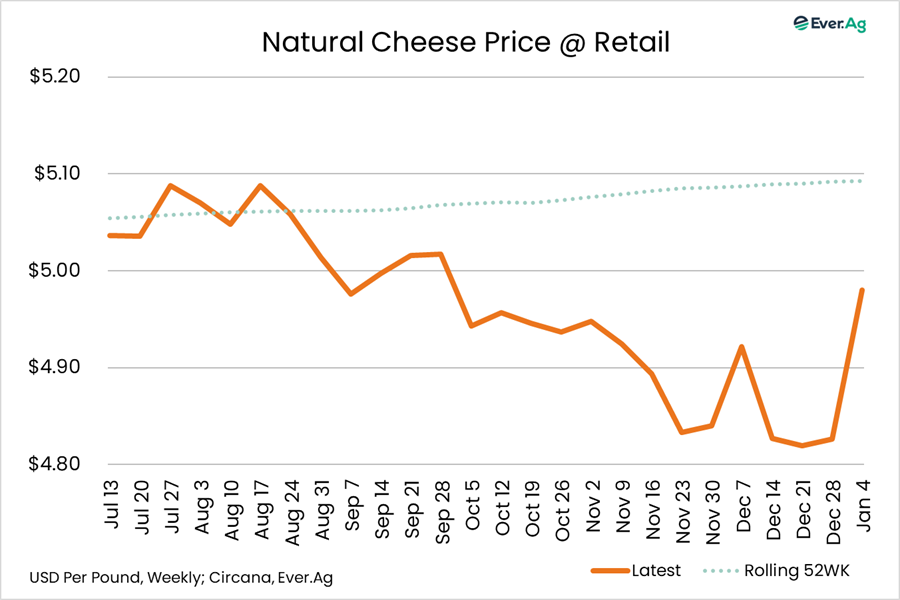

Retail butter and cheese sales didn’t impress during the week ending January 4. Circana data showed natural cheese volume sales at retail down 1% to 2%, while butter sales increased fractionally. Prices moved higher for the second week in a row, with cheese at $4.98 per pound, up 15 cents on the week but down 5% year over year. Butter: $4.95 per pound, up 42 cents on the week to the highest level since late September.

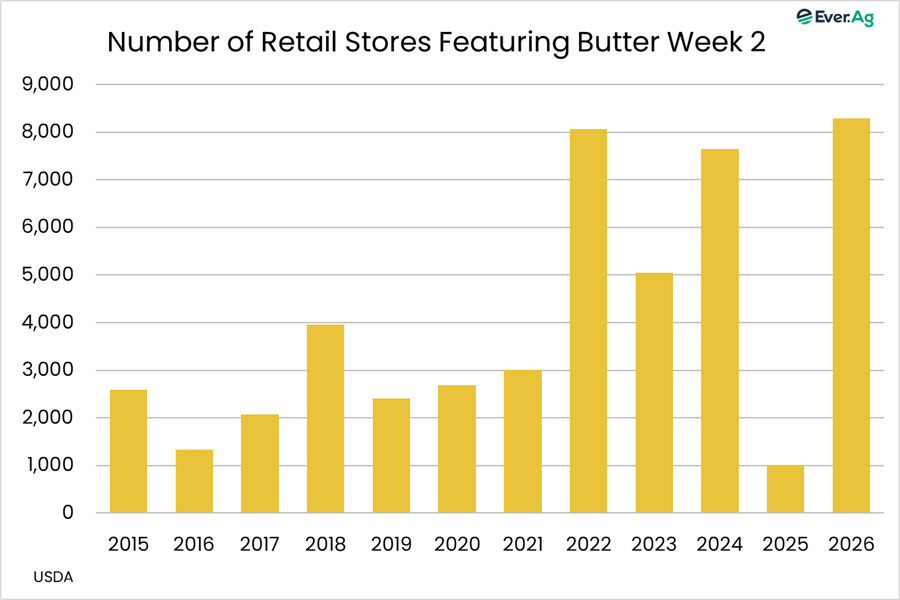

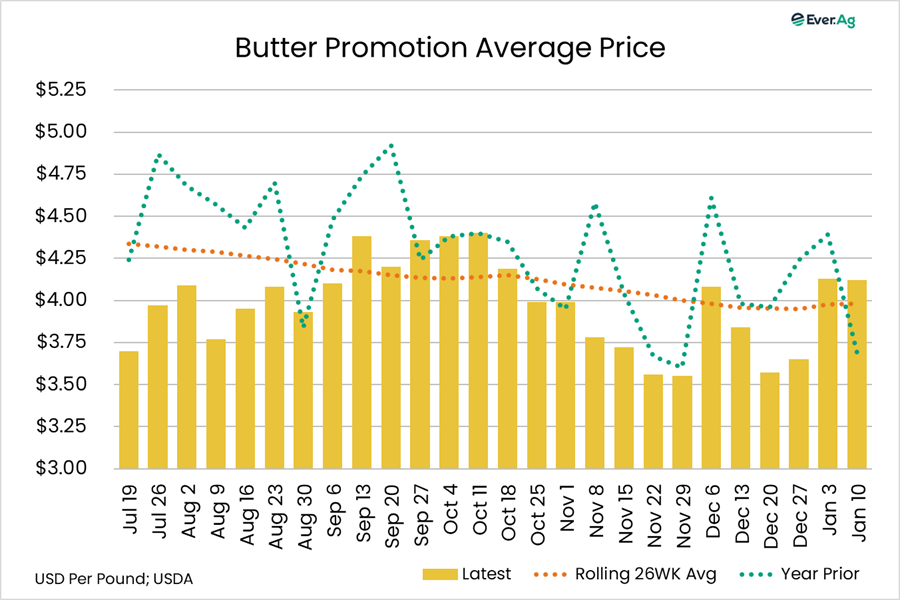

There’s more butter on sale in grocery stores in early 2026 than was the case in early 2025, but pricing isn’t that aggressive. According to the USDA, 8,286 outlets have butter deals this week, up more than eightfold from last year (1,010 in week two). But the average price is $4.12 per pound, up 12% year over year and up 57 cents (+16%) from the 2025 holiday-season low. Cheese prices are up, too, with the average at $2.57 per package for six-to-eight-ounce shreds, up three cents on the week and up 7% year over year. Activity increases week over week (+20%) but declines year over year (-3%).

Futures and options on futures trading involves significant risk and are not suitable for every investor. Information contained herein is intended for informational purposes and is obtained from sources believed reliable but is in no way guaranteed. Past results are not indicative of future results. Any data contained herein is proprietary and may not be copied, disseminated, or used without the express written permission of Ever.Ag Insights.